Asian infrastructure

Introduction

While a significant portion of infrastructure assets around the world are held by asset owners outside of fund investments, the global infrastructure asset class is large. In total, there were around USD 1.3tn in infrastructure assets under management at the end of September 2023, the most recent period for which data is available.1 Yet the global infrastructure market, when it comes to fund investing, is top heavy. And it’s also heavily concentrated. The biggest funds dominate, and - almost universally - these are focused on just two markets: the US and Europe.

This leaves a significant gap for those looking to target investments in Asia, with a huge opportunity available outside of the largest assets. The Asian mid-market is already powering growth across the region, and needs significant capital over an extended period if climate targets are to be met. The region also dominates the global supply chain in many technologies, particularly those focused on renewable energy, so there is a pool of resource to benefit from. We believe that for those with an on-the-ground presence within Asia, there is a huge and long-term investment opportunity available.

Positive, but skewed, market backdrop

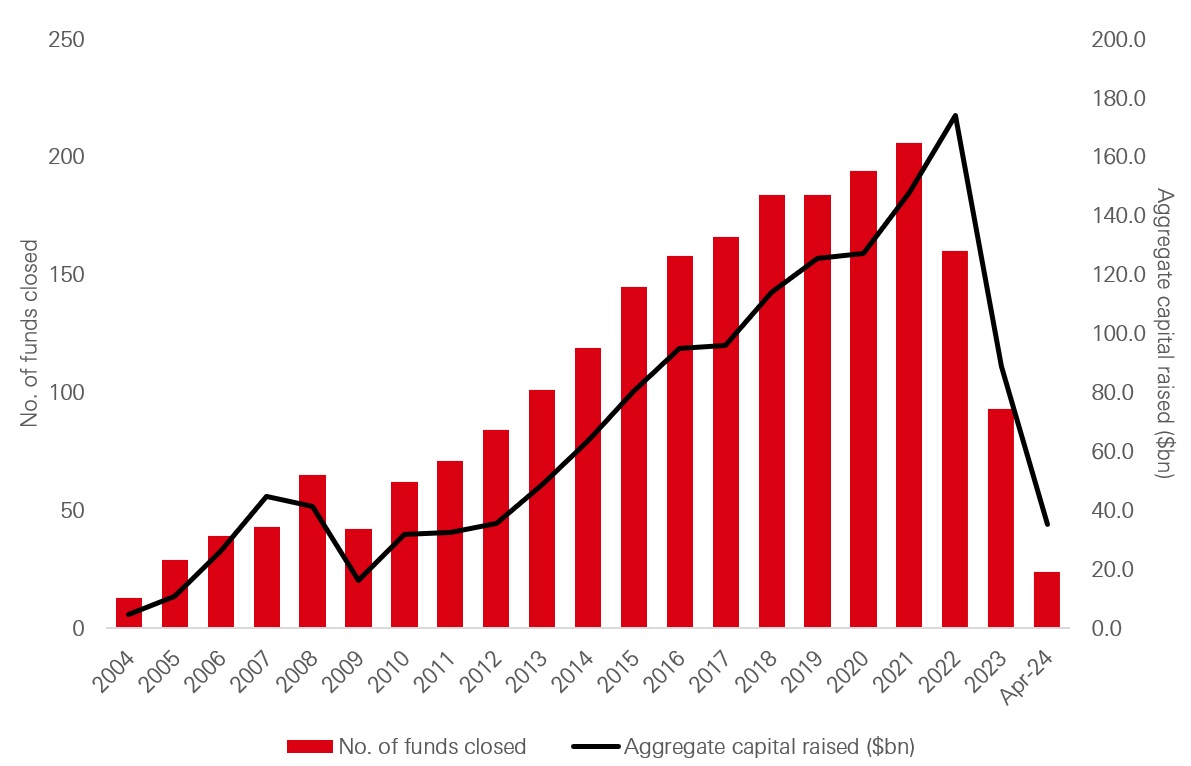

In recent years, the asset class has been boosted by significant capital inflows, with 2021 and 2022 each record years for capital raising. During each of these years, infrastructure funds raised USD 148.1bn and USD 174.2bn, respectively. While 2023 was a year of consolidation, we believe this represents a natural period of digestion for the asset class following two exceptional years of activity. What the headline numbers do not necessarily show is the regional split of the funds closed in each year. When looking below the surface, it is clear that North America and Europe-focused funds dominate the global infrastructure industry.

