Asia Insights

Key Highlights:

- An analysis of Vietnam's transformation into a global manufacturing hub

- Insights into the technological advancements and regulatory reforms shaping Vietnam’s business environment

- Our outlook for equity and bond markets for the broader region

In a nutshell

Vietnam, an emerging frontier

- Vietnam has significantly expanded its trade relationships through policy initiatives and free trade agreements, with significant acceleration in trade seen since the 2010s

- An advantageous geographic location, appealing demographics and substantial investments in infrastructure have made Vietnam a key beneficiary of recent supply chain diversification efforts

- The country is increasingly embracing advanced industries such as semiconductors, with major tech firms establishing facilities in Vietnam. This aligns with government initiatives to develop a skilled workforce and position Vietnam as a leader in technological innovation within ASEAN

- The challenge of low local value-add in manufacturing must be addressed to sustain the growth trajectory. Proactive governmental strategies focused on education and vocational training can support this

- Impressive earnings growth is being realised amidst economic success beyond its regional peers

- While Vietnam’s frontier market classification currently limits institutional investment, ongoing regulatory reforms and a push for emerging market status could unlock significant foreign inflows in the coming years

Asia Equity: Diverse opportunity set

- Asian equities have had a relatively positive start to the year, following notable stability in 2024 amidst varying performance across the region driven by unique economic conditions

- China's focus on high-end manufacturing, India's infrastructure boom, and Southeast Asia's role in global supply chains provide diversified investment opportunities that are appealing, in our view

Asia Fixed Income: Fundamentals and carry

- High-yield spreads remain wide, offering carry opportunities as the asset class evolves post-deleveraging in China’s property sector

- Despite ongoing geopolitical tensions and global economic uncertainties, Asia's credit market is insulated due to regional diversification and stable domestically-driven economies like India and parts of ASEAN

Vietnam, an emerging frontier

Vietnam has emerged as a key beneficiary of global supply chain diversification efforts, with a number of positive domestic factors supporting growth potential ahead.

Vietnam’s rise in the global supply chain

In recent years, geopolitical disruptions and rising protectionism have significantly reshaped global supply chains resulting in the diversification of global production away from traditional centres. The escalation of the US-China trade tensions, in particular, prompted many companies to adopt what is now commonly known as the ‘China+1’ strategy to mitigate risks associated with over-reliance on manufacturing in the country. Vietnam has been an important beneficiary, supported by its stable political environment, investment-friendly policies, and existing trade agreements.

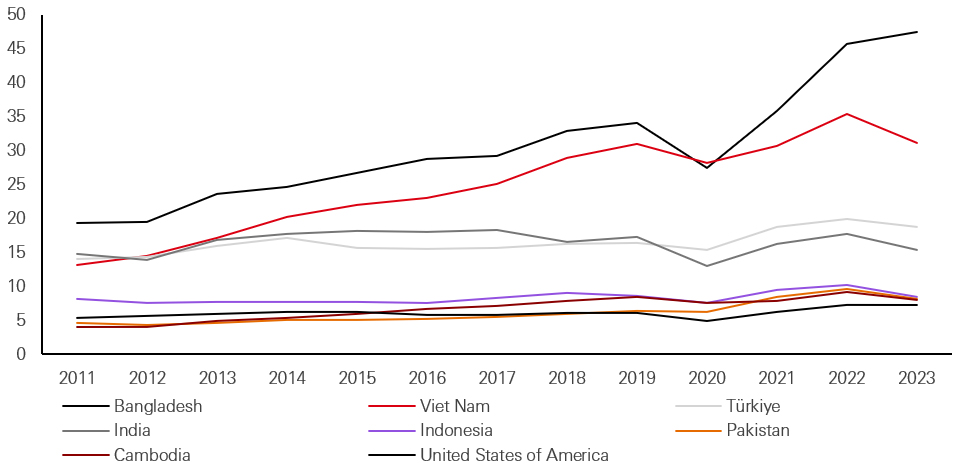

Until the early 2010s, multinational firms saw bureaucracy, infrastructure bottlenecks, and inconsistent enforcement of trade policies as deterrents to Vietnam’s business environment. However, Vietnam’s efforts to simplify regulations, reduce bureaucratic red tape, and attract foreign investment has helped improve the country’s business climate steadily. This was reflected in Vietnam climbing the ‘ease of doing business’ rankings from 93 in 2010 to 70 in 2020.1thth2 in Asia. It has also ascended to the position of world’s 3rd

Top 9 apparel exporters globally after China (USDbn)

Click image to enlarge

Source: WTO, data as of February 2025. Note: China is excluded which is the largest apparel exporter.

