Venture Capital Investing

- Venture Capital (VC) is a financing method where capital is invested in startups or young businesses in exchange for ownership shares. VC firms, also known as General Partners (GPs), raise funds from Limited Partners (LPs) to invest in companies with high growth potential, particularly in innovative sectors like software, fintech, and biotechnology

- VC differs from private equity buyouts in terms of company types, ownership stakes, risk profiles, and investment strategies. VC investments are typically higher risk but offer the potential for outsized returns, often relying on a few successful investments to drive the overall portfolio performance

- The VC industry has seen significant growth, with assets under management (AUM) projected to reach USD3.8tn by 2028. North America remains the dominant region for VC activity, although interest is growing in emerging markets too

- The fundraising market has slowed since its peak in 2021, with a notable decrease in deal values. But the number of deals has relatively stabilised now, indicating a focus on smaller investments. The exit market has also contracted, but successful IPOs suggest potential recovery

- However, we believe that for knowledgeable and experienced investors with the appropriate risk tolerance, we believe now is an opportune time to invest in VC, as valuation corrections may allow access to top-performing managers and high-quality companies at favourable prices

Venture capital – what’s important to know?

Whether you’re booking a holiday through Kayak, grilling a plant-based burger from Impossible Foods or buying groceries through Instacart, you are likely to use services and products from venture capital-backed companies – they are all around us.

Venture capital (“VC”) is a form of financing where capital is invested into a company – generally a start-up, young business or a small business – in exchange for an ownership share in the company. VC firms (General Partners – “GPs”) will raise funds from investors called Limited Partners (“LPs”) to invest in emerging companies that they believe have exceptional long-term potential. Beyond providing capital, GPs will support companies through their networks to building their teams and develop the product. Both the GP and the LP benefit if the company does well. The companies receiving the capital will generally invest it into their business in a variety of ways to help support the growth: for example, add on new teams to target a new market, or invest in sales, technology or product development.

VC-backed companies exhibit high growth potential and aim to offer highly innovative products or services within high-potential, highly scalable industries such as software, fintech, digital infrastructure, and pharmaceutical/biotechnology, although the reach of venture has expanded over time. Despite this, start-ups face significant challenges, including product development, customer adoption, market evolution, and financing risks, which is why many fail in the early stages. Venture strategies seek to offset these losses through well-diversified portfolios with outsized returns from a core of highly successful investments.

There are many prominent VC firms with experienced teams and a long-term track record of successfully selecting winning and high-profile investments.

The difference between VC and Buyouts

Both VC and Private Equity Buyouts share the same goal: to increase the value of companies they invest in before selling their stake for a profit; however, they differ in the following ways:

- Types of companies

- Ownership stake

- Risk profile

- Team construction

- Holding periods

- Fund fees

VCs seek start-up companies, or those in their relative infancy; the company can be as early stage as a small team with a business plan and no assets or cashflow. VC funding gives them access to vital capital and GPs can also share expertise, experience and network, informally or via a board seat, to support companies and improve the chances of success.

VC managers often take minority stakes - 50 per cent or less - when making an initial investment in order to gain access to the most attractive companies and potential ‘pro-rata’ rights in subsequent rounds. Although there’s no "controlling” investor as seen within PE, the VC managers with the biggest ownership positions typically sit on the company board and are part of strategic and growth discussions.

Another notable difference between Buyouts and VC is the risk profile. VC investments are generally higher risk, with both the potential for higher relative returns and an increased chance of failure. As such, the loss ratios are higher in VC than in Buyouts. There is increased risk in VC investment as young companies are often still developing products or services, which might need refinement, they may be in immature or new markets and could be operating at the cutting edge of a technology. Given these characteristics, while risks to the downside are greater, so is the potential upside. As a result, venture portfolios tend to be well-diversified with managers typically seeking a handful of ‘home run’ investments that alone generate the majority of fund returns, this is commonly referred to as the “Power Law.”

In terms of team construction, VCs are much smaller and nimbler, allowing them to move quickly. Investors typically employ a thesis-driven sourcing approach and are encouraged to take calculated risks to uncover outliers, often without the need for formal voting processes. Unlike Buyouts, where operational efficiency is key to value creation, VCs focus on offering access to networks, strategic guidance and mentorship to help fuel growth.

Given VC managers invest in less mature companies, holding periods are typically longer than Buyouts; however, the potential for outperformance makes it worth the wait with compounding returns. Successful VC-backed companies are typically exited through the public markets via IPO or through a sale to a larger, strategic company.