Figure 1: Global infrastructure capital raising

Source: Preqin Pro, data as of 3 April 2024

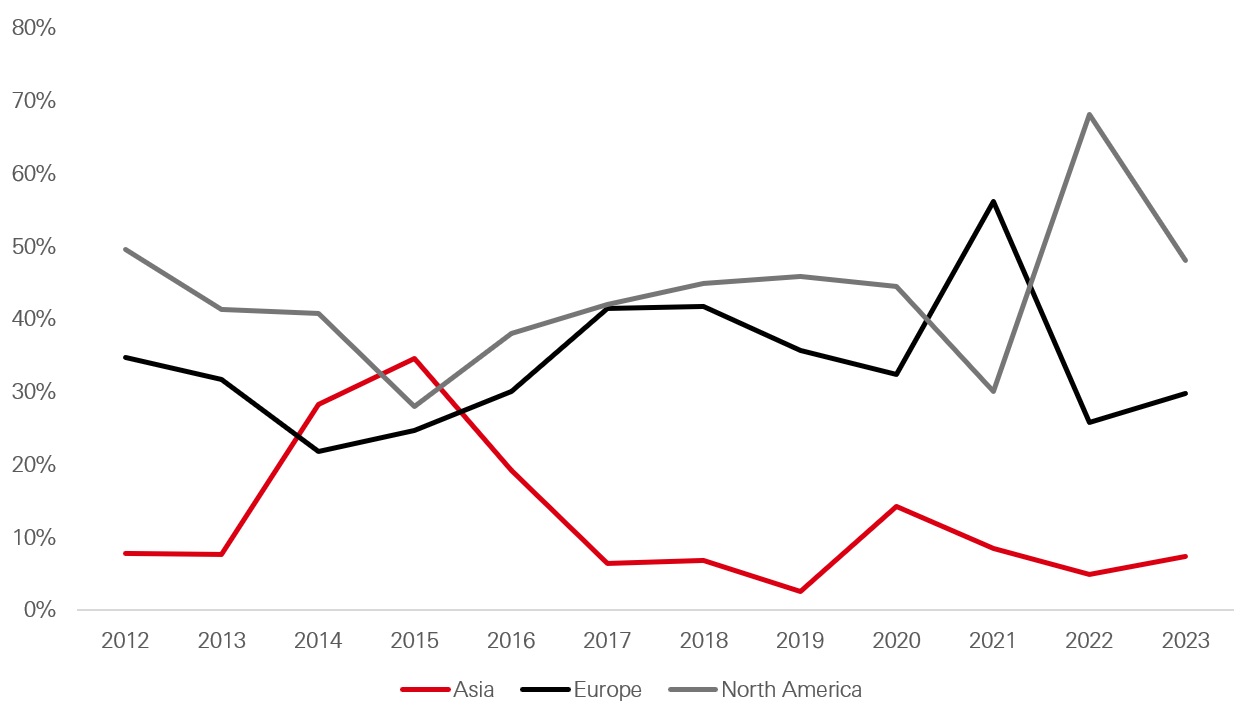

Despite seeing a surge in the proportion of capital raised during 2014-2016, Asia-focused infrastructure funds secured an annual average of 12.4 per cent of all capital raised within the asset class during the 2012-2023 period. Ignoring three standout years, the average is just 7.4 per cent of all capital secured. As most infrastructure funds are based outside of Asia, the skew away from the region may not be surprising. However, this creates opportunities for teams with Asia-based decision-makers, who can move faster and take advantage of local opportunities, with local connections and knowledge.

