CLOs: Discovering the Diamond in the Rough

Synopsis

- Collateralised Loan Obligations (CLOs) are floating rate securities, providing investors with high income when base rates are elevated

- CLOs are performing strongly in the higher for longer macroeconomic environment

- Manager and Security Selection is key in this sector. We believe broadly syndicated CLOs sponsored by high-quality CLO managers offer attractive risk-adjusted returns and are our preferred investment versus mid-market loan CLOs and commercial real estate loan CLOs

- Credit enhancement behind the senior tranches provides investors with a significant cushion against collateral losses.

- Tranches allow investors to choose their level of risk, along with where they want to allocate across senior, subordinated and equity tranches

- Demand for the asset class, as demonstrated by record CLO issuance in 2024 was well absorbed by the market and bodes well for the sector

What is a CLO?

A CLO is a special purpose vehicle (SPV) backed by a pool of loans – typically leveraged loans that are issued to corporate entities. CLOs represent ~33 per cent (c.USD1.3tn) of the distributed securitised credit market.

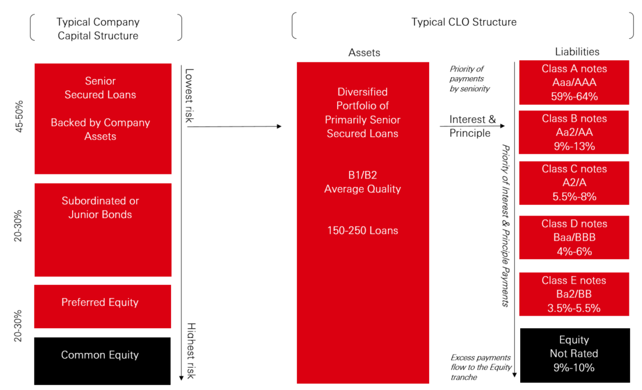

The below chart shows an illustrative structure of a CLO including the number of underlying leveraged loans to private companies, the different levels of risk comprising the CLO and the order of payments from these loans to the investors in different CLO tranches.

Typical CLO Structure

Source: HSBC Asset Management, LCD Global Review – US/Europe 2Q 2018 and LCD Loan Primer “Syndicated Loans: The Market and the Mechanics – 2017”

CLOs can offer investors diversification benefits versus equivalent rated corporate bonds due to lower correlations but also offer much more…

- Floating rate: CLO securities pay investors a spread above a benchmark such as SOFR or EURIBOR. The spread is larger than for comparably rated corporate bonds and provide additional yield. The floating rate aspect means that elevated base rates provide attractive levels of income and while the yield curve is inverted significant benefit over longer duration bonds. The fact that the coupons change with rates means that this yield is paid as current running income. High interest rates globally has meant the sector continues to offer significant income generation.

- Manager selection: Choosing the right CLO manager is fundamental to CLO investing. The CLO manager selects the different loans across various sectors that make up the CLO itself. Therefore, it is crucial the loans selected are in the right sectors, are of high credit quality and are in full compliance with the terms/triggers and criteria of the CLO structure.

Dynamicity is also a key factor. An active CLO manager has the ability to spot warning signs in individual loans and sectors early and move the portfolio to lower risk sectors. Extracting the best opportunities allows the CLO manager to enrich risk-adjusted returns for investors.

It is our opinion that top tier institutional quality CLO managers are more likely to achieve this by selecting a diversified portfolio of high-quality loans across market sectors. - Tranches: Tranches create a capital structure within the CLO, allowing investors to allocate based upon their risk appetite across senior, subordinated and equity securities. Senior tranches receive principal and interest payments from the CLO first with subordinated and equity tranches receiving their payments only once the senior tranche above them has been paid. The lower tranches are also the first to absorb any losses realised within the structure.

- Credit enhancement: The structural features of credit enhancement may provide an extra layer of protection in addition to the underlying collateral security before investors begin to suffer losses. Credit enhancement at the top tranches of the securitisation are higher now than in previous cycles. These include cash reserve funds, overcollateralisation (where the value of collateral exceeds the loan value) and excess spread (amount paid by CLO loan holders exceeds amount paid to investors).

