Implementing sustainable investment policy: a checklist for treasurers

Introduction

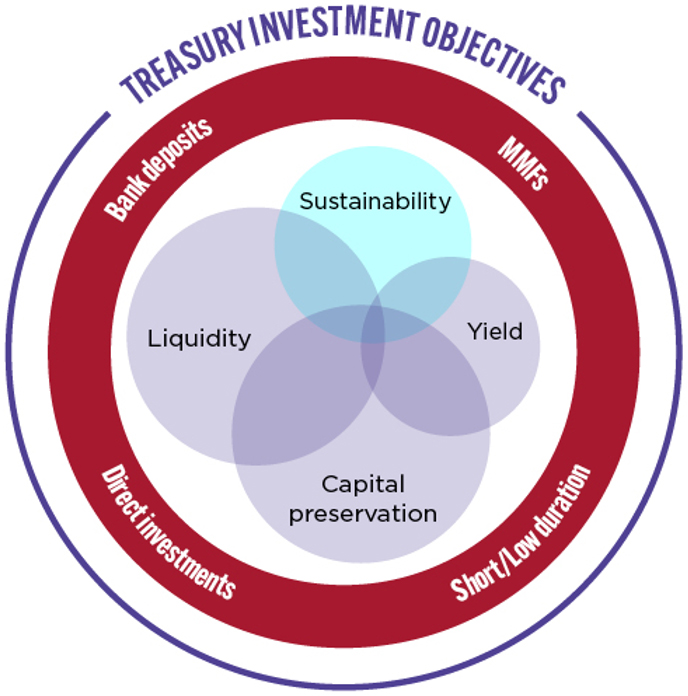

Treasurers understand the importance of SLY (security, liquidity and then yield) when considering what to do with their surplus cash. However, there is increasing pressure to add ESG considerations into investment decisions and treasurers need to work out how to incorporate this new element. Here, we provide treasurers with guidance on things to consider when reviewing their existing treasury policy to ensure it remains fit for purpose.

1. Obtaining stakeholder support

The perceived success of any strategic change will, to a large extent, be contingent on whether it meets the expectations of key stakeholders. It’s therefore imperative that objectives and expectations are clear and well supported from ideation to implementation of the change. In the case of treasury policy, determination of investment and ESG criteria on which to evaluate performance may be of particular significance where investment performance and ESG performance move asymmetrically, at least in the short term. It will require stakeholders to be supportive of a more holistic assessment of the benefits than investment performance alone, attributing value to sustainability that may only be fully realised over the longer term.

2. Setting the objective

Capital preservation and liquidity objectives have always been the core objectives of treasury investment policy, designed to safeguard the firm’s assets and making them available when required. Maximising yield is rarely a treasury objective, as to do so would be to compromise the core objectives. Nevertheless, whilst yield may not be an objective, it may be one consideration when allocating between cash investment solutions of the same type. Without a clear treasury objective on sustainability and clear policies to support it, the principles of sustainable investment risk being compromised by comparisons on relative investment performance. In turn, this risks putting a price on principles of sustainability. To this end, it’s important to consider that the ESG component of, for example an ESG Money Market Fund (MMF) investment strategy, is just one of many variables that may influence the relative investment performance of one fund versus another. To ensure that sustainability objectives are not undermined by the policy itself, comparative yield considerations (which are likely to be low single digit basis point over the full interest rate cycle, all other things being equal) should be avoided.

The objective may also make considerations for philanthropy that will also need to be reflected in policy to ensure it is not overridden by other considerations. Some investment solutions may have philanthropic features, directing a proportion of the return towards social causes that may contribute to a firm’s corporate social responsibility (CSR) objectives. These benefits may not be easily quantifiable so stakeholder expectations and corresponding treasury investment policies need to be appropriately set and the output assessed qualitatively.