Figure 2: Share of infrastructure capital raised by region (USD)

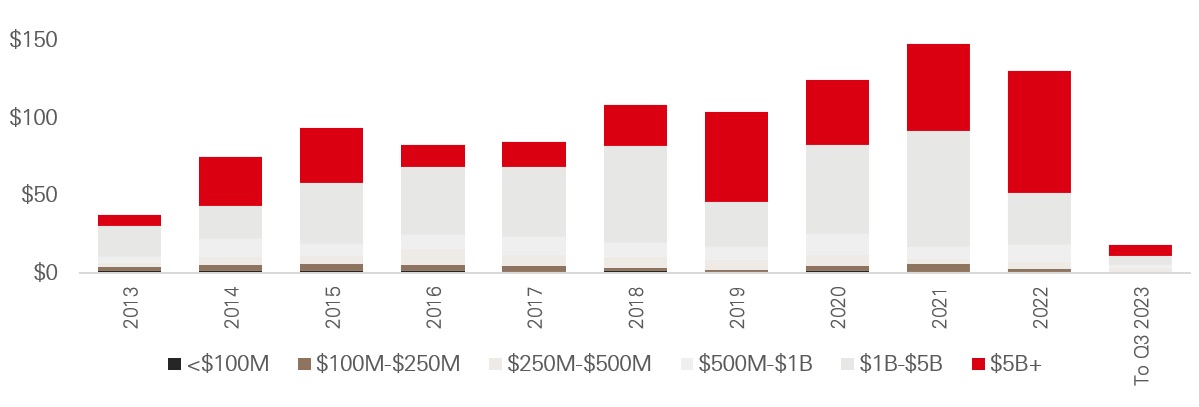

Further analysis shows that the bulk of infrastructure capital raising is focused on large-scale funds, which are bigger than USD 1bn in size: an average of 76 per cent of capital raised was secured by funds bigger than USD 1bn between 2012 and the end of Q3 2023, according to Pitchbook data. Given that Asia-focused funds represent a fraction of those infrastructure-focused funds closed, it is likely that most capital targeting the region is held within funds below USD 1bn in size.

Figure 3: Infrastructure capital raised by fund size (USD bn)

Source: Pitchbook, data to end Q3 2023, as of December 2023

In our view, while these points highlight the dominance of other regions when it comes to securing investor allocations, it also provides an opportunity for those funds which do focus on Asian infrastructure investments. Larger funds will need to deploy capital rapidly at scale to make a meaningful impact upon fund-level performance. As a result, there is likely to be a gap in activity below this level. This opens up a large opportunity set of potential investment for smaller funds, which can target investments that are largely ignored by the biggest funds. Competition for these deals is likely to be less intense, as mega funds often compete with each other for the biggest and highest profile deals in advisor-led auction processes. Similarly, while large-scale infrastructure projects can grab headlines in the press, the bulk of activity on the ground, particularly in the renewable energy space, is across a larger number of smaller projects.

The benefits of a focus on the mid-market

Mid-market companies are the often-unsung drivers of global economic activity. In the US, for example, mid-market companies with revenues between USD 10mn and USD 1bn are responsible for around a third of the country’s economic output, according to data from the World Economic Forum. Similarly, the Mittelstand2 in Germany provides roughly 60 per cent of the country’s jobs. While these statistics relate to companies, a similar theme is true of mid-market infrastructure investments. While airports and expensive train lines can generate headlines, most activity takes place away from the headline-grabbing projects.

When it comes to infrastructure, the mid-market segment accounts for approximately one-third of infrastructure deal value and three-quarters of the number of deals, according to CBRE IM. Their research suggests that the mid-market covers an investment universe equal to around USD 1tn in enterprise value.