- Risk retention: Regulatory changes have symbiotically aligned issuer and investor interests in the CLO market, providing further protection to CLO investors. EU Risk Retention regulation forces CLO managers distributing in Europe to retain 5 per cent of the securitisation on the CLO manager balance sheet (skin in the game).

- Prudent management: Typically, the CLO managers take exposure to the lowest quality equity tranche of a securitisation and are restricted to a maximum of 7.5 per cent allocation to CCC rated debt, further incentivising prudent management of the underlying assets.

Size matters

When it comes to the CLO sector, size matters with regards to the corporates backing the loans, the CLO manager, and the syndication of the CLOs.

- Corporates: Typically, the underlying assets in CLOs we invest in are mostly Senior Secured/First Lien corporate loans (this means the CLO manager has a priority claim on the secured assets in event of a bankruptcy). These loans are all from established corporates that typically have an EBITDA greater than USD200mn. A CLO holds between 150–250 corporate loans.

- Type of CLO manager: As mentioned above, repeat-issue, top tier institutional quality CLO managers with experience in the market are most likely to outperform. Given this, it should come as no surprise that we utilise our enhanced due diligence procedure and our team’s length of time in the market to select the better performing managers. With roughly 140 CLO managers in the US CLO market, we only invest with a small selection of managers that we believe can unlock the opportunities and navigate the pitfalls in this asset class.

- Broadly syndicated loans: CLOs at a broader level can be segregated into different types based on the underlying loan collateral. The main types are broadly syndicated loans (i.e. big loans to big companies, with many large institutions as investors behind the loan), smaller mid-market leveraged loans and commercial real estate (CRE) CLOs.

We only invest in CLOs backed by broadly syndicated loans and therefore avoid the higher credit risk associated with smaller mid-market firms and nuances involved with commercial real estate CLOs. Indeed, mid-market and CRE CLOs are already showing signs of distress. The size of the broadly syndicated loans market also facilitates sectoral diversity within the CLO portfolio, which we believe makes it the most attractive segment.

High interest rates mean high coupons for investors, but the increase in borrowing costs for the underlying companies increases the risk of default and loan loss in the CLO. Selecting a manager with the right credit resources to make the best loan selection and manage the loan portfolio during the term of the CLO is even more important than ever in a high rate environment.

We envisage loan losses increasing from current low levels (c.2 per cent) towards longer term averages (c.3–4 per cent). Along-side our allocation to higher rated tranches (i.e. senior securities), our approach to CLO investing seems well suited to manage this potential increase as well as any possible credit deterioration within the underlying CLO collateral.

Why is 2024 shaping up to be an important year for CLOs?

Expectations for interest rate cuts have so far been delayed this year as data has remained resilient and inflation has proven harder to tame. For floating rate CLOs, the delay has led to continued elevated coupon income.