1 – World Bank Doing Business report, 2020

2 – WTO Annual Trade Reports (2024 projections), United Nations COMTRADE Database

This commentary provides a high-level overview of the recent economic environment and is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Economic reforms and strategic policy decisions

Vietnam’s economic ascent from an agrarian economy to a key player in global manufacturing is a testament to strategic reforms and trade liberalisation. The pivotal moment came in 1986 with the introduction of the Doi Moi (Renovation) reforms, marking a shift from a centrally planned system to a socialist-oriented market economy. These reforms focused on developing a multi-sectoral market, restructuring fiscal and monetary policies, controlling inflation, and attracting foreign direct investment (FDI).

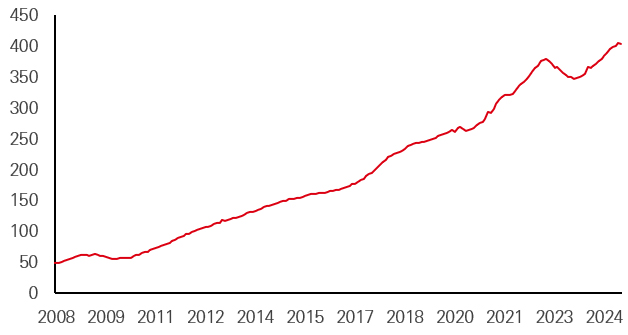

In 1995, Vietnam began integrating into the global economy by joining the Association of Southeast Asian Nations (ASEAN). This facilitated greater regional trade, investments, and economic cooperation. Since Vietnam joined the ASEAN Free Trade Area (AFTA) in 1996, its trade with other countries in the bloc has expanded more than tenfold. Growth has accelerated the most since the 2010s. From 2010-2021, exports from Vietnam to ASEAN more than tripled to USD 29.1bn. Imports to Vietnam also had a similar rise, from USD 14.5bn to over USD 41bn. In 2022 alone, import and export value to ASEAN countries grew by more than 15 per cent from the prior year.3

Beyond ASEAN, Vietnam solidified its role in global trade by joining the World Trade Organisation (WTO) in 2007. Simultaneously, it entered into 15 free trade agreements including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA). These agreements reduced trade barriers by lowering tariffs, enhancing market access and positioning Vietnam as a reliable trading partner. Notably, the US-Vietnam cooperation trade agreement enabled Vietnamese textile and apparel firms to expand exports in the world’s largest consumer market.

The combination of domestic reforms and reduced trade barriers has provided the foundation for the country's growing role in supply chains. Accordingly, new employment opportunities, particularly for younger workers with lower education levels, have helped reduce inequality. The rate of extreme poverty has been massively reduced, from 60 per cent in the 1990s to under 3 per cent now, creating a more dynamic economy with a growing middle class and consumer spending.4

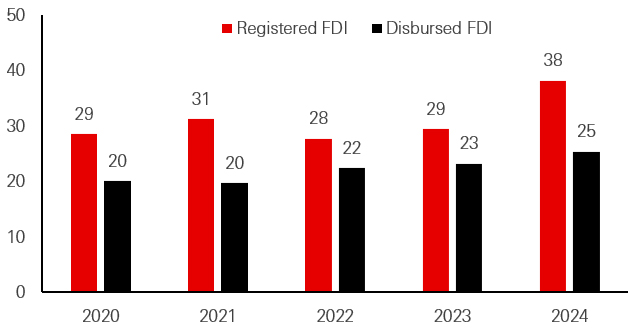

Throughout this period Vietnam has actively encouraged FDI. Today this continues to be a key pillar of Vietnam’s economic progress. According to the Ministry of Planning and Investment, in January 2025, Vietnam attracted a total of USD 4.3bn in FDI pledges, a 49 per cent rise year-on-year, from 55 countries. These figures, alongside a 9.4 per cent annual increase in realised FDI over 2024, reflects the growing investor confidence.

Vietnam’s exports (USDbn)

Click image to enlarge

Source: HSBC AM, Bloomberg, data as of 31 January 2025.

