Energy Transition Infrastructure

Introduction

To arrive at any destination, one must first make steps towards it. Similarly, it is simply impossible to achieve a goal without making any effort or movement. It is also true when it comes to our climate targets – without investment and progress, they simply will not be achieved.

But much of the investment within the green energy infrastructure asset class – important to the delivery of climate targets – in our view, is targeted in the ‘wrong’ place or is focused on the ‘wrong’ assets, leaving significant gaps that need to be filled.

We believe Asia represents a significant opportunity for renewable energy investment, particularly given the outsize role coal has played (and still does in many countries) in the energy generation mix.

Scale of the challenge

If the world is to meet net zero targets, then a total of USD 194tn of investment is required by 2050.1 Put another way, to achieve net zero targets, every one dollar invested in fossil fuel energy supply will need to be matched with five dollars invested into low-carbon supply until 2050.2

The sheer scale of investment needed is great. With a significant sum required, there will need to be significant input from the private sector – private capital markets will have a major role to play.

In some countries, governments fund green energy infrastructure projects without external investors becoming involved. These projects can also be delivered by state owned enterprises, reducing private participation. In other countries, governments introduce packages with backstops for private companies, to reduce the risk around delivery of individual green energy infrastructure projects. In reality, there is no one-size-fits-all approach.

However, given the scale of the investment needed to hit net zero targets, governments will increasingly need to rely on the private sector to deliver infrastructure projects. In our view, it is here where private capital can help to fill the gap.

The world is still early on in the long-term transition towards cleaner and more sustainable sources of energy, and significant sums still need to be invested to meet climate targets.

New assets must be built, and emerging sectors supported

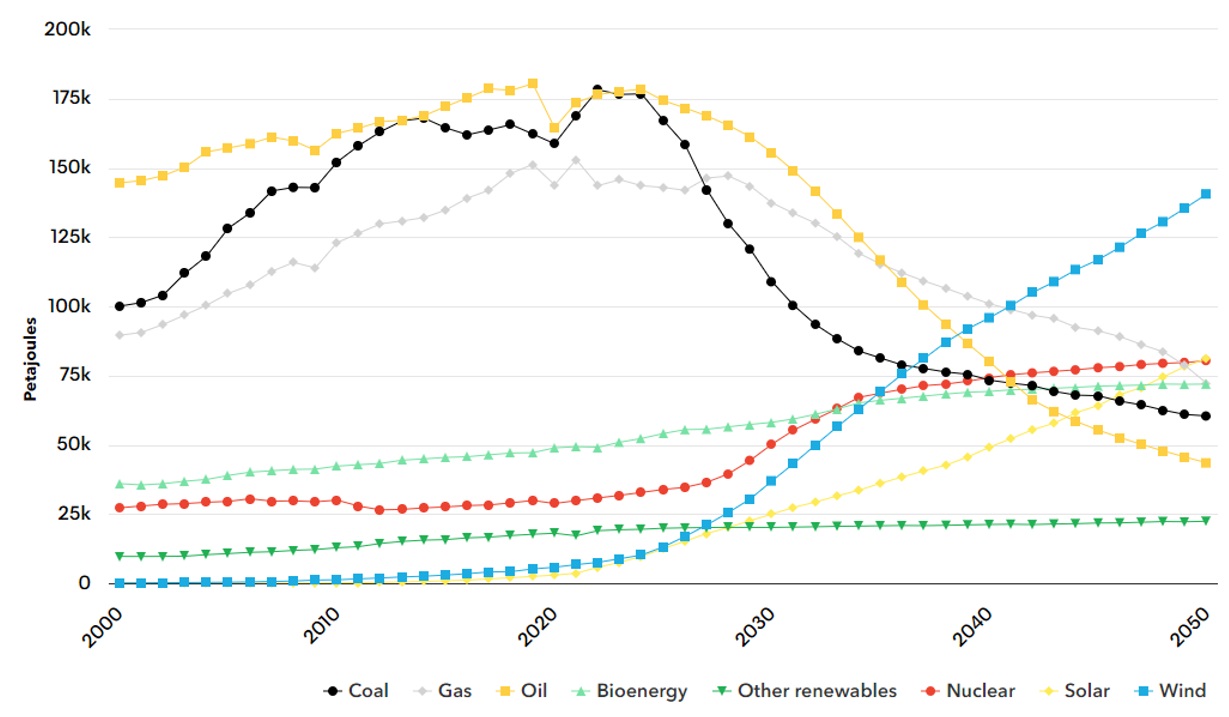

In our view, climate targets will not be achieved by existing green energy infrastructure projects alone. As such, the investment community needs to shift its focus towards the delivery of new projects. These are the projects which will deliver the transition away from fossil fuel energy sources, and many governments are introducing legislation to aid their delivery. In the 2040s, with a significant increase in investment, wind could become the dominant source of energy. By 2050, nuclear and solar are also likely to account for a greater share of energy consumption.