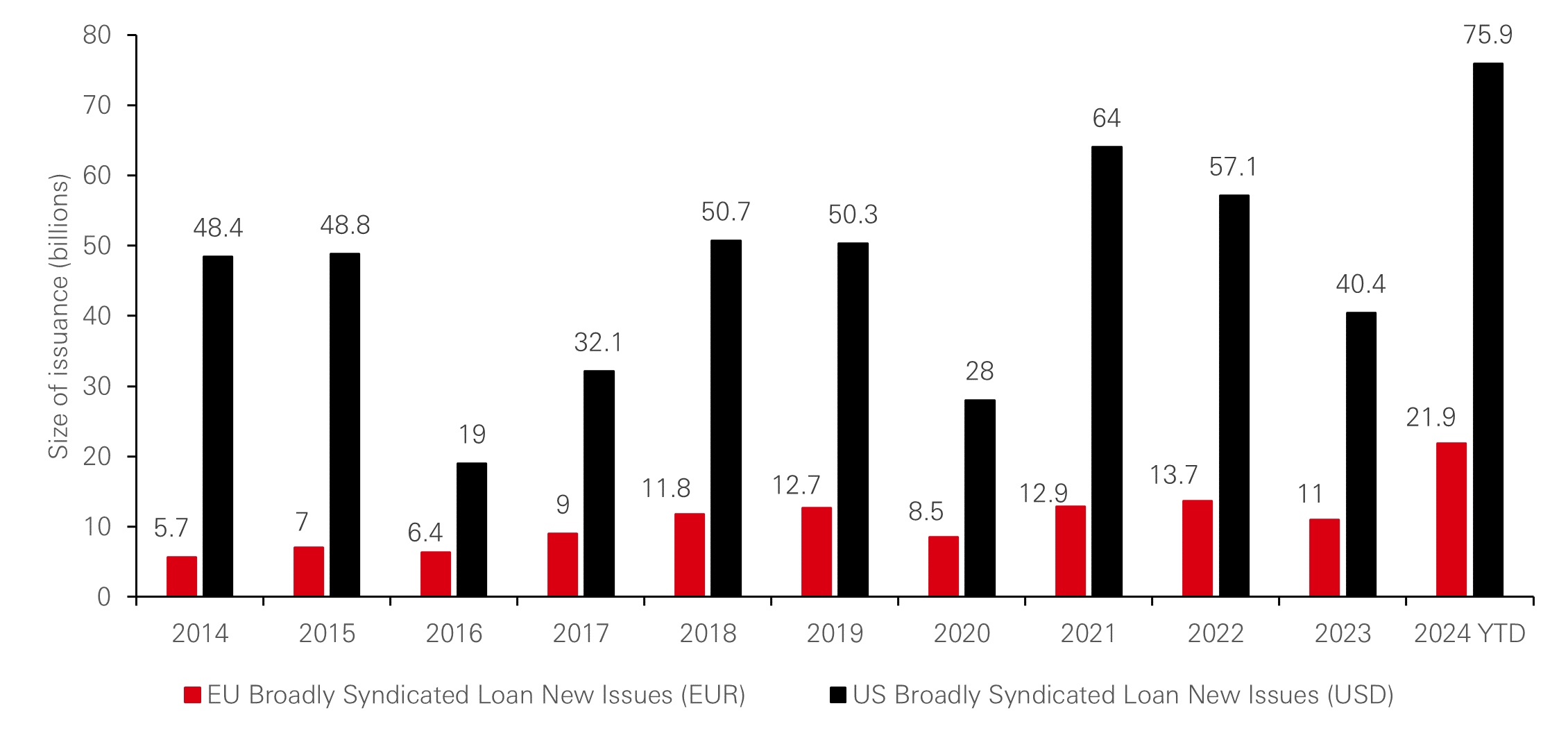

Demand for CLOs given the market backdrop has been sizeable and has been met with record issuance. USD46bn was raised in May alone, making it the second highest month on record. Year-to-date USD97.8bn of broadly syndicated CLO paper has been issued. Despite this, demand is still outstripping supply for high quality managers and spreads have tightened.

This market demand is expected to remain strong going forward into the second half of 2024, with institutional clients and investment banks continuing to make up the lion share of investment.

Broadly syndicated CLO loan issues

Source: HSBC Asset Management, Barclays

Whilst investors have continued to be surprised by the stickiness of inflation, consensus is that we will likely see interest rate cuts in the latter stages of 2024. As CLOs are floating rate, this would mean a reduction in the coupon payments. However, there are two points to note that suggest returns for CLOs remain attractive even with interest rate cuts.

- CLO securities will still generate high levels of income as interest rates will likely remain higher than in the past decade.

- Lower interest rates could mean spread tightening in the sector due to improved corporate fundamentals, especially with the diversified corporates which make up the CLOs.