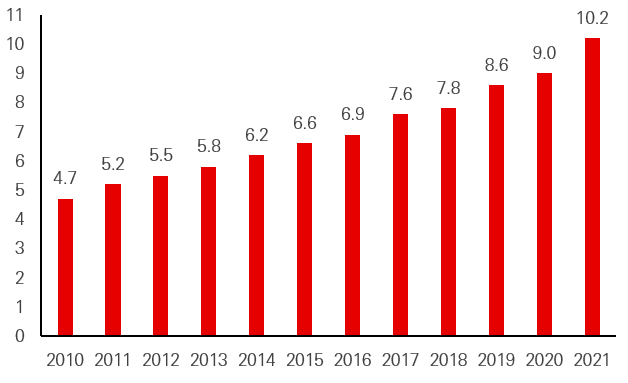

FDI inflow into Vietnam (USDbn)

Click image to enlarge

Source: HSBC AM, General Statistics Office of Vietnam, Ministry of Finance, data as of December 2024.

3 – World Trade Organisation, Vietnam Chamber of Commerce and Industry, August 2023.

4 – World Bank, 2022 Vietnam Poverty and Equity Assessment report, 2022.

For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Geographical advantage and infrastructure development

Vietnam’s location in Southeast Asia has provided strategic benefits. Its proximity to major markets like China, Japan, and the ASEAN nations, allows for efficient trade flows, while its extensive coastline along the South China Sea provides access to vital shipping routes. To take advantage of this, Ports such as Hai Phong in the north and Ho Chi Minh City in the south have been upgraded to handle increasing cargo volumes, reinforcing the country’s role as a transshipment hub.

Moreover, the government has been heavily investing in transportation infrastructure to remove bottlenecks. For example, the development of the North-South Expressway and expansion of the Noi Bai and Tan Son Nhat international airports have helped improve connectivity. These upgrades have significantly reduced transportation costs and transit times, enhancing overall supply chain efficiency. Development remains in early stages, with Vietnam needing more than USD 100bn in capital expenditure over the next 5 years to support projected trade growth.5

Demographic dividend

The demographic profile of Vietnam is also supportive of its position as a growing manufacturing base. Each year, around 1 million new workers enter the labour market. Today, with a population of over 100 million, Vietnam benefits from a young and increasingly skilled workforce of nearly 53 million workers. Notably, 28 per cent of this workforce holds formal training certificates.

To sustain and enhance this advantage, the Vietnamese government, in late 2024, approved strategies aimed at advancing education, training, and vocational training by 2030. This vision extends to 2045 and plans to have various partnerships with international institutions to elevate workforce competitiveness for an increasingly automated world.

Growing population (2000 versus 2023)

Click image to enlarge

Source: World Bank Group, data as of February 2025.

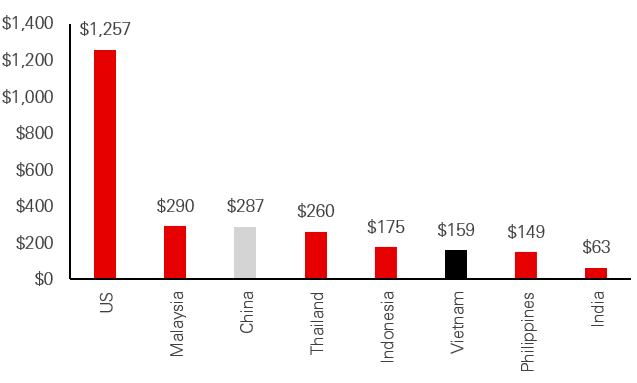

Monthly minimum wage (2021)

Click image to enlarge

Source: International Labour Organisation, data as of 2021.

5 – McKinsey & Company report, Diversifying global supply chains: Opportunities in Southeast Asia, September 2024

For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

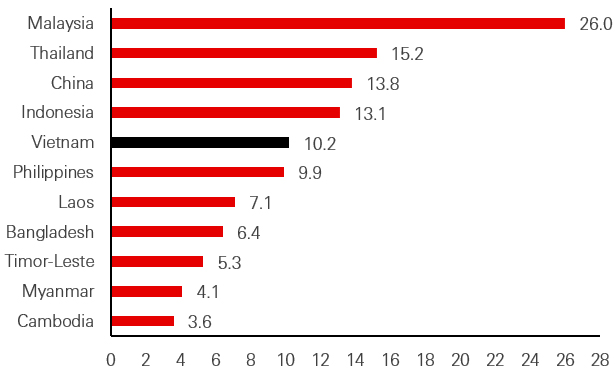

Vietnamese labour is also a cost-effective alternative to other manufacturing powerhouses like China, where wages have been steadily rising. The ILO reported in 2021 that the monthly minimum wage in Vietnam stood at USD 159, slightly over half of China’s USD 287. This cost efficiency has drawn well-known multinational corporations to establish operations in Vietnam.