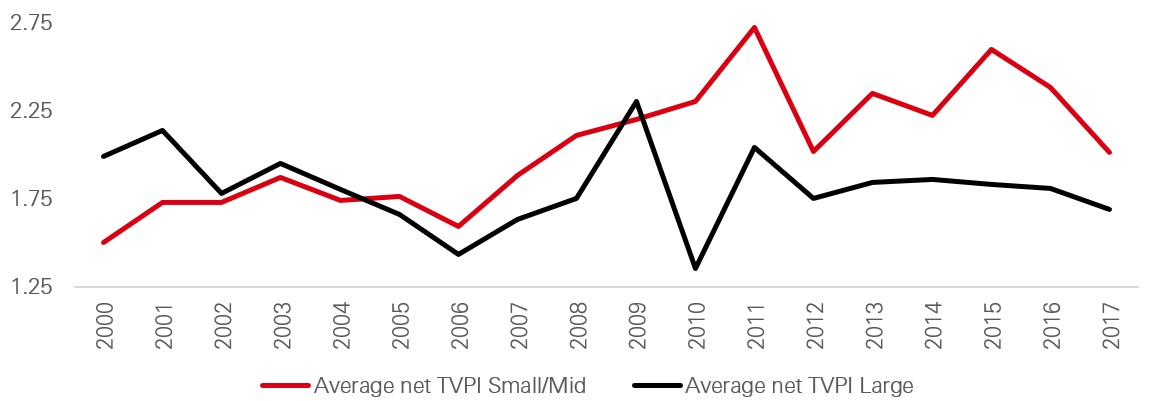

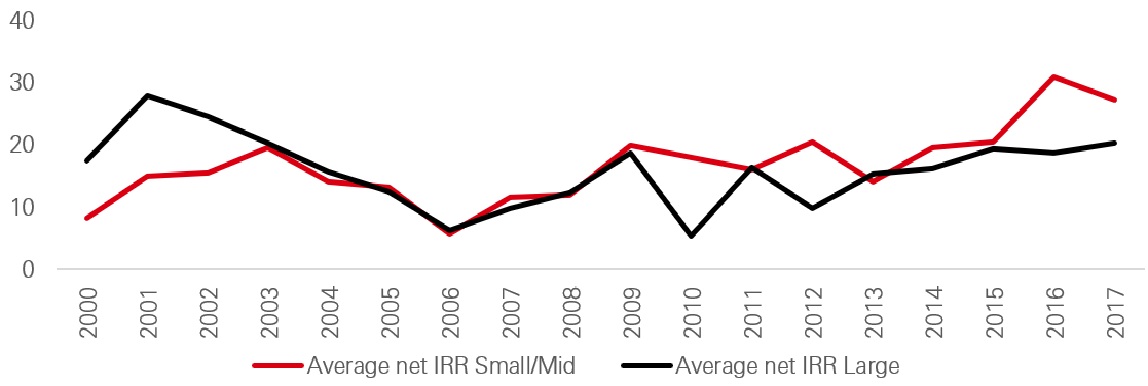

Funds dedicated to investment in these mid-sized private firms have typically achieved more attractive purchase multiples for LPs, and have returned more attractive IRRs compared with equivalent large-scale funds.

Figure 4: Average net TVPI and IRR by fund vintage

Source: Preqin, Schroders Capital, data as of 2023, performance numbers are net to investors

With these traits and a market of such a size, it is unsurprising that, according to Infrastructure Investor, “Investors are proactively looking to increase their mid-market exposure. Part of that is driven by a more sophisticated approach to portfolio construction”. This may be due to the fact that many investors have favoured allocations to large-scale funds or managers, which often pursue the same strategies or investments in the same markets. With an approach such as this there is a risk of strategy replication, rather than enhanced diversification.

The pitfalls of exposure to only large-scale funds

This is particularly evident in large infrastructure investments. These are often operational, have stable cash flows and could be classed as ‘core’ assets. As a result, across large-cap core infrastructure, returns are likely to be lower than other infrastructure investments – this may mean returns are closer to some lower risk investment grade bonds.