Energy from coal is expected to be hit first in BloombergNEF’s net zero climate scenario, which also sees oil demand falling at a steeper rate than that of gas.

Fig 1: Primary energy consumption by fuel, Net Zero Scenario

Source: BloombergNEF

Report published November 2022

However, investing in the development of new projects can be a hurdle for some investors to overcome. New renewable energy generation projects, for example – so-called “greenfield development” can carry risks, such as: planning, site acquisition, permitting and construction (with exposure to contractor risk and input price volatility). Ramping up to operations or hand-over to an operator can also pose risks. Many investors, despite being familiar with risk management in many different forms, understandably, baulk at these risks – particularly if they do not fully understand them or have limited experience in managing and mitigating them.

For investors with experience in project underwriting, development and delivery, therein lies the opportunity – not just to create a larger impact towards net zero goals, but to invest in a slice of the market where there is less capital and lower competition, which in turn can mean a more favourable risk-return profile, compared to other projects.

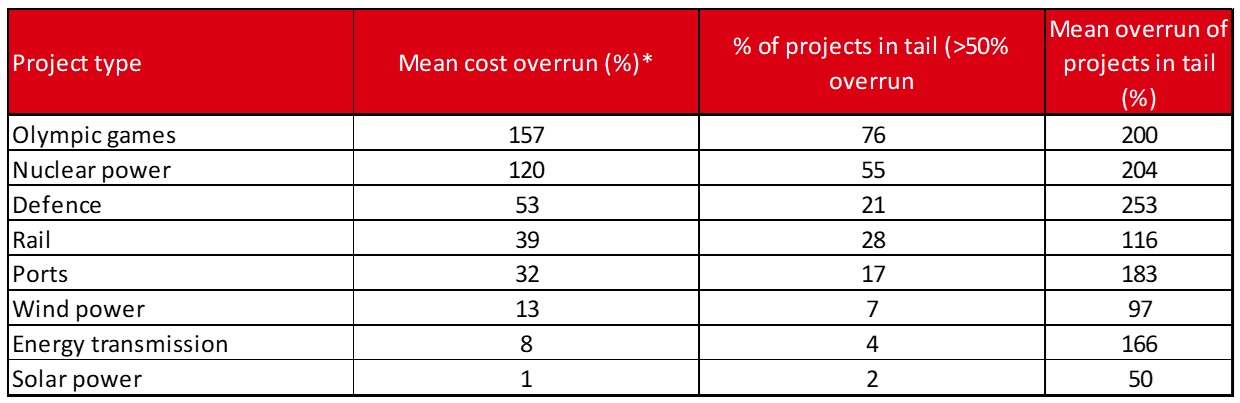

In addition, green energy infrastructure projects have historically had lower risk of cost overruns than traditional infrastructure projects, which in our view boosts the rationale behind investments in those projects.

Fig 2: Infrastructure cost overrun and prevalence

Source: How Big Things Get Done, Prof. Bent Flyvbjerg & Dan Gardner, published February 2023

*Cost overrun was calculated not including inflation and baselined as late in the project cycle as possible, just before the go-ahead (final business case at final investment decision). This means the numbers in the table are conservative. If inflation had been included and early business plans used as the baseline, cost overrun would be much higher, sometimes several times higher.