Technological upgrades

Beyond traditional manufacturing, Vietnam is gaining a solid foothold in advanced industries such as semiconductors and related areas including artificial intelligence. Leading technology companies like Samsung, LG, Apple and Google have already established manufacturing facilities in Vietnam. Global semiconductor firms are increasingly eyeing Vietnam as a competitive alternative to regional manufacturing hubs like Malaysia. For instance, Vietnam recently secured a commitment of USD 1bn in investment from South Korean manufacturers extending through 2025, resulting from its strengths in assembly, testing, and packaging. Separately, Nvidia has committed to establishing an AI research hub which includes a USD 200mn AI factory in Hanoi and training for 30,000 prospective AI professionals. This aligns with the government’s national strategy to transform Vietnam into ASEAN’s hub for AI research and development by 2030, and is reflected in the country’s climb in global innovation index rankings.

Global innovation index ranking (1 = best)

Click image to enlarge

Source: WTO, WPO, HSBC, data as of 2024.

Supporting this ambition, the Vietnamese government has been prioritising digital transformation across the economy, encouraging the adoption of Industry 4.0 technologies such as automation, artificial intelligence, and blockchain. Incentives are being offered in the form of corporate tax breaks and dedicated industrial zones for high-tech firms.

Technological development has proven effective in improving supply chain efficiency and transparency, enabling companies operating in Vietnam to meet the demands of global markets. For instance, blockchain technology is being used to enhance traceability in the agricultural supply chain, ensuring that products meet international quality standards and boosting consumer confidence.

Maintaining the growth trajectory

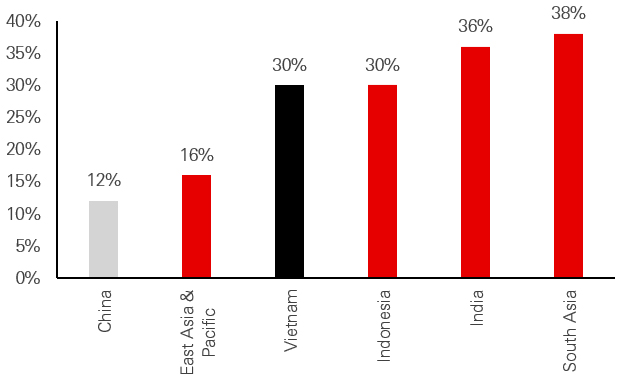

While Vietnam’s manufacturing and outputs are becoming more sophisticated, the country remains in early stages of technological adoption. Continued advancement in manufacturing capabilities will be needed to maintain its high economic growth rates and sustain an advantage over neighbouring countries with similar demographics.

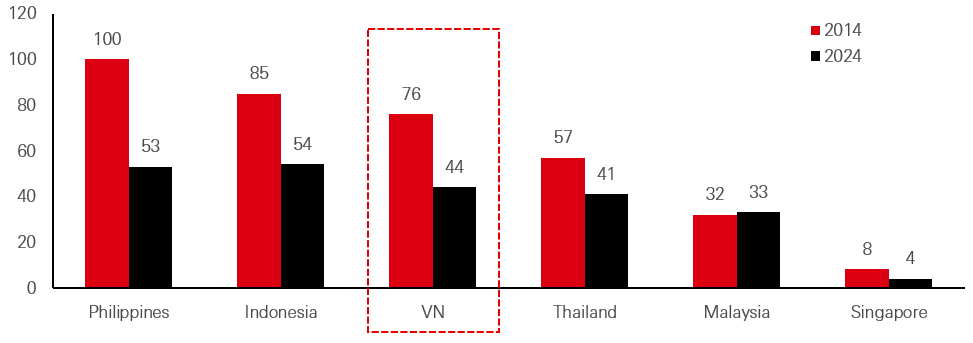

Currently, Vietnam’s inexpensive labour force does not boast high labour productivity. While manufacturing and trade has grown exponentially, local value-add remains low. Government investment in upskilling the workforce can be seen via steadily improving labour productivity. However, in the context of its Asian neighbours, more progress will be needed to capture greater value locally that supports opportunities for a more skilled workforce and insulates the country from competing supply chain locations.