Large infrastructure projects can also come with other problems – particularly while they are under construction. Most (90 per cent) large infrastructure projects go over-budget. Meanwhile a large proportion (73 per cent) of mega-projects suffer from poor execution, according to research by McKinsey Global Institute. A further study by authors Flyvbjerg, Holm and Buhl, assessing a total of 258 rail, bridge, tunnel and road projects worth a combined USD 90bn, found that “projects have become larger over time and that for bridges and tunnels, larger projects have a larger percentage of cost escalations.” In a further potential hit, delays in projects can also combine rising construction costs with increasing interest payments before the project is operational. What may be lower risk projects when in operation are not always so when still under construction or ramping up operations.

For the funds themselves, competition for the larger trophy investments needed to move the dial on performance and deployment can be fierce. This can lead to pressure to overpay, while aborted deal costs on those managers miss out on can quickly add up. With a relative dearth of large infrastructure deals, deal values fell 22 per cent in 2023, compared to 2022, according to Infrastructure Investor. When measured by deal numbers, the volume was down 14 per cent in 2023, compared to 2022. Meanwhile, M&A transactions were down 40 per cent year-on-year, highlighting the impacts that this market polarization can have.

Disciplined approach to deal-making is vital

In our view, in comparing large-cap core type investments to smaller mid-market or lower ticket sizes, risks are likely to increase, but these can be managed with a disciplined approach to investment underwriting and portfolio construction. What is more, with smaller investment sizes there are likely to be greater opportunities for intensive asset management to move the dial on returns, with value creation strategies particularly important. Starting from a lower base can also mean there is a wider spectrum of opportunities for exit, compared to large-cap core investments. Given the smaller scale, there is also a broader range of up-front investment opportunities.

An additional factor that can result in attractive entry points for mid-market investments is the fact that negotiations are generally bilateral. This means relationships can be strong through any negotiation process, with the end result beneficial to both parties, as there is not the competition associated with an auction process. This is not always the case with large-scale core investments, as competing funds can bid up prices – sometimes to the detriment of ultimate performance.