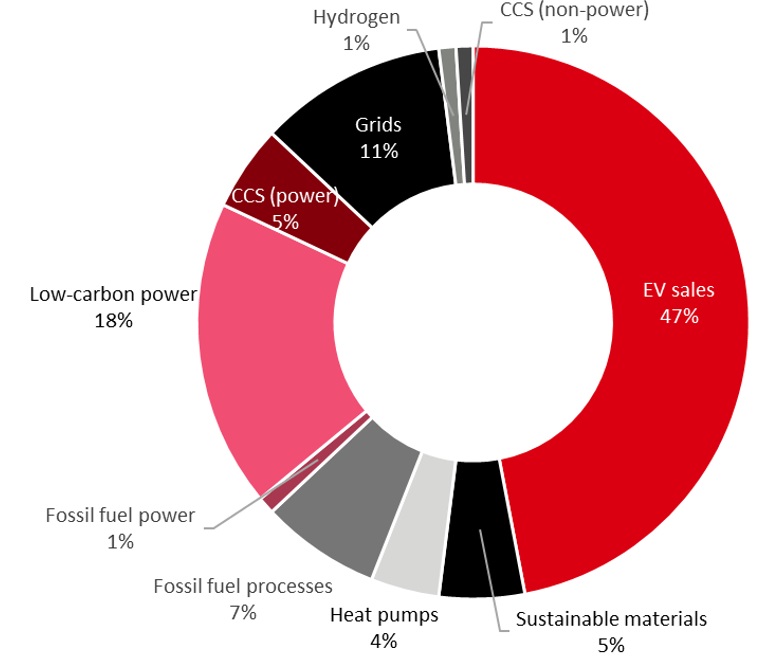

Broadly speaking, energy transition infrastructure refers to the physical systems, facilities, and networks that support the shift from traditional, fossil fuel-based energy sources to cleaner and more sustainable alternatives. The purpose of this infrastructure is to enable the integration, distribution, and utilization of renewable energy sources while reducing greenhouse gas emissions and promoting a more sustainable energy system. It includes infrastructure required to stabilise and transmit the increasing amount of green energy coming onto grids (such as energy storage systems, transmission and distribution networks, electric vehicle charging stations, and smart metering), and infrastructure required to decarbonise sectors of the economy that cannot easily be electrified (such as sustainable aviation fuels and the whole hydrogen ecosystem).

These emerging classes of infrastructure within the energy transition landscape are emerging in response to increased electrification and will also require significant amounts of capital – not only during their development, but even more so to enable their roll-out at scale. In our view, private capital needs to understand the nature of these emerging sectors and how to effectively direct investment towards them.

Fig 3: Breakdown of global investment volumes – Net zero scenario

Source: BloombergNEF, November 2022

Note: carbon capture and storage (CCS) includes investment in power sector (fossil fuel plant and CCS equipment), industry and blue hydrogen production (CCS equipment), as well as storage and transport infrastructure across all sectors

Energy transition investment tops fossil fuels for the first time

During 2022, investment in the energy transition topped USD1tn – outpacing that of fossil fuel investment for the first time.3 While this is a much-needed step in the right direction, in our view, it represents a small proportion of the new investment that is needed.

This investment will be difficult to deliver. Public investment in infrastructure is significantly higher than private investment (particularly in developing economies, where public investment has been reported to represent around 83 per cent of investment, according to the GI Hub).4 This reflects not only government control, as outlined earlier, but also the lack of incentive or opportunity for private investors to deploy capital in new projects in some locations. This needs to change if targets are going to be met.

What could be the driver? The unprecedented fiscal and monetary stimulus in response to the COVID-19 pandemic saw public debt levels reach 100 per cent of GDP in 2020, a record high.5 Debt levels are likely to have since declined due to growth and higher inflation, but they remain elevated and well above pre-pandemic levels. In our view, to meet growing global infrastructure needs, it is important to create stable environments for private capital into infrastructure.