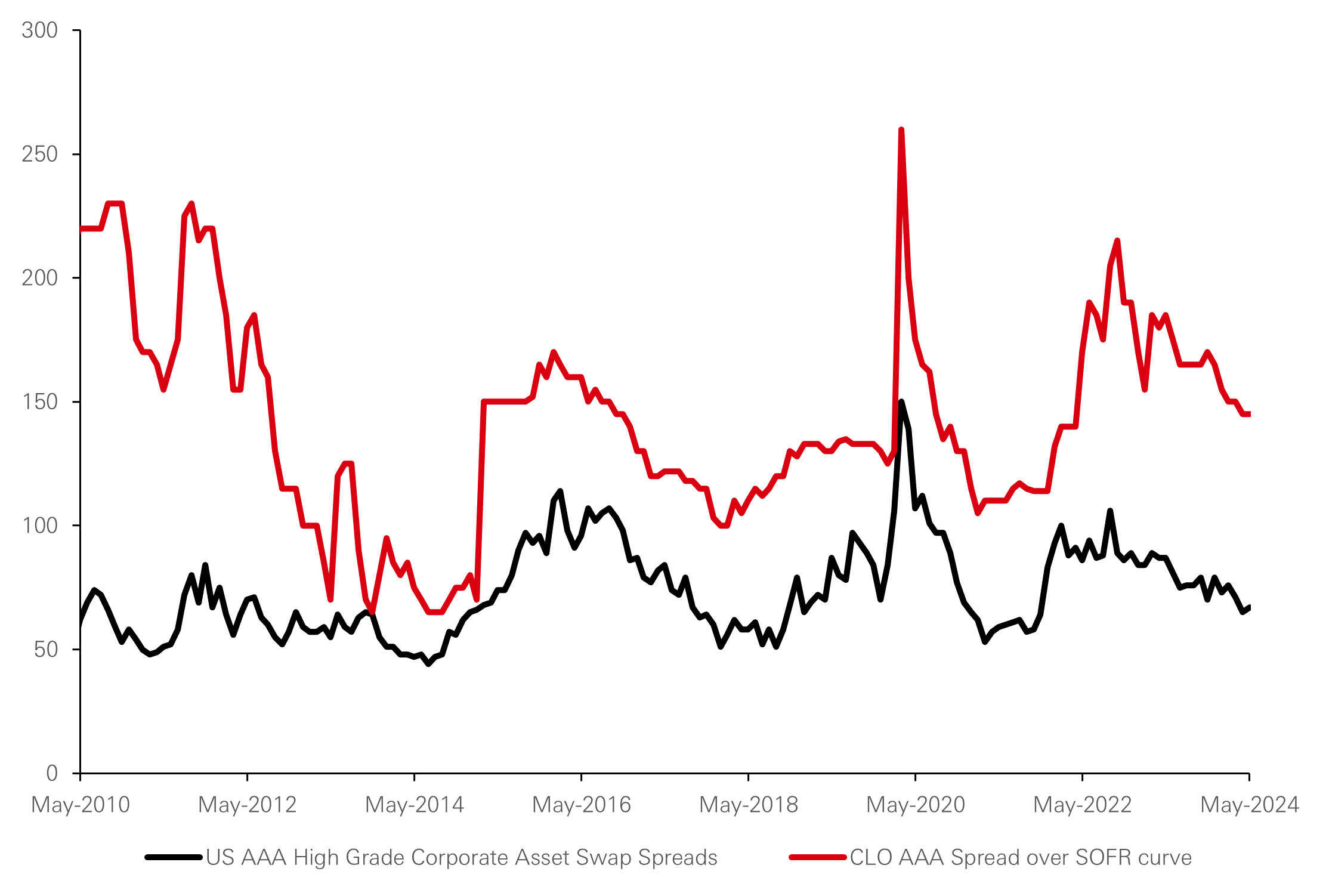

When we look at CLO spreads, they remain wide of historical averages as a result of market shocks such as COVID-19, the LDI crisis in 2022 and ongoing geopolitical tensions.

CLOs provide additional spread when compared to equivalent rated corporate bonds (which are at historical spread tights). One can argue from an asset allocation perspective that high quality CLOs are more attractive than high quality corporate bonds at this point in the cycle.

In fact, as can be seen below, in almost all instances within the below chart, CLOs offer a wider spread than corporate bonds, highlighting their attractiveness.

CLO spreads are at historical wides

Source: Bloomberg, JP Morgan, HSBC Asset Management

Conclusion

We are entering a new paradigm of higher for longer interest rates. Given this, it should come as no surprise that we believe CLOs should be front and centre in the minds of institutional investors. There is a yield pick up on offer as a result of higher interest rates and the opportunity for further returns through spread compression. However, extracting the returns will hinge on manager selection which is of paramount importance. There is strong demand for the asset class as evidenced by the record levels of issuance and one could arguably have to look far and wide for a worthy alternative.