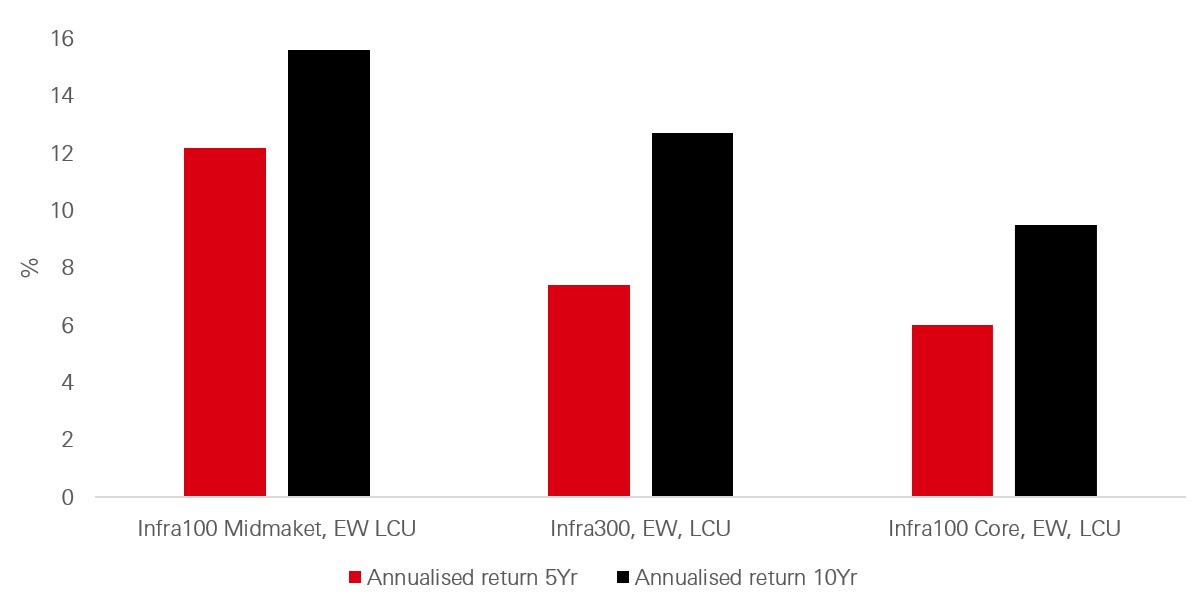

Data from EDHEC shows mid-market infrastructure investments have significantly outperformed core investments over both the five-year period and the 10-year period to the end of December 2022. Although when broken down there is more variability in the returns across quartiles, in terms of annualized volatility there is little variability between mid-market and core. For mid-market investments, the compensation through higher returns and similar volatility represents an attractive risk / reward trade-off, in our view. Clearly, targeting investments towards mid-market infrastructure can be a defensive play for investors that are looking for stable and yielding investments.

Figure 5: Infrastructure performance

Source: EDHECinfra, data as of April 2023, indices equally weighted and in local currency

Given the composition of infrastructure fundraising markets, with core and lower risk strategies more dominant, particularly within large funds, those operating at a level below the largest could benefit from this wider hunting ground. When the positive impacts of greater deal flow, more attractive pricing, less competitive processes and the broad range of opportunities, are taken into account, this part of the market boasts obvious positive points. In addition, considering the lack of focus on Asian infrastructure markets among many fund managers, we believe there is an opportunity for those who are willing and able to take a slightly different approach.

Asian economies in growth mode

While economic growth in some European countries continues to remain low, many Asian economies are experiencing solid growth – which is expected to continue into the future.3 The region has largely been insulated from the inflation increases seen in Europe and the US, particularly.4 While higher policy rates in Europe and the US have brought inflation back towards target levels, there is increasing concern that rates will have to stay higher for longer, in the US, particularly. This is not necessarily the case in Asia, where inflation remains under relative control.

The current scenario does not necessarily mean there is a two-speed global economy, but the solid growth and comparatively benign inflation outlook mean that many Asian markets are in a sound position to fund future investment in infrastructure. Much of this investment is focused on renewable energy generation. Governments across Asia have been proactive in supporting renewable energy through incentives, subsidies, and favorable policies to meet growing demand sustainably. Many are moving towards providing significant support for investments in renewable energy infrastructure, positioning themselves as global leaders in renewable energy capacity. And there are many drivers of activity within Asia’s infrastructure market.

Huge investment needed in Asian infrastructure

Given the scale of infrastructure investment needed in Asia, the opportunity to invest and deploy capital is huge. In recent years, Asia has emerged as a key player in the global energy landscape, both as a major consumer and as a rapidly growing market for renewable energy.

While Asia is home to some of the world's most populous and rapidly developing countries, the region faces significant challenges in meeting its energy demands, while minimizing greenhouse gas emissions.

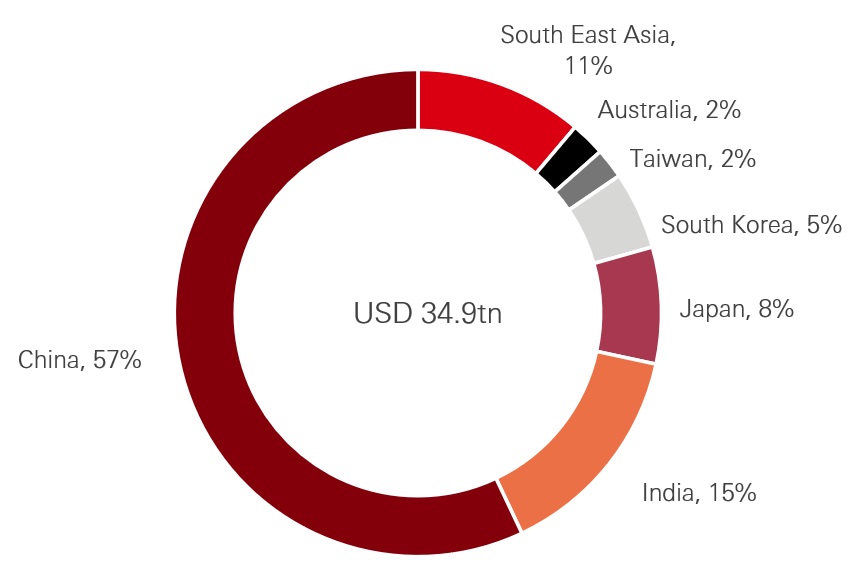

Figure 6: Selected APAC estimated energy supply investment to reach net zero (2020-2050) USD tn