Existing activity too focused on operational assets

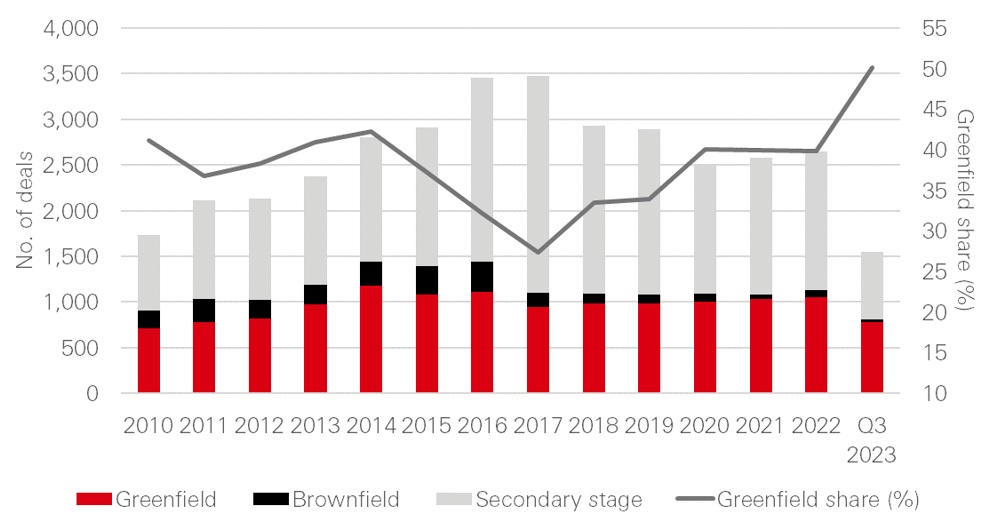

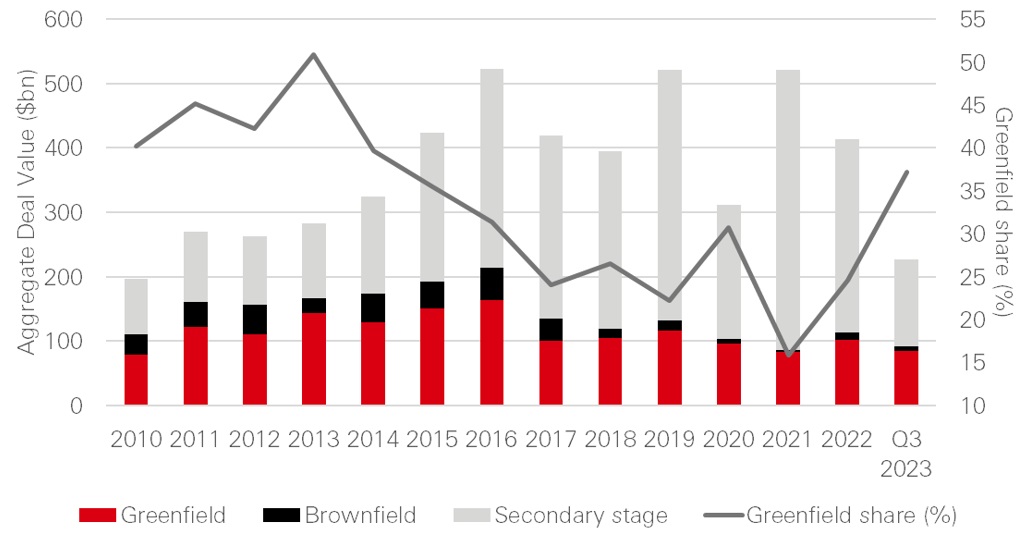

Current private sector investment into energy transition infrastructure is heavily focused on the renewable energy sector, particularly wind and solar projects. According to the Global Infrastructure Hub’s Infrastructure Monitor 2022, renewable energy attracts the largest share of private investment in infrastructure projects, accounting for almost half (48 per cent) of all investment in 2021.6 But this is not enough, particularly given the bulk of investment is focused on assets that are already either in operation or very close to being so.

In a study of closed-ended infrastructure investment funds,7 the GI Hub found that “nearly 70 per cent of assets in the infrastructure asset class that are being managed by private sector funds have no construction risk. This leaves banks to finance most greenfield infrastructure. Its latest Infrastructure Monitor report shows that 63 per cent of private investment in infrastructure projects in primary markets is provided by financial institutions, mainly commercial and investment banks.”

To further support this notion, if we break down global infrastructure transactions, measured by the stage of the asset or project, we can see that the bulk of investment within private markets is focused on existing assets. Projects have been largely de-risked, as construction is complete, there is little chance of cost over-run and revenues are often being generated. Revenues from operational assets can be long-term, index-linked or benefit from monopolistic positions. This makes the assets and their revenue potentially attractive. On the other hand, it can also at times make these assets highly competed for and over-valued.

Fig 4: Number of infrastructure deals by project state, 2010 – Q3 2023

Source: Preqin, data as at October 2023

Fig 5: Annual aggregate infrastructure deal value by project stage, 2010 – Q3 2023

Source: Preqin, data as at October 2023

The data on where the majority of existing capital is deployed, coupled with the forecast net zero requirements, could represent an investment opportunity for equity investors: invest in renewables (and ancillary sectors within the energy transition) and invest in greenfield projects. This strategy combines a greater environmental impact with a better risk return outcome, given there is less competing capital.

A pure-play greenfield strategy may be a stretch too far for some investors – in particular those institutional investors looking to deploy capital in the sector. A more nuanced strategy to calibrate capital exposure across the asset lifecycle in a diversified portfolio may be the logical answer. Rather than bluntly rejecting any investments in project development, we believe investors should consider strategies that manage deployment so that capital exposure is diversified across a portfolio of “de-risked” operational assets as well as assets in development and construction.