Vietnam labour productivity, GDP per hour worked

Click image to enlarge

Labour productivity in 2021, GDP per hour worked

Click image to enlarge

2017 international USD at purchasing power parity. Source: McKinsey & Company, ILOSTAT data, World Bank data, as of February 2025.

Economic growth translating to earning growth

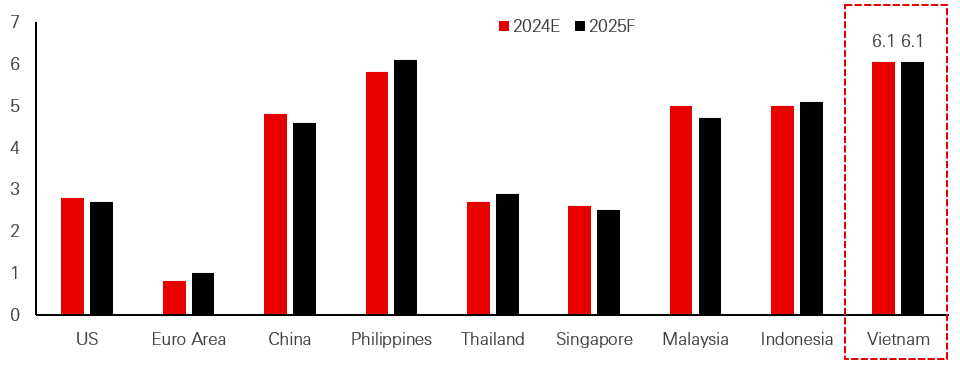

According to IMF estimates, Vietnam’s economy grew by over 6 per cent last year, following growth of 5 per cent in 2023 and over 8 per cent in 2022. As robust global demand and improving domestic consumption provides support, Vietnam is projected to outpace its ASEAN peers next year. Amidst steady growth, Vietnam maintains a well-balanced economy, with both a current account surplus and a trade surplus, alongside a moderate debt-to-GDP ratio of roughly 34 per cent in 2024 — lower than many of its regional competitors.

Forecasted GDP growth rate (per cent)

Click image to enlarge

Source: HSBC AM, IMF World Economic Outlook Database, data as of January 2025.

Coinciding with impressive economic growth, strong earnings growth underlies Vietnam’s investment appeal today. According to estimates, total earnings across all sectors will have risen by nearly 20 per cent year-on-year in Q4 2024, contributing to overall earnings growth of 13 per cent for the year.6

6 – Bloomberg, HSBC Asset Management, March 2025.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Following negative earnings growth in 2023, this rebound is fuelled by a resurgence in manufacturing activity. Additionally, lower interest rates have supported margin expansion for businesses as well as credit creation for consumers, boosting overall spending. According to Bloomberg estimates, the earnings growth trend is set to continue, with growth of 21.4 per cent this year and over 30 per cent projected for 2026 in USD terms.

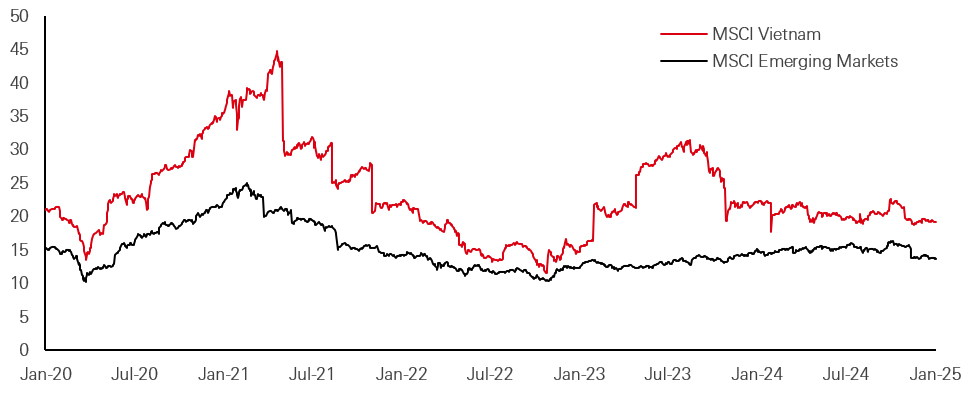

While Vietnamese equities command a higher valuation than broader frontier markets - with a PE ratio of 16x for MSCI Vietnam compared to 11x for MSCI Frontier Markets - it is only slightly higher than the 15x for emerging markets, and reflects investor confidence in its long-term growth prospects. Given superior earnings growth potential and structural tailwinds, these valuations remain justified in our view.