3. Identifying investment solutions and setting appropriate ESG criteria

ESG criteria should be aligned to the company’s sustainability objectives and be implemented at instrument level to reflect any unique considerations. For example, if the treasury policy includes the use of bank deposits, the criteria may be to invest only in green deposits or to apply ESG metrics to the deposit taking banks. Whichever is used, there will be considerations for resourcing, the cost and availability of data and a degree of subjectivity within assessments of relative value.

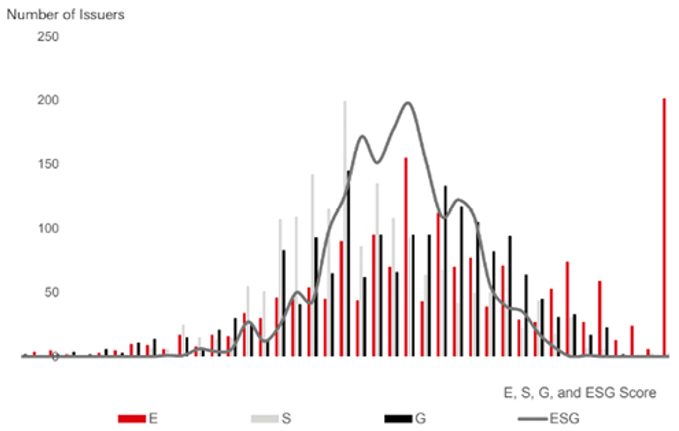

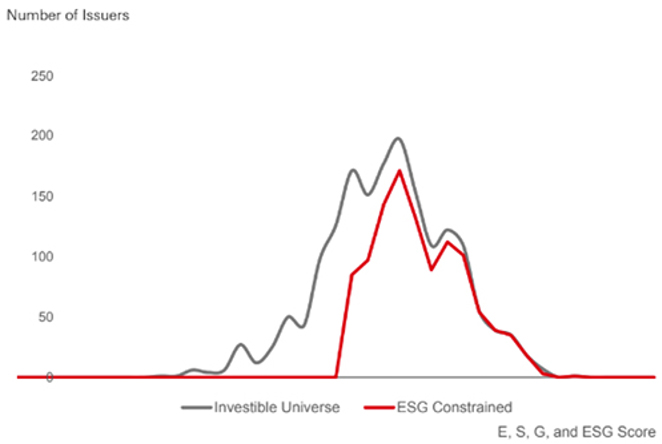

Similarly, when setting ESG criteria around MMFs, it’s important to consider the investment approaches adopted. These can range from ESG integration, a baseline assessment of issuers’ ESG data within the credit process, to best-in-class investment approaches which seek to specifically select issuers or tilt portfolios towards higher ESG performing issuers. As with other cash investment solutions, there are specific considerations unique to MMFs. For example, while the MMF portfolio characteristics may be similar in terms of credit, liquidity and duration, the ESG profile of the funds may be materially different and can result in a modest drag on yield, owing to a more constrained universe of issuers. Conversely, funds with similar aggregate ESG metrics may be constructed differently. The same portfolio ESG score can be obtained by owning high and low scorers (the distribution of score in the money market A1/P1 universe is shown below) as by holding more issuers clustered around the middle and right of the distribution. An approach that constrains the distribution (see below) achieving a similar score could be said to be the better at managing ESG risk. It is important to understand both the asymmetric relationship between ESG and investment performance and that there are varying approaches to ESG portfolio construction.