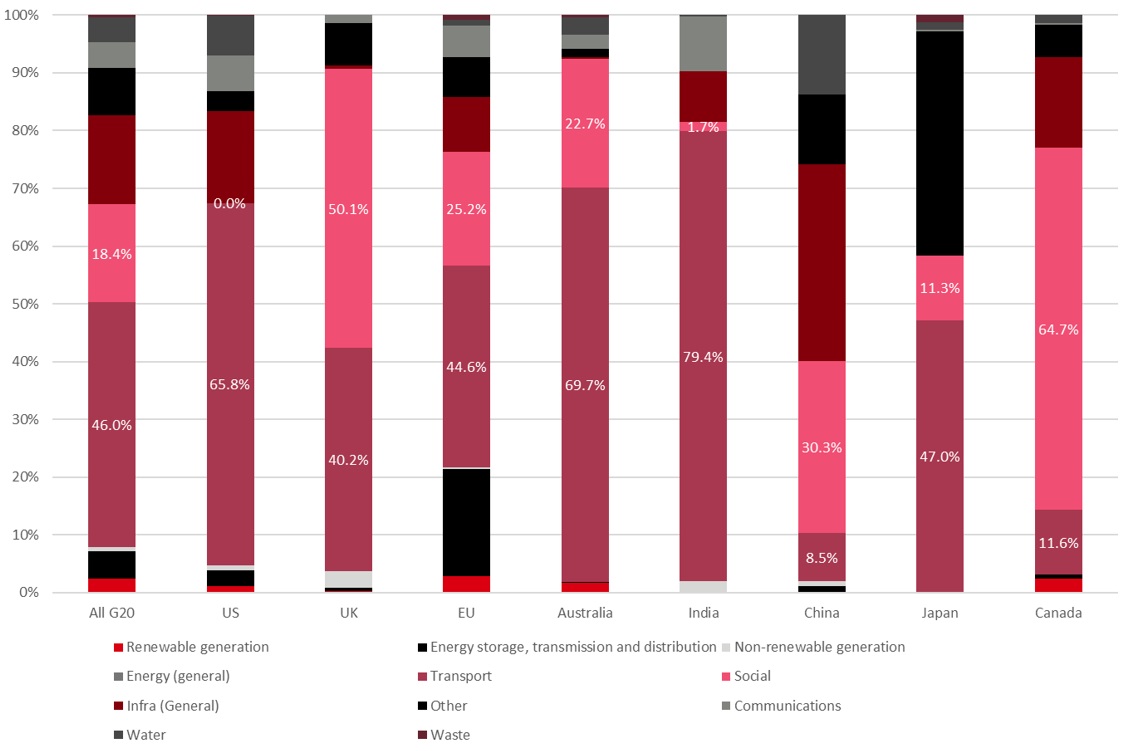

Fig 6: Government investment in infrastructure, 2022, by sector

Source: Global Infrastructure Hub, April 2023

The Asia opportunity

In recent years, Asia has emerged as a key player in the global energy landscape, both as a major consumer and as a rapidly growing market for renewable energy.

Asia is home to some of the world's most populous and rapidly developing countries, yet the region faces significant challenges in meeting its energy demands, while minimizing greenhouse gas emissions.

We believe private market activity focuses where companies and investors can generate compelling risk-adjusted returns, or in places which are offering incentives to invest. The availability of skills and raw materials, as well as environmental conditions conducive to renewable energy sources, are also important factors.

In our view, when considering each of these factors, the opportunity in Asia stands out. The scale of investment needed in renewables is large and spread across many countries, many of which have a long-term track record of infrastructure delivery with private sector participation. This is supportive of investment activity, as risks are reduced, compared to other countries without this long-term experience or track record of investment, or compared to those without established regulatory or legal frameworks. Furthermore, many countries within Asia currently use coal as an outsized contributor to electricity generation. As mentioned earlier, we believe coal will likely be hit first amongst the fossil fuels, providing further impetus to the energy transition in Asia.