Finally, VC fund managers operate in the same way as other private market fund managers, in that they charge management and performance fees; however, they can be higher than the Buyouts industry standard 2 per cent management fee and 20 per cent performance fee (over a specified hurdle rate) – due to expected outperformance. Management fees are typically calculated as a percentage of assets under management (AUM) within a fund and performance fees are calculated as a percentage of the profits from investing. These performance fees incentivise managers to deliver greater returns and are generally paid out to employees to reward their investment successes.

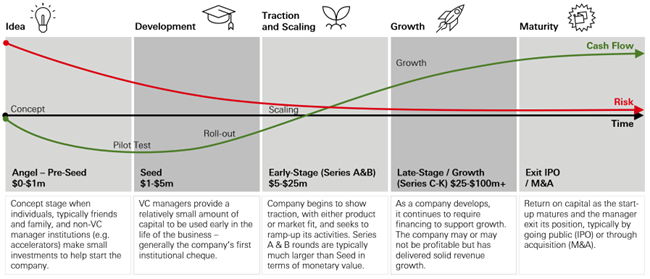

The Venture Capital cycle

Source: HSBC Asset Management, HSBC Global Private Banking, November 2024. Note: Conceptual illustration based on industry data and statistics.

The stages of VC fundraising

As start-ups grow and develop, they will require financing from VC fund managers to support the growth. This happens through fundraising rounds across different stages from angel, pre-seed, seed to late stage, as described below. After the seed round, fundraising rounds are called “Series” and are labelled alphabetically, e.g., Series A, Series B, etc. With each Series, the fundraising rounds typically increase in size as well as the valuation of the company. In a fundraising round, companies may seek new VC fund managers to diversify the investor base and seek investors that can provide additional support e.g., through their networks. The new fundraising round will also provide an opportunity for existing investors to provide additional or follow-on capital to the company. Some VC fund managers may specialise in specific stages, and some may invest across all (known as multi-stage managers).

Angel and Pre-Seed Stage

This is the initial concept stage when individuals, typically friends and family, and non-VC manager institutions (e.g. accelerators) make small investments to help start the company.

Seed stage

When a VC fund manager provides a start-up company with a relatively small amount of capital to be used early in the life of the business, it is referred to as seed funding. The seed round is generally the recipient’s first institutional cheque. The initial investment can be in a range of formats and is often in the form of convertible notes, equity or preferred stock options in exchange for an investment in the company.

Early stage

Early-stage is generally intended for companies that have started to show some traction either with the product or services, or customers, and are seeking to ramp-up their activities. As such, this stage of financing is usually larger, in terms of the monetary value, than the seed stage. Within early-stage, fundraising rounds are generally labelled as Series A or Series B.

Late stage / Growth

As a company develops, it will continue to require financing to support its growth. Late-stage funding is targeted towards more mature companies than start-ups (but less mature than PE), which may or may not be profitable but have delivered solid growth and are typically revenue generating. Within late-stage, fundraising rounds are labelled as Series C, Series D etc. up to Series K usually.