Universe Distribution of ESG, E, S, and G

Criteria to consider before formulating a treasury ESG policy

- Materiality: does the approach achieve a material improvement relative to traditional alternatives

- Exclusionary criteria; align with the corporate-wide policy

- Capacity: Does the solution(s) have sufficient capacity to support your needs, does flexibility need to be retained where capacity constraints exist

- Quantitative assessment: what are the goals and how am I measuring success, for example, improving the ESG score of my investment portfolio relative to a baseline or alternative or constraining the investment universe to better manage ESG risks

- Other considerations; subjectivity / assessment of process

4. Defining performance measurement

Traditionally, considerations for performance within the policy were purely financial, the relative risk adjusted performance of one investment versus another. Within a sustainable treasury policy, considerations are also given to ESG risks i.e., the policy considers ESG factors when evaluating cash investment solutions. This presents a problem for treasurers trying to identify quantitative thresholds for investment, not least because of the more subjective nature of sustainable investment more broadly. Irrespective of whether an ESG score relates to an individual instrument or a portfolio of instruments, e.g. MMF, it’s imperative that the scoring methodology is understood and consistently applied. Comparing the ESG scores of individual instruments is relatively straightforward, for example, directly comparing the ESG scores of one issuer or bank versus another. This process becomes more complicated when evaluating the aggregate ESG score of one portfolio versus another and without proper understanding of how the portfolio is constructed, could result in exposure to issuers that may have otherwise been excluded on ESG grounds, even if the portfolios aggregate ESG score is above thresholds or appears relatively high or at least consistent versus another. For example, a process that seeks to achieve a minimum weighted average ESG score could still take exposure to poor performing counterparties provided the weighted average score remained above the minimum targeted for the portfolio. By comparison, a process specifically designed to eliminate the worst performing issuers within the theoretical universe of issuers, the bottom quartile of ESG scoring issuers for instance, would be more constrained. Ultimately, the aggregate ESG scores of both portfolios could be similar, but the former could have exposure to poor performing issuers from an ESG perspective that would not be apparent from the portfolio ESG score.

Performance considerations for an ESG MMF

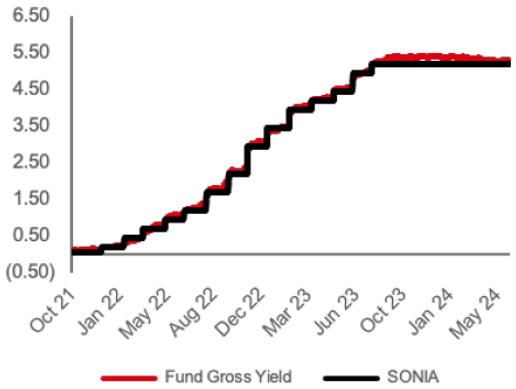

Investment performance: While an MMF fund is not managed to a benchmark, the fund’s performance is expected to closely track short-term interest rates with a low level of volatility. In Fig 1, we have plotted a fund’s gross yield versus the reference rate (SOFR).

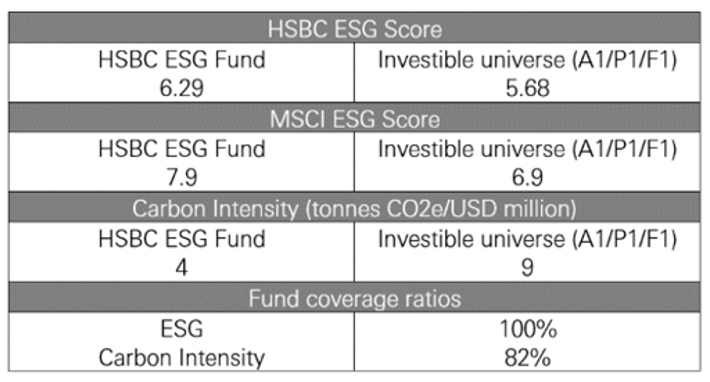

ESG performance: In the case of an MMF, data is available on issuers within the portfolio across E, S and G pillars. These scores can be used to define minimum investment thresholds and measure the portfolio’s ESG performance relative to the theoretical investible universe of issuers potentially available for investment by MMFs.

An example of the types of data available is shown in Fig 2 below.

ESG specific characteristics

Fig 1: The above performance is reflective of the period 12 October 2022 to 31 May 2024. Yields are monthly average gross yields, annualised using 365 days in accordance with the Institutional Money Market Funds Association. Yields are based on a snapshot of the portfolio on that day.