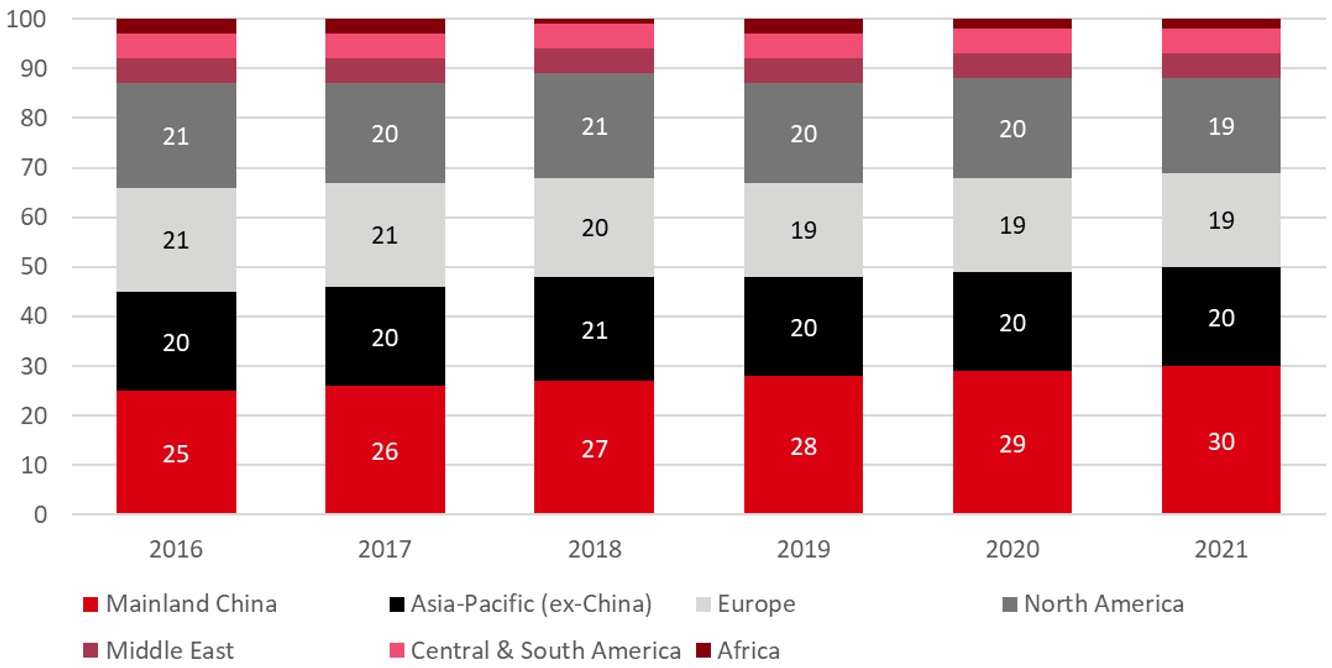

Fig 7: Share of annual electricity generation by region or country

Source: BloombergNEF, as of November 2022

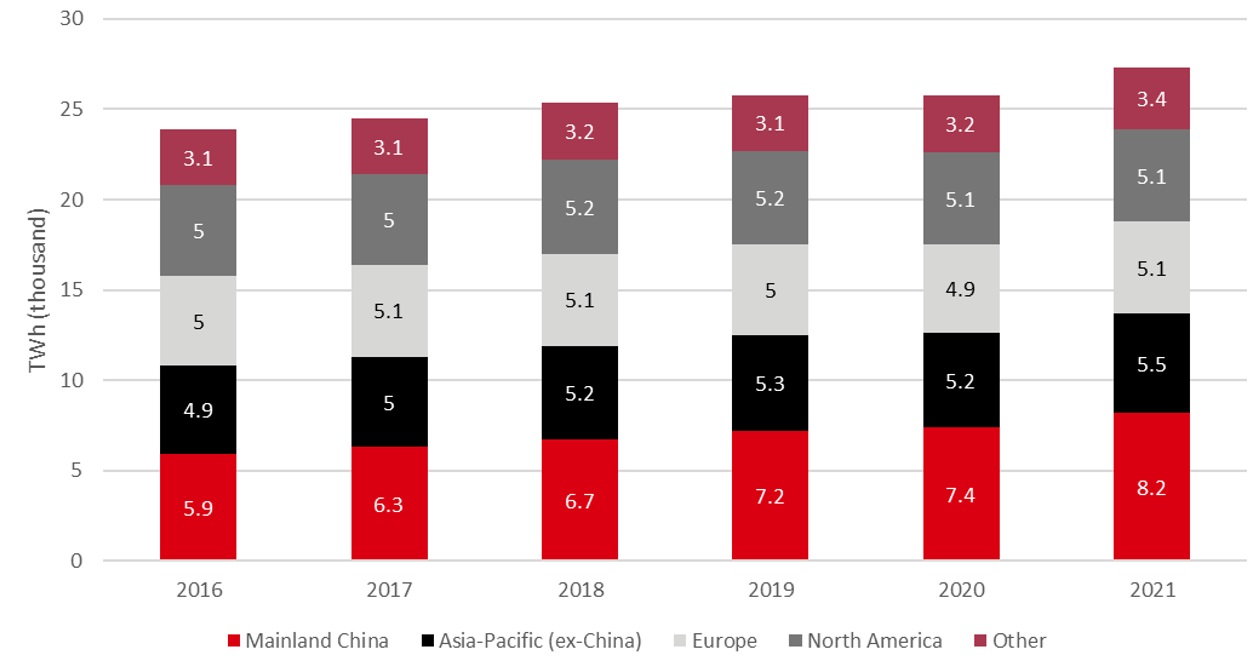

Demand for electricity from the APAC region has risen over the past decade and the continent now accounts for half of global generation. Mainland China alone accounts for 30 per cent of the global power generation (up from 23 per cent in 2012).7 Meanwhile, relative generation capacity in North America and Europe continues to decline. North America and Europe accounted for 19 per cent each of the world’s electricity production in 2021, down from 21 per cent each in 2016. Clearly, the trajectory in Asia is very different to that in Europe and the US. As a result, in our view any energy transition investment needs to have a focus on this region.8

China has experienced the strongest growth in electricity generation over the period between 2012 and 2021. Over this time, electricity generation grew from 4.8TWh to 8.2TWh – equal to compound growth of 5.9 per cent per cent per year. In