The broader venture capital market

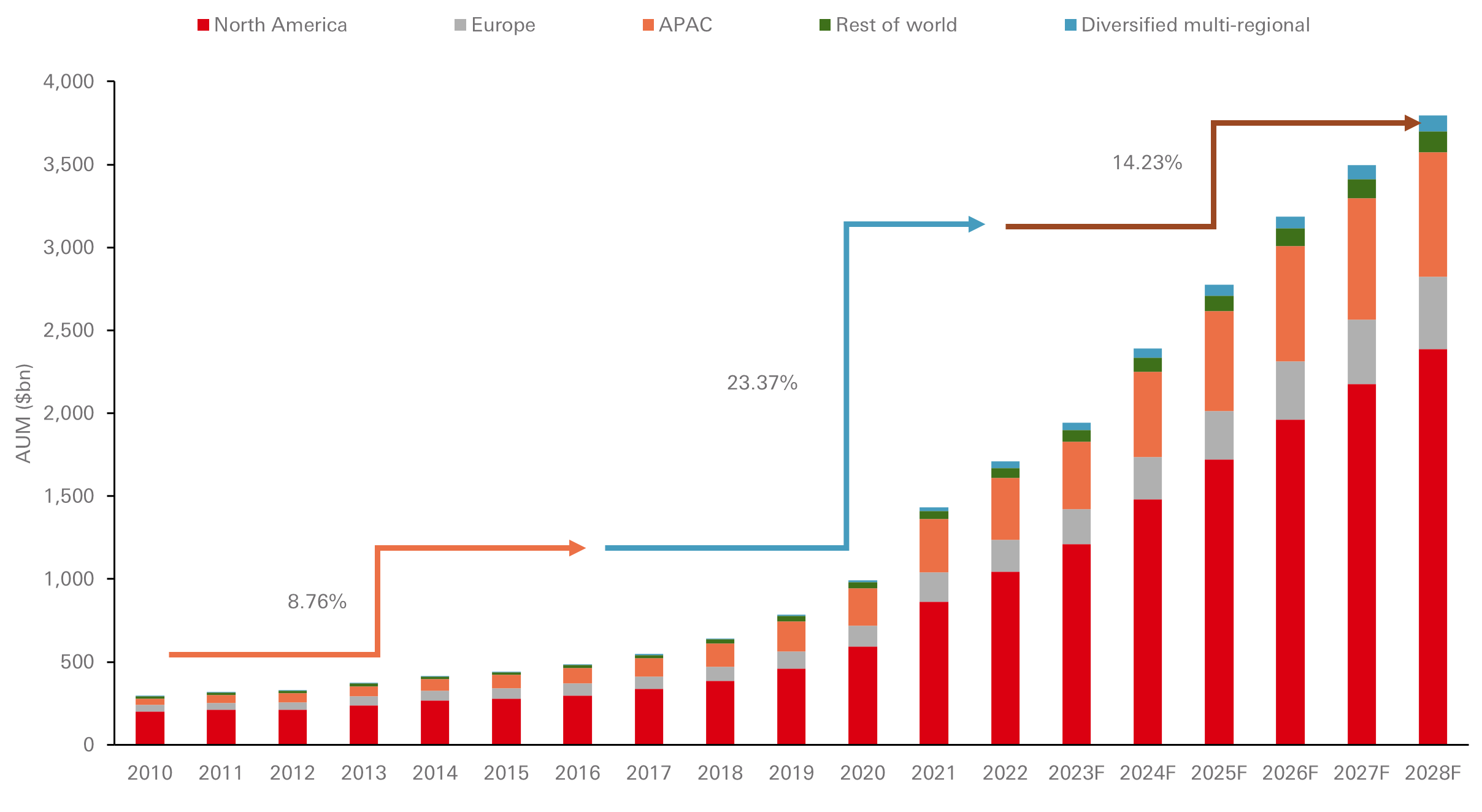

The VC industry has been a major beneficiary of the growth in private capital markets, particularly in recent years. Between 2010 and the end of 2022, VC AUM increased from USD293bn to USD1.7tn, according to Preqin report on Future of Alternatives 2029. Their forecasts suggest that while the rate of growth in the asset class will slow, it will remain the fastest growing asset class within private capital markets. Over the forecast horizon, which runs from 2023-2028, Preqin expects VC AUM to reach USD3.8tn – equal to a compounded annual growth rate of 14.2 per cent between the end of 2022 and the end of 2028. VC is expected to dwarf that of both infrastructure and real estate, which should reach AUM of USD1.7tn and USD2.2tn in 2028, respectively. Among the attractions driving interest in VC markets are access to cutting-edge technology and market disruptors while they are in the nascent stage, something traditional asset classes cannot provide until much later in a company’s lifecycle.

The vast majority of VC activity is located in North America. Of the expected USD3.8tn in VC AUM in 2028, 63 per cent is forecasted to be in North America, compared to 11.5 per cent in Europe and 19.8 per cent in APAC. That said, VC fund managers are expanding their horizons beyond traditional technology hubs such as Silicon Valley: there is growing interest in emerging markets and secondary cities that offer promising opportunities for innovation and growth (i.e. London, Berlin, Singapore, Tel Aviv).

Venture capital AUM* by primary region focus

Source: Preqin Future of Alternatives 2028, HSBC Global Private Banking, November 2024. Past performance does not predict future returns. Note: *AUM figures exclude funds denominated in Yuan Renminbi and data is as of November 2023. This information shouldn’t be considered as an investment advice. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

As a result of this growth, the composition of the VC industry has changed. There are now more and larger participants in the VC market, as the industry has evolved and increased in size. VC markets are primarily (but not entirely) focused on technology investments of some kind, and eight of the ten largest companies in the world are now technology companies, initially funded by VC (Source: Companiesmarketcap.com). In 2015, it was only one (Source: PWC). Indeed, VCs are increasingly prioritising sectors that, in their view, demonstrate more resilience and long-term potential, principally in areas such as AI, healthcare IT, climate tech and fintech. Generative AI, specifically, continues to dominate the VC landscape. Large language models continue to see the majority of AI funding, along with AI development tools.

