Broadening-out story – where are we?

Revisiting US exceptionalism after a rise in uncertainty and big market moves

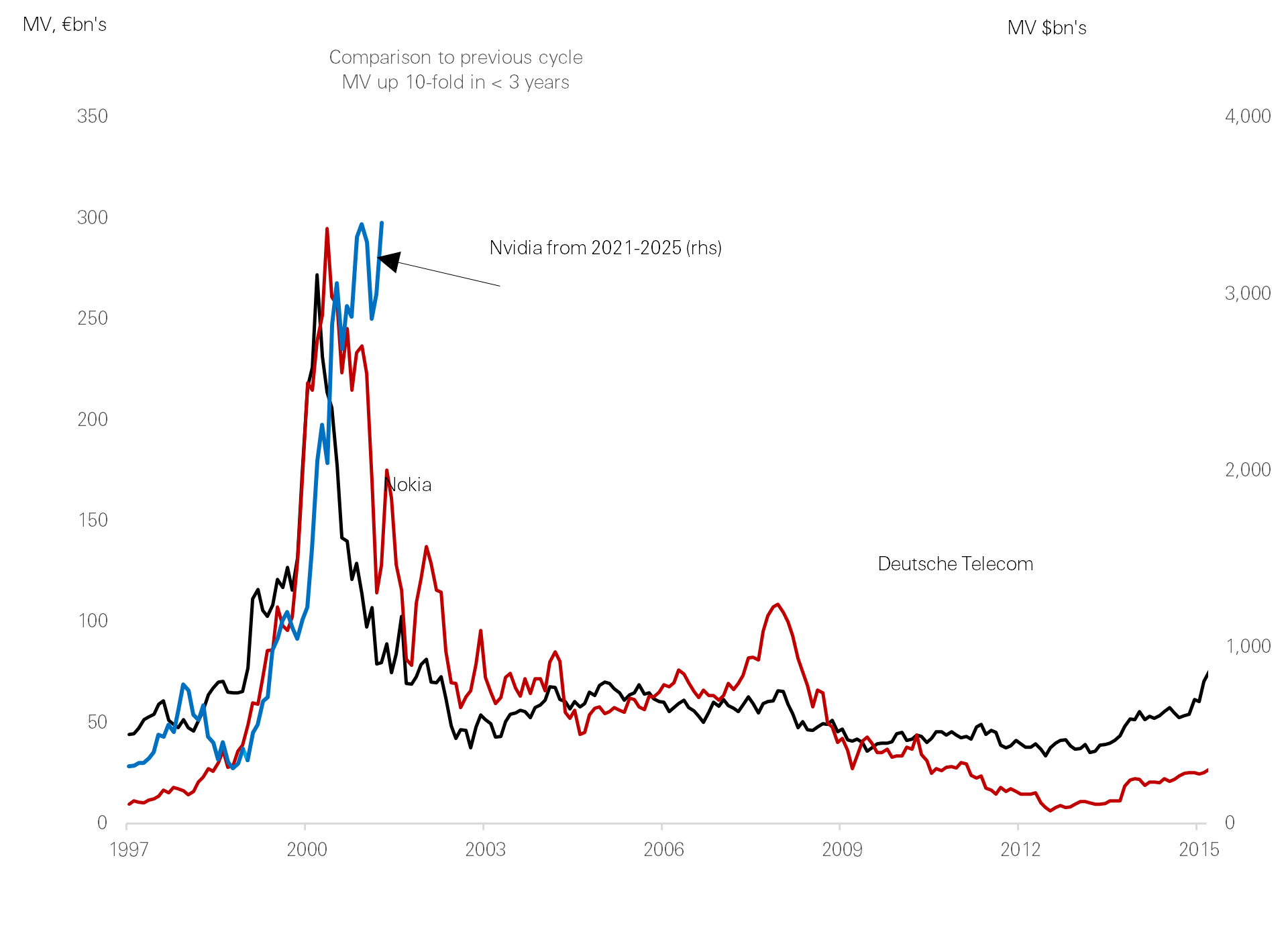

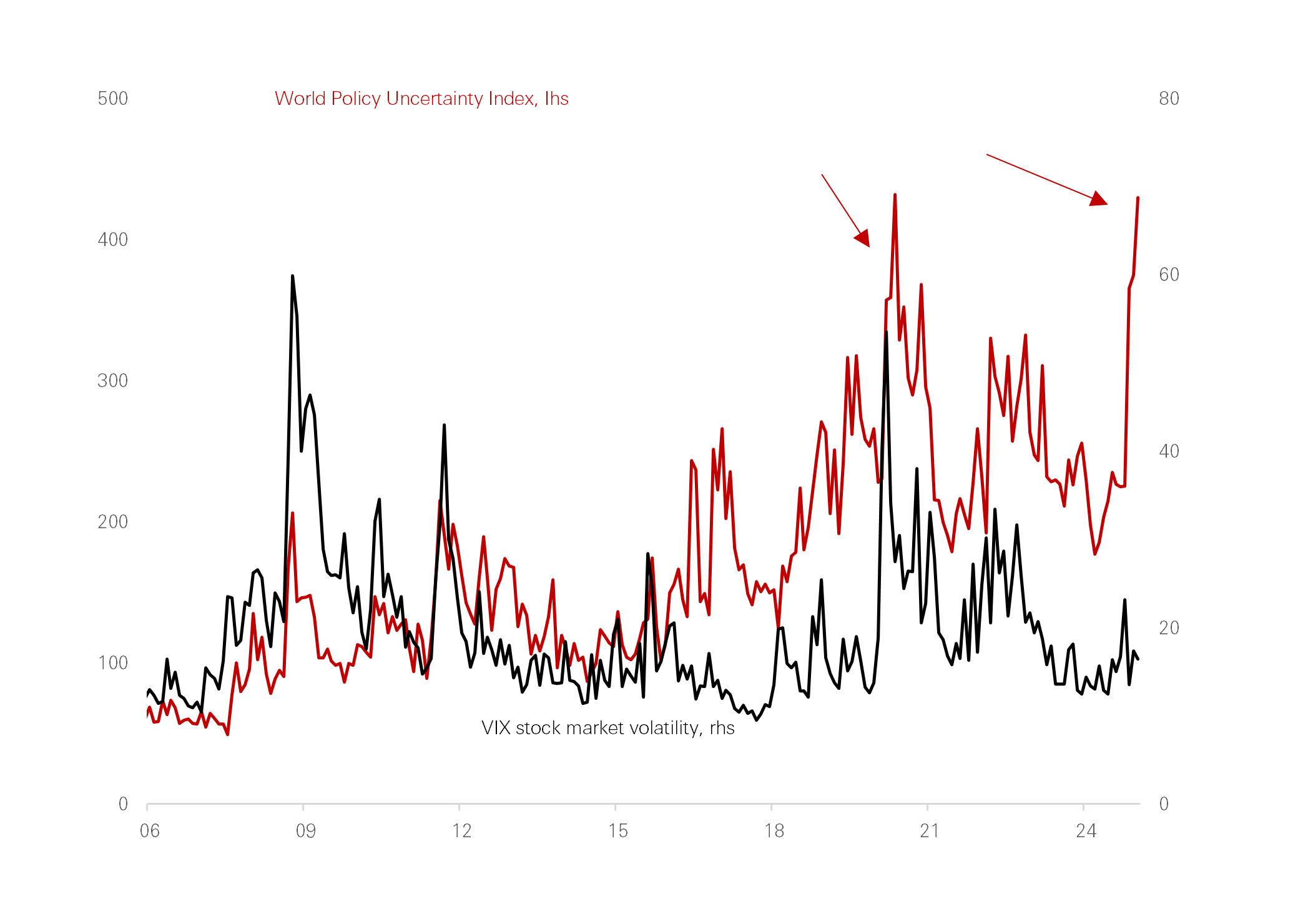

Forecasting the direction of financial markets has recently become more challenging with trade/policy uncertainty at pandemic levels (Figure 1) and with concerns about US Tech dominance given new entrants and rising capex. The US has delivered some phenomenal gains: Nvidia’s market cap is up 10-fold since 2022. While cycles can vary, we’ve seen this before in the 2000 Tech boom (Figure 2). Investors question if the recent US wobbles are more ‘buy the dip’ opportunities or something different this time.

Although it may not be the end of US exceptionalism, the last decade is unlikely to be repeated. Since 2020, there were USD 1.2tn of inflows to US equity funds versus a meagre USD 0.2tn to Rest-of-World funds (BoA Flow Show, 23/01/25). If the world ex-US sees even marginal improvements relative to the US, we could see some meaningful reversals. Even after the recent bout of broadening out many valuation gaps remain extreme.

In this Macro Insight, we revisit US exceptionalism and broadening in a sea of change. European and Chinese equities are up to 12 per cent to 17 per cent, outperforming the US (MCSI), but will it last?

We look to answer three key questions:

- What does US exceptionalism look like?

- Are the risks rising?

- What’s left in the broadening out trade?

Figure 1: Uncertainty back at pandemic levels

Source – HSBC Asset management, Macro bond, February 2025

Figure 2: We’ve seen it before, 10-fold jump in MV

Source – HSBC Asset management, Refnitiv, February 2025