Fig 2: The above data is as at 31 May 2024. To demonstrate the performance of the fund against its sustainable investment aim, the ESG scores and carbon intensity of the fund are shown compared to the scores of the A1/P1/F1 rated investible universe of a Short-term Money Market Fund.

5. Be clear on the benefits

Risk management is a central component of any treasury investment policy, and a sustainable treasury policy extends this consideration to ESG. Companies adopting sustainable treasury investment policies are introducing greater levels of governance on investment decision-making. Solutions such as ESG MMFs offer the opportunity to effectively outsource ESG investment decision-making. This not only helps to safeguard the company against reputational damage but can also be used to demonstrate to the wider business how corporate values around sustainability can be adopted throughout its operations.

Transparency and disclosure are critical elements of a sustainable treasury investment policy. In addition to increasingly comprehensive corporate disclosure and reporting requirements, firms are under increasing pressure to go further. A sustainable investment policy signals a commitment and transparent reporting allows stakeholders, including investors and the public, to assess the company’s efforts and hold it accountable for its actions. This openness fosters trust improves governance scores and demonstrates a dedication to ethical and responsible financial practices.

6. Assessment of greenwashing risks

A further complexity for treasurers, is the lack of clear definitions on sustainability and the generally more subjective nature of sustainability. Regulation to date has arguably caused further confusion. The EU’s Sustainable Finance Disclosure Regulation is often incorrectly considered to be a fund labelling regime. The regulation however does not define sustainability and simply imposes reporting criteria based on how an investment manager classifies their fund, leaving it to investors to determine the materiality of the ESG considerations within the strategy. What one manager may consider as sustainably invested, another, with a more refined framework may not.

7. Fund manager selection

Investors considering ESG MMFs should demand that the solutions offered are robust, credible and are meaningfully differentiated from a non-ESG fund. Just as reliance on an AAA MMF rating masks a spectrum of risk and return profiles, an over-reliance on the Sustainable Finance Directive Regulation (SFDR) classification could lead an investor to conclude that all ESG solutions are the same. In reality, each ESG investment methodology will be different, and the impact of these methodologies on an investible universe can vary widely. It is therefore important to consider if the methodology results in a quantifiable impact on the investment universe; for example, by constraining a proportion of the investible universe by removing issuers with lower ESG scores. This focuses investment in issuers that are deemed better at managing E, S and G risks in their business. Alongside a constrained universe, a well-articulated and targeted engagement strategy can augment an ESG value proposition to stakeholders.

8. Implementation and ongoing evaluation

Implementation may be a phased approach reflecting instrument type capacity and may be specifically limited to certain instrument types based on the cost and availability of data and other factors identified during policy development. Training is essential among treasury team members, particularly if there is a more fundamental shift in policy or processes, to ensure the objectives of the policy and expectations for what success looks like are understood to ensure smooth adoption. As the reliability, availability, and interpretation of ESG and other sustainability data improves, (potentially leading to new cash investment solutions or features), the policy and the processes will necessarily evolve.

Summary

A sustainable treasury investment policy represents a strategic approach to financial management that integrates ESG criteria, risk management, and responsible investment principles alongside core objectives of security and liquidity. By aligning financial decisions with corporate sustainability goals, treasury teams can contribute to positive societal and environmental outcomes while safeguarding long-term financial health. Treasury teams must critically assess ESG data alongside considerations unique to instrument types. Fund manager approaches and the processes that underpin them must also be well understood to avoid binary decision-making based on portfolio ESG scores which could result in unintended consequences.As the corporate landscape evolves, adopting a sustainable treasury investment policy is not only a responsible choice but also a strategic imperative for companies’ evolution to more sustainable business models.

Policy Checklist

- Obtain stakeholder support

- Set the objective

- Identify possible solutions and establish criteria

- Define performance measurement

- Articulate the benefits

- Assess risks

- Select manager

- Implement, monitor and refine