PE ratio comparison (x)

Click image to enlarge

Source: Bloomberg, HSBC AM, data as of January 2025.

Capturing relevant exposure

A key challenge for investors, however, remains Vietnam’s classification as a frontier market, limiting investment from institutional investors. Vietnam is actively seeking an upgrade to emerging market status, a move that, according to the World Bank, could generate foreign net inflows of up to USD 30bn by 2030. To achieve this, regulatory reforms are being enacted, including the removal of the pre-funding requirement under Circular 68, which had previously posed a major barrier for foreign institutional investors. With further improvements in foreign ownership regulations, an upgrade to the FTSE Emerging Market Index is possible this year, and MSCI reclassification could follow thereafter.

Moreover, the implementation of a new Korea Exchange (KRX) technology system by 2025 aims to modernise Vietnam’s stock market infrastructure, enhancing liquidity through same-day trading (T+0), short selling, and reduced settlement times. These changes will further deepen Vietnam’s financial markets, which already boast daily trading volumes exceeding USD 1bn — second only to Indonesia within ASEAN and outpacing some established emerging markets like Mexico.

Looking ahead, Vietnam's leadership has set ambitious targets for its stock market capitalisation, aiming to reach 100 per cent of GDP by 2025 and 120 per cent by 2030. Additionally, the country seeks to increase the number of investor trading accounts from 9.3 million to 11 million by 2030, with a focus on institutional and foreign participation.

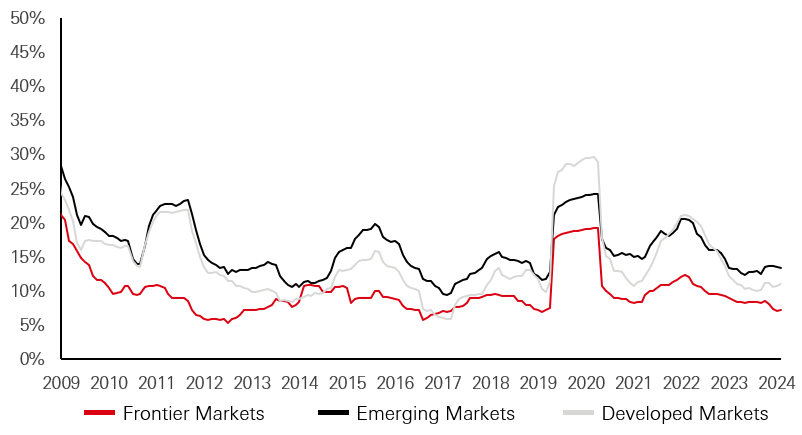

Despite the long-term growth potential, direct investment in Vietnam is likely to be a challenging option for many global investors who must evaluate the implications for their risk budgets. Accordingly, we advocate for exposure to such opportunities through a frontier markets allocation. Vietnam carries the largest weighting in the MSCI Frontier Markets index, at roughly one quarter of the index. Importantly for risk-averse investors, unique economic drivers in individual frontier market countries mean that intra-country correlations are low – resulting in relatively low volatility at the asset class level.

Volatility (1-year, daily returns)

Click image to enlarge

Source: Bloomberg, HSBC AM, data as of 31 December 2024.

Given the potential for Vietnam to be reclassified to emerging market status in the not-too-distant future, this supports taking an active approach to frontier markets exposure. Such an approach can allow for exposure to both frontier and smaller emerging market countries that are typically overlooked in emerging market allocations dominated by the likes of China, India, Taiwan, etc. Furthermore, long-term growth opportunities in frontier countries remain less researched and understood, also supporting an active approach to capture them.

Ultimately, we think the case for Vietnam is an interesting one within frontier markets today, which can also help diversify equity portfolios given the unique drivers of returns in underlying markets.

Diverse opportunity set

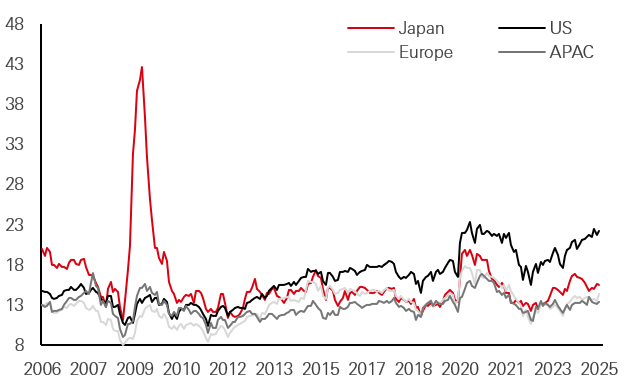

Asian equities demonstrated overall stability in 2024, with key markets delivering mixed performances given distinct economic environments.