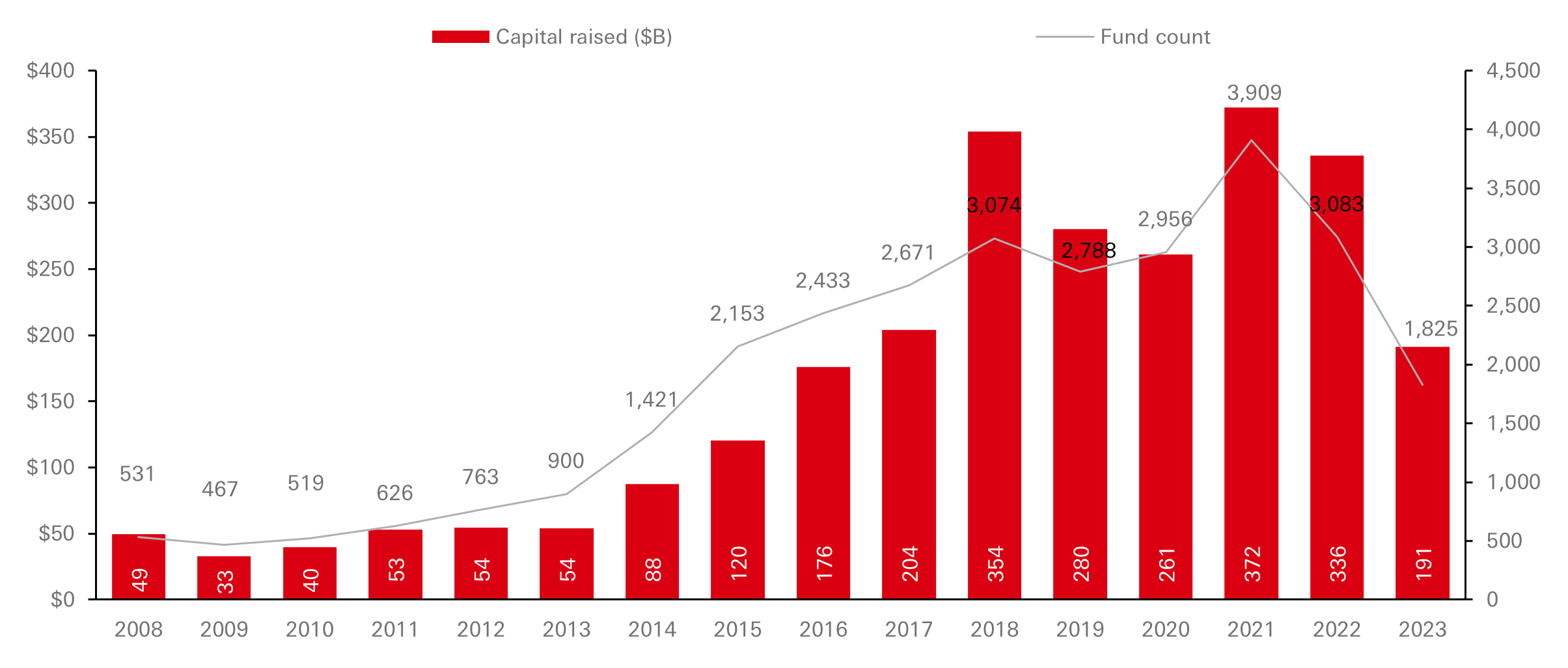

Fundraising markets slow from the 2021 peak

The global venture capital fundraising market has slowed since the peak in 2021. During that year, almost 4,000 VC funds closed, raising a combined USD372.3bn, according to Pitchbook data. This had fallen to just over 1,800 funds closing in 2023, raising USD191.2bn – the quietest year since 2017. The slowdown has been driven by the contraction in valuations, which, due to the denominator effect, has resulted in a number of LPs reducing overall allocations to fund managers (across private markets). This provides a potential opportunity to gain access to top-performing managers that may otherwise have been difficult to access. That being said, the top performing venture capital funds will continue to raise funds, even in tougher fundraising environments. In fact, these environments tend to lead to outperformance as the best managers can choose the best opportunities at more attractive valuations. In the first quarter of 2024, global VC funding grew by around 16 per cent quarter over quarter. In addition, there was USD89bn distributed over 4,600 deals as the market continued to see ongoing activity.