While we believe that, generally, private market activity focuses where companies and investors can generate compelling risk-adjusted returns or in places which are offering incentives to invest, this is not necessarily the case in Asian infrastructure. This is despite the burgeoning industry supporting infrastructure investment and development. The availability of skills and raw materials within the region are key to its success. In addition, the region boasts positive environmental conditions, which are conducive to renewable energy sources: each very important factors driving activity and investment.

Source: Tsinghua University estimates for China, Investor Group on Climate Change estimates for Australia, Asia Investor Group on Climate Change estimates for other countries. South East Asia comprises Indonesia, Malaysia, Philippines, Thailand and Vietnam.

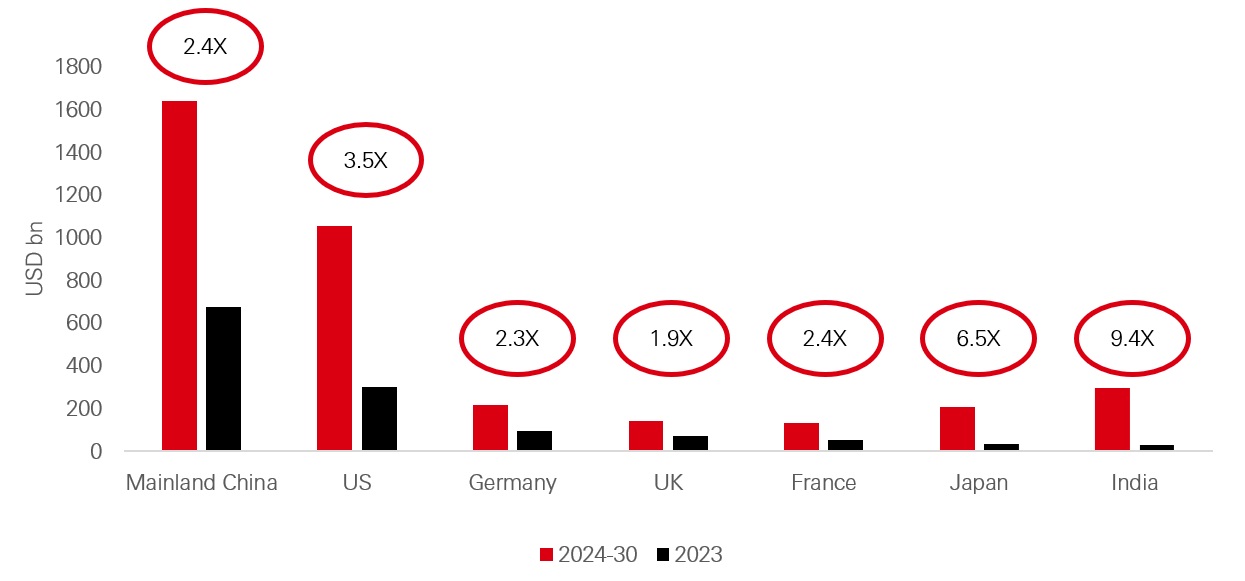

However, it is clear that across Asia, various countries are at different stages in their infrastructure investment and development. China spends a significant sum on energy investment that will help to transition away from fossil fuels – but it is still not enough, with 2.4X more investment needed to hit targets. Spending less, Japan and India need to invest far more if they are to hit targets. Japan needs to invest 6.4X more than at present, while India needs to invest 9.4X current levels if targets are to be achieved. These figures are large and highlight the scale of the opportunity for those aiding the continued energy transition. The equivalent numbers in select Europe markets and the US are lower at 1.9x – 3.5x.

