HSBC RIF – Europe Equity Green Transition

|

|

|

A thematic fund classified under Article 9 SFDR1

1. SFDR = Sustainable Finance Disclosure Regulation. Classified Article 9 since 31/08/2021.Art 9 SFDR: the product has a sustainability objective.

The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus. More information on our ‘Responsible Investment’ Policy and ‘Implementation Procedures’ can be found on our website. The decision to invest in the promoted fund should take into account all the characteristics or objectives of the promoted fund as described in its prospectus.

HSBC RIF Europe Equity Green Transition is a thematic fund. It invests in European companies of all market capitalisations, which plays an active role in the decarbonisation of the planet.

This fund is classified under Article 9 SFDR, and backed by the 3 strictest European Sustainable Finance labels.

Why act now

- Climate change is one of the biggest and most urgent challenges of our time

- The time has come to protect our planet. CO2 emissions need to come down by six times to reach carbon neutrality by 2050 and prevent global warming from exceeding 2 degrees by 2100

- We as investors can contribute to surmounting this prodigious challenge. Transitioning to a greener world requires extraordinary investments and financing. Growth in green technologies will be tremendous and long lasting.

Focus on the HSBC RIF – Europe Equity Green Transition

HSBC RIF – Europe Equity Green Transition

- A concentrated thematic fund for investors to help accelerate the transition to a greener world

- A rigorous and transparent approach focusing on companies with climate mitigation and adaptation activities

- An investment process that finances climate transition under Socially Responsible Investment guidelines and the UN’s Sustainable Development Goals (SDGs)

High conviction approach

We seek out companies actively involved in 8 eco-sectors:

An experienced management team

The fund is managed by a pair of seasoned ESG professionals:

|

Bénédicte Mougeot SRI Portfolio Manager |

|

François Travaillé SMID Portfolio Manager |

Harnessing HSBC’s global resources for ESG and equity analysis and engagement.

Fund details

| Benchmark1 | MSCI Europe GDP weighted (EUR) NR |

| Average weight of holdings | 1 %-5 % |

| Target tracking error | 4 %-7 % |

| Annual portfolio turnover | <50 % |

| Cash | 0-5 % |

| Legal form | UCITS - SICAV (France) |

| Classification | European equities |

| Strategy launch date | 16 Novembre 2018 |

| Recommended investment horizon | 5 years (min.) |

| Fees (max.) | Management fee A share: 1.50%; Management fee B & I share: 0.75%; External administrative fees for A, B & I shares: 0.30% |

| Dealing | Daily before 12h (CET) |

| Daily NAV calculation | Daily |

| Management company | HSBC Global Asset Management (France) |

| Custodian and transfer agent | CACEIS Bank |

| Minimum initial investment | A: 1 thousandth of a share I: 100 000 EUR |

| Eligible for PEA | Yes |

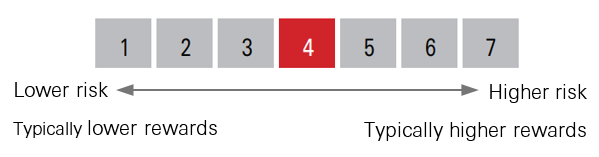

| Synthetic Risk Indicator (SRI)2 Do not run any unnecessary risk. Read the Key Information Document. |  |

| Swing price3 | Yes |

| SFDR classification | Article 9 SFDR : the product has a sustainability objective |

| Active fund | The fund is actively managed |

| ISIN | AC: FR0000982449 AD: FR0000982456 IC: FR0011235340 ID: FR0013476181 BC FR0013287224 |

1. Index given for comparative and illustrative purposes only. The fund is not managed to the index, is actively managed and returns may deviate materially from the performance of the specified index.

2. The SRI (Summary Risk Indicator) is an overall indicator of the product risk level. The scale varies from 1 (least risky) to 7 (most risky). Historical data may not be a reliable indication for the future. The rating is not guaranteed to remain unchanged and the categorisation may shift over time. The lowest rating does not mean a risk-free investment. Do not run any unnecessary risk. Read the Key Information Document. The fund has a high risk indicator. The value of investments can go up as well as down.

3. The fund uses the swing principle calculation method which determines the net asset value of the fund. Swing pricing allows investment funds to pay the daily transaction costs arising from subscription and redemptions by incoming and outgoing investors. The aim of swing pricing is to reduce the dilution effect generated when, for example, major redemptions in a fund force its manager to sell the underlying assets of the fund. These sales of assets generate transaction costs and taxes, also significant, which impact the value of the fund and all its investors.

Characteristics and weightings are for illustrative purposes only, are not guaranteed and are subject to change over time, and without prior notice, taking into account any changes in markets.

Main risks associated to the fund

It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed

- Capital loss risk: It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed

- Equity risk: portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements

- Discretionary Management: Discretionary management is based on anticipating the evolution of different markets and securities. There is a risk that the fund will not be invested at any time in the most efficient markets and securities

- Foreign exchange risk: Where overseas investments are held, the rate of exchange of the currency may cause the value to go down as well as up

- Small & Mid Caps: Please note that the fund is invested in securities issued by companies which, due to their small & mid market capitalization, are less liquid and may present higher risks

Important Information

"HSBC RIF – Europe Equity Green Transition" is a sub fund of HSBC Responsible Investment Funds, a French domiciled SICAV. Before subscription, investors should refer to Key Information Document (KID) of the fund as well as its complete prospectus. For more detailed information on the risks associated with this fund, investors should refer to the complete prospectus of the fund. The shares of HSBC Responsible Investment Funds have not been and will not be offered for sale or sold in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons.

The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Global Asset Management (France). Consequently, HSBC Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document.

If necessary, investors can refer to the complaints handling charter available in the banner of our website.

Please note that the distribution of the product can stop at any time by decision of the management company.

HSBC Global Asset Management (France) - 421 345 489 RCS Nanterre. Portfolio management company authorised by the French regulatory authority AMF (no. GP99026) with capital of 8.050.320 euros. Offices: HSBC Global Asset Management (France). Immeuble Coeur Défense - 110, esplanade du Général Charles de Gaulle - 92400 Courbevoie - La Défense 4 – France. (Website: www.assetmanagement.hsbc.fr).

Copyright : All rights reserved © HSBC Global Asset Management (France), 2023.