comparison, Europe saw growth of just 0.2 per cent and North America saw growth of 0.7 per cent. Europe and North American generation is also behind that of Asia Pacific (ex-China), which has delivered 5.5TWh of capacity.8

Fig 8: Global annual electricity generation by region

Source: BloombergNEF, as of November 2022

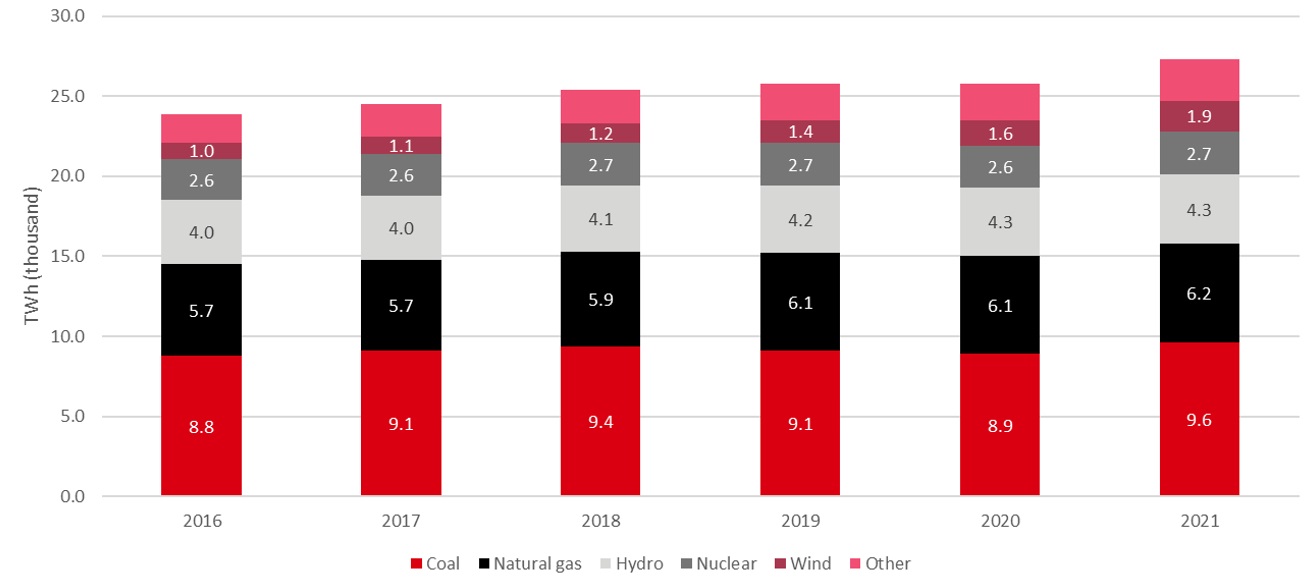

The Asia energy transition is increasingly important given the proportion of generating capacity derived from coal-fired power plants. Global coal-fired power generation capacity has also increased by 1.1TWh in 2021, to reach 9.6TWh in 20219 – meaning coal remains the dominant source of global energy generation. Mainland China and India lead in the building of new coal-fired power generating capacity. The two countries accounted for 83 per cent of new coal additions in 2021. Mainland China alone added 62 per cent of global coal generating capacity between 2012 and 2021. Transitioning this generation capacity to renewable energy sources is important to achieving net zero targets, not only for Asia but also globally.