China rebounded sharply following a three-year correction, with the MSCI China Index returning 19.7 per cent. This was largely driven by a policy pivot in late September, which laid the groundwork for a series of proactive fiscal and monetary measures. Notably, targeted efforts to resolve local government debt, reduce borrowing costs and stabilise the property market reflect commitment to address deflationary concerns and boost growth. While ongoing property sector weaknesses remains and has contributed to consumer uncertainty, strong exports and government intervention has reignited investor confidence. Momentum has continued this year, helped by AI developments providing a tailwind for the country’s tech sector. Still, China offers meaningful valuation discounts of 42 per cent and 10 per cent relative to DM and EM ex China.

India equities saw some reversal amidst gains in China. While the MSCI India Index rose by 12.5 per cent in 2024, performance was weaker in the latter half of the year. This came amidst election-driven volatility, valuation concerns and waning earnings momentum. Indian capital markets still saw record fundraising, with USD 42bn secured through IPOs and institutional placements. Domestic investors also remained steadfast, purchasing USD 63bn in equities, counterbalancing foreign selling. India’s medium-to-long term outlook continues to be bolstered by discretionary consumption, a booming capex cycle, and improving balance sheets. The latest government budget reinforced these long-term growth drivers through a balance of fiscal consolidation and consumption stimulus, including income tax cuts, while sustaining investment and capex trajectory.

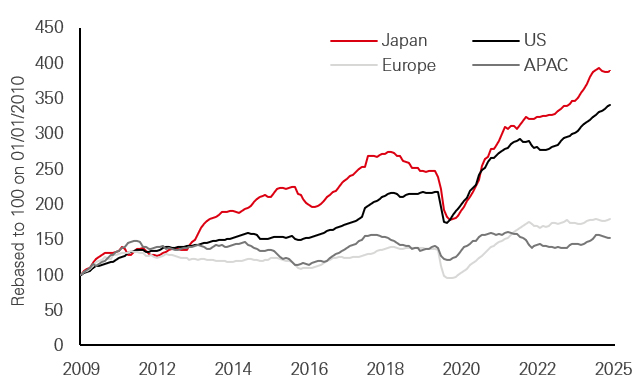

In developed Asia, Japan’s Nikkei 225 Index reached new highs last seen over three decades ago, benefiting from corporate governance reforms, a strengthening economy and a weaker yen which has boosted export competitiveness. Japanese stocks continue to trade at a discount relative to both US equities and global peers when considering earnings growth, a trend that has accelerated in the past year. With earnings growth remaining the primary driver of returns, this leaves potential for re-rating ahead. However, geopolitical risks stemming from US-China trade tensions and broad tariffs on exports to the US, alongside persistent deflationary pressures, could pose headwinds.

12-month forward earnings growth index

Click image to enlarge

12-month forward P/E ratio

Click image to enlarge

Source: HSBC AM, Bloomberg. Data as of 31 January 2025.

Overall, we believe current valuations for Asian equities make them worthy of attention. The combination of proactive fiscal policies, structural reforms, and rising domestic consumption is expected to support long-term growth. China’s shift towards high-end manufacturing, India’s infrastructure boom, and Southeast Asia’s increasing prominence in global supply chains all provide diversified opportunities for investors. Separately, Japanese equities offer a relatively unique mix of growth and inexpensive valuations in developed markets.

