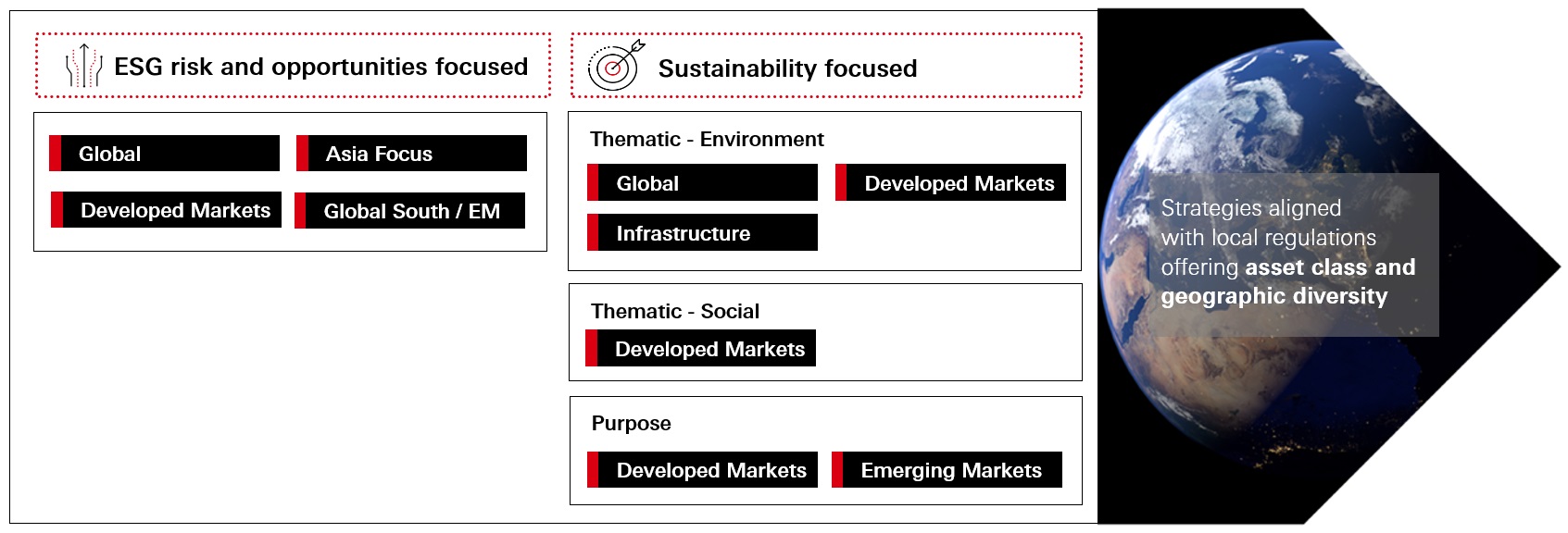

ESG and Sustainable Investing strategies

At HSBC Asset Management, we are committed to developing new capabilities that seek to deliver investment performance, alongside the potential to contribute to more sustainable outcomes.

To address the diverse needs and interests of our clients, we provide a broad range of ESG and sustainable investing solutions across both traditional and alternative asset classes.

HSBC ESG and Sustainable Investing Framework is an HSBC internal classification framework used to establish sustainable investment standards and promote consistency across asset classes and business lines where relevant. HSBC AM strategies within the HSBC Group ESG and Sustainable Investment Framework may not necessarily be marketed as sustainable externally, depending on the relevant regulatory regime for sustainable investment disclosure where there may be differences in requirements.

Our solutions to manage sustainability risks and opportunities

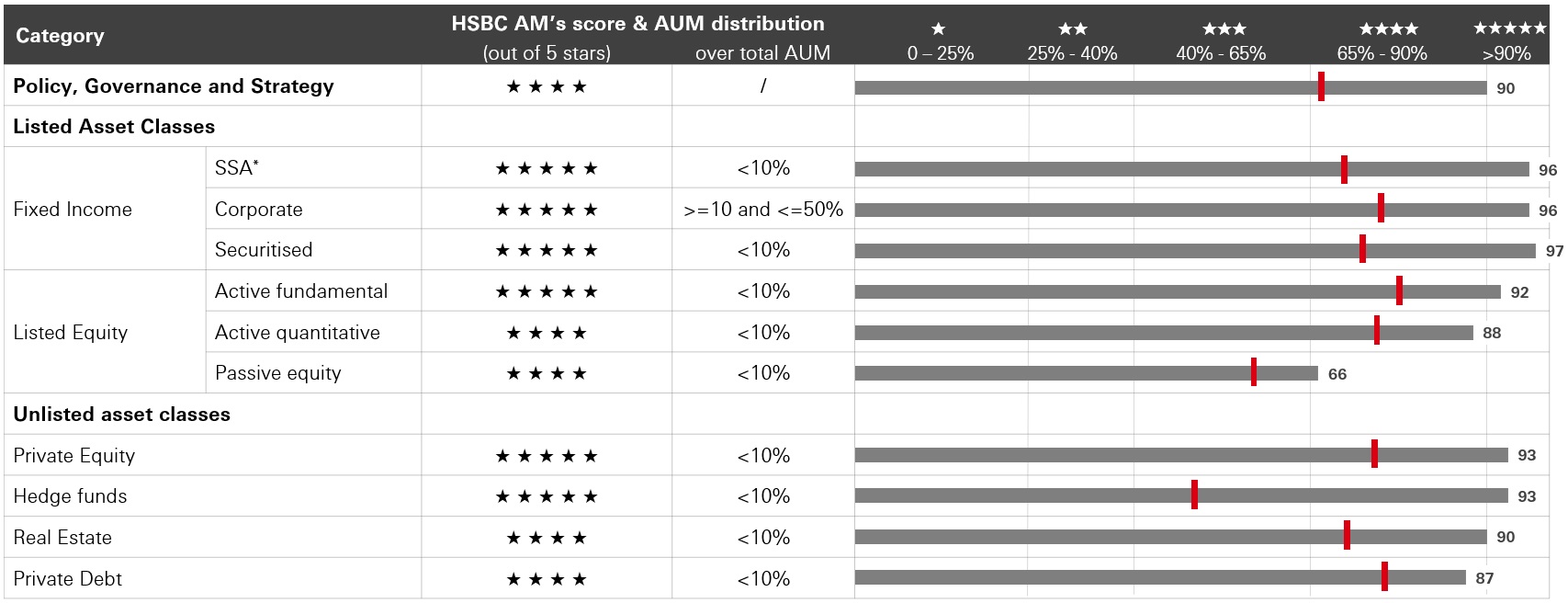

PRI Assessment Report 2025

Following the 2025 PRI reporting cycle, we achieved ratings of 4 or 5 stars across all categories. This reflects our ongoing commitment to maintaining high standards in responsible investing across various asset classes and strategies.

*Sovereigns / Supranational / Agencies

The score figures displayed in the document relate to the past and past scores should not be seen as an indication of future scores.

As a signatory to the UN PRI, HSBC Asset Management reports on our activities and progress towards implementing the Principles inline with the requirements of the PRI's reporting framework.

Sources: UNPRI, HSBC Asset Management as of November 2025. For illustrative purposes only. To read our public Transparency report, please visit: https://ctp.unpri.org/dataportalv2/transparency.

Article 8 SFDR : The product promotes environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices.

Article 9 SFDR : The product has a sustainability objective.

y

y