Fig 9: Global annual electricity generation by technology

Source: BloombergNEF. As of November 2022

Finally, the majority of the global renewables supply chain is located in Asia.10 This means Asia, in addition to replacing its existing generation capacity with renewable sources and installing new renewable generation capacity to meet growth, in our view also needs to invest in the industrial capacity to deliver the required equipment for this region and the rest-of the-world. This should provide significant ancillary investment opportunities in the region.

Investing in energy transition infrastructure in Asia offers a compelling opportunity to combat climate change effectively. By focusing on renewable energy sources such as solar, wind, and hydroelectric power, countries in Asia can reduce their reliance on fossil fuels, decrease carbon emissions, and contribute to global climate goals.

Additional benefits of investing in energy transition infrastructure

Aside from a potentially compelling risk/return proposition and environmental impact, investing in energy transition infrastructure presents economic opportunities for the host countries. Asia's transition to renewable energy has the potential to create jobs, attract investment, and stimulate growth.

In addition, investing in energy transition infrastructure provides an avenue for greater energy security and independence. The energy landscape of many Asian countries has traditionally been reliant on imported fossil fuels, making them vulnerable to price fluctuations and at the prospect of geopolitical tensions. We believe by diversifying energy sources and promoting domestic renewable energy production, countries in Asia can reduce their dependence on foreign oil and gas, bolstering their energy resilience and mitigating risks associated with supply disruptions and price volatility.

Thirdly, rapid industrialization and urbanization in many Asian countries has resulted in increased levels of air pollution, affecting public health and quality of life. Investing in clean energy infrastructure can significantly improve air quality by reducing harmful emissions. This shift not only benefits public health by reducing respiratory illnesses but also reduces healthcare costs and enhances overall well-being.11

Finally, investments in energy transition infrastructure can act as catalysts for innovation and technological advancement further up the investment risk spectrum. While these traits are true for many regions, given the large reliance on imported sources of energy across the region and it being home to the majority of the global renewables supply chain, the potential benefits of a shift towards renewable energy can be amplified.

A potentially compelling opportunity

Climate change is real, and the impacts are being experienced around the world every day. The shift towards renewable sources of energy needs to accelerate in order to achieve the Paris climate commitments. But the scale of investment needed globally is significant. Governments alone cannot fill the gap and will need private investors to step in. In our view, more capital needs to be directed at developing and building new assets, not just investing in existing assets. While this is a global opportunity, we believe it also represents a major opportunity across Asia.

Investing in energy transition infrastructure can bring a range of potential benefits. These are not only in favour of investors but can have far wider positive implications. The benefits extend beyond expected returns and environmental considerations, encompassing economic growth, energy security, improved public health, and technological innovation. By channelling resources into energy transition infrastructure, Asia can lead the way in the global transition to a low-carbon economy while reaping the rewards of a cleaner, more resilient, and prosperous future.

Any forecast, projection or target when provided is indicative only and is not guaranteed in any way. Past performance does not predict future returns.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way, HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

1. USD 200tn Is Needed to Stop Global Warming. That’s a Bargain – Bloomberg, July 2023

2. Energy Transition Investment Trends 2023 | BloombergNEF (bnef.com)

3. Global Low-Carbon Energy Technology Investment Surges Past USD 1tn for the First Time | BloombergNEF (bnef.com), January 2023

4. Global Infrastructure Hub as of April 2023.

5. Global Debt Reaches a Record USD 226tn (imf.org) , December 2021

6. Infrastructure Monitor (gihub.org), updated March 2023

7. Greenfield infrastructure struggles to attract private investment (gihub.org), June 2023

8. All data from BloombergNEF, as of November 2022

9. All data from BloombergNEF, as of November 2022

10. Can US and EU unseat China as the dominant supplier of green energy tech globally? SCMP as of August 2023

11. China: Fighting Air Pollution and Climate Change through Clean Energy Financing. World Bank as of June 2020.