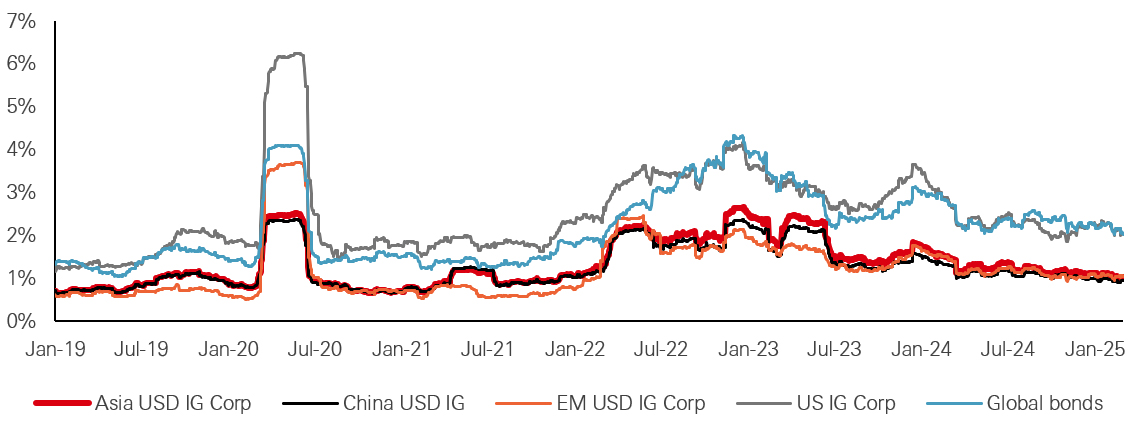

Fundamentals and carry

Asia's fixed income market demonstrated strong resilience, outperforming global bond markets in 2024, and looks poised for continued strength in 2025. Asia credit is currently offering relatively high yields of over 6 per cent, versus a five-year average of 5.6 per cent. The investment grade segment, in particular, presents a strong case due to its lower volatility and favourable risk-adjusted returns when compared to global peers. Corporates within this segment have demonstrated improving leverage and stronger interest coverage ratios over the past two years.

Investment grade market comparison (Rolling 3-month volatility)

Click image to enlarge

Past performance does not predict future returns.

Source: Bloomberg; JP Morgan, ICE Data Indices, as of 28 February 2025.

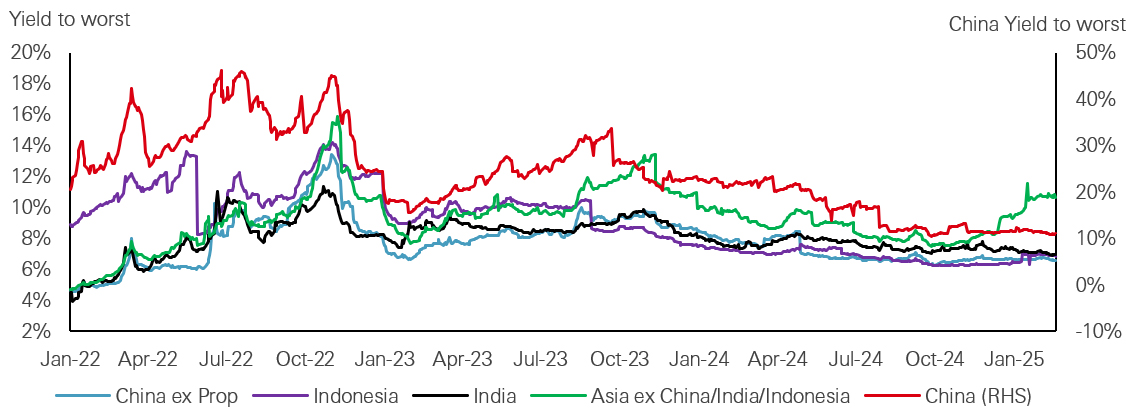

Meanwhile, high-yield spreads remain wide, presenting a strong carry opportunity, especially as the asset class continues to evolve structurally following extensive deleveraging in China’s property sector. Notably, this segment now accounts for only 7 per cent of the universe, allowing for greater diversification across high-growth markets.

Regional yield breakdown of JACI High Yield Corporate since 2022

Click image to enlarge

The level of yield is not guaranteed and may rise or fall in the future. Source: HSBC AM, JP Morgan, data as of 21 February 2025.

While key risks remain – including geopolitical tensions, global policy uncertainties, and concerns over Western economic growth – Asia’s credit market is well-insulated against volatility. This is primarily due to increased regional diversification provided by domestically driven economies, such as India and parts of ASEAN, exhibiting stability against external shocks. Additionally, the region benefits from relatively high GDP growth and controlled inflation that could mitigate the impact of global headwinds.

Technically, too, the supply-demand balance remains supportive for Asian credit. With projected bond issuance at around USD 170bn in 20257 – well below pre-pandemic levels – issuers are increasingly turning to domestic funding sources, further stabilising the market. This stabilisation and the improvement in overall credit quality is further underscored by the enhanced repayment capabilities of Asian dollar issuers.

Data watch (as of February 2025)

Click image to enlarge

Past performance does not predict future returns.

For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Asset class positioning

Click image to enlarge

Past performance does not predict future returns.

For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.