Figure 7: Comparison of 2023 energy transition investment versus required annualised levels, and multiple of current investment required, in New Energy Outlook 2022 net zero scenario

Source: BNEF, data as of January 2024

The multiplier shows the multiplication factor required for the 2023 investment levels to match the average annual investment needs across 2024 to 2030 to align for net zero

In our view, when considering each of these factors, the opportunity in Asia stands out. The scale of investment needed in renewables is large and spread across many countries, several of which have a long-term track record of infrastructure delivery with private sector participation. This is supportive of investment activity, as risks are reduced compared to other countries without this long-term experience or track record of investment or compared to those without established regulatory or legal frameworks. Focusing on the mid-market in Asia means there are additional benefits from quicker decision-making processes and the ability to adapt more rapidly to market changes compared to the often slower-moving large-scale projects in the US and Europe. This agility can lead to faster deployment of renewable infrastructure.

Spotlight on Japan

While, in our view, the market opportunity across Asia stands out, within the region there are specific countries that offer significant potential. Japan is one of those. While other Asian countries are experiencing strong macroeconomic growth, this might not be true in Japan. However, as one of the world’s industrial powerhouses, the country is playing catch-up when it comes to the move away from traditional sources of energy and towards renewables. Data suggests that investment in renewable generating capacity needs to increase by more than six times current levels.

A start is being made towards this. There is a growing domestic offshore wind industry, which is raising awareness of the Japanese opportunity. Recently, the domestic market composition has begun to change. While previous offshore wind auctions were dominated by a single local market participant, more recent auctions have been successfully won by a wider range of firms, pointing towards a more competitive and open environment for operators to participate in. This increased offshore wind activity comes on top of a well-established domestic solar industry. Meanwhile, the Japanese tech sector is also growing, with a focus on datacenters and digital infrastructure.5 These are power intensive industries that require significant up-front investment. The volume of data being created is growing, and intensive applications such as artificial intelligence will only add to the processing power (and electrical power) needed in future. Around the world, there is increasing focus among data center operators on the source of their power. This is also true in Japan, with renewable energy sources in demand, either as a primary source of power or as a back-up, providing resilience in the event of power disruptions.

The Japanese government is also investing to provide the groundwork for further power production and grid expansion. The government has announced plans to invest between USD 50bn and USD 60bn over the next decade to enhance transmission lines, for example.6 Although BNEF data suggests that this is not enough, it represents a solid starting point for future activity to build upon.

Global investors are likely to be familiar with investments in Japan, potentially having existing exposure through listed equities, real estate or fixed income investments to aid diversification. Adding additional exposure to infrastructure can benefit investors in other ways too, as investment in new power generation, in particular, is likely to accelerate, in our view.

Conclusion

We believe that Asian infrastructure presents a huge and long-term investment opportunity. But many investors are simply not seeking exposure. For those targeting the region, there may be less competition in Asia than in other markets, given the lower volumes of capital making its way towards the region. That is despite the huge investment needed and the broad base of activity across the whole of Asia. Focusing on the mid-market opportunity in a range of countries within Asia could deliver solid returns, particularly compared to core assets. Benefits such as the market size, breadth and depth of opportunities, the ability move fast and make a positive environmental impact and close relationships with partners stand out. There are many options for investors to deploy capital in a range of assets, filling the gaps left by others, who are focusing their attention elsewhere.

1. Preqin - Alternative Assets Data and Intelligence - Databases, Publications and Research

2. Commonly defined as a statistical category of small and medium-sized enterprises

3. India predicted to outshine China as Asia remains a bright spot for global growth (cnbc.com)

4. Asia's growth will outperform the U.S. and Europe, Morgan Stanley says (cnbc.com)

5. Japan’s Booming Data Center Market Draws Multinationals as Digitization, 5G and AI Drive Growth | Japan Insight - Investing in Japan - Japan External Trade Organization - JETRO

6. Together for Action: Japan's Initiatives for Achieving the Common Goal of Net Zero by 2050 | The Government of Japan - JapanGov