Global venture capital fundraising activity

Source: Pitchbook, data as of June 2024, HSBC Global Private Banking, November 2024. Past performance does not predict future returns.

For illustrative purposes only. There is no guarantee that the trend illustrated by the chart above will continue

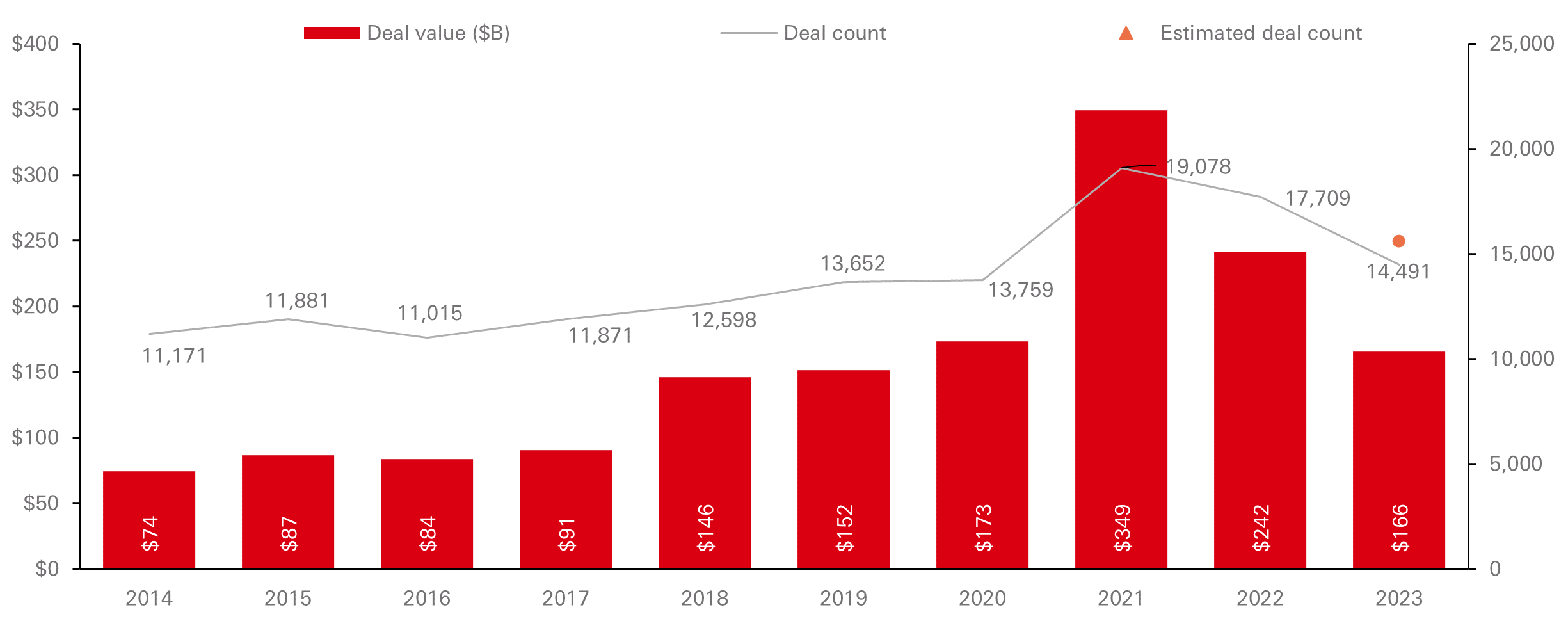

Deal values fall but the market remains active

As with capital raising, VC deal activity also peaked during 2021. In the US alone, more than 19,000 deals were completed during 2021, with an aggregate deal value of almost USD350bn. While the value of deals had fallen by the end of 2023, with aggregate deal values less than half the level witnessed in 2021, the number of deals fell by a far smaller amount (24 per cent, compared to 53 per cent). This suggests that activity was focused more towards smaller deal sizes, rather than a wholesale retrenchment of activity, with a particular dearth of mega deals.

US venture capital deal activity

Source: Pitchbook, data as of June 2024, HSBC Global Private Banking, November 2024. Past performance does not predict future returns.

For illustrative purposes only. There is no guarantee that the trend illustrated by the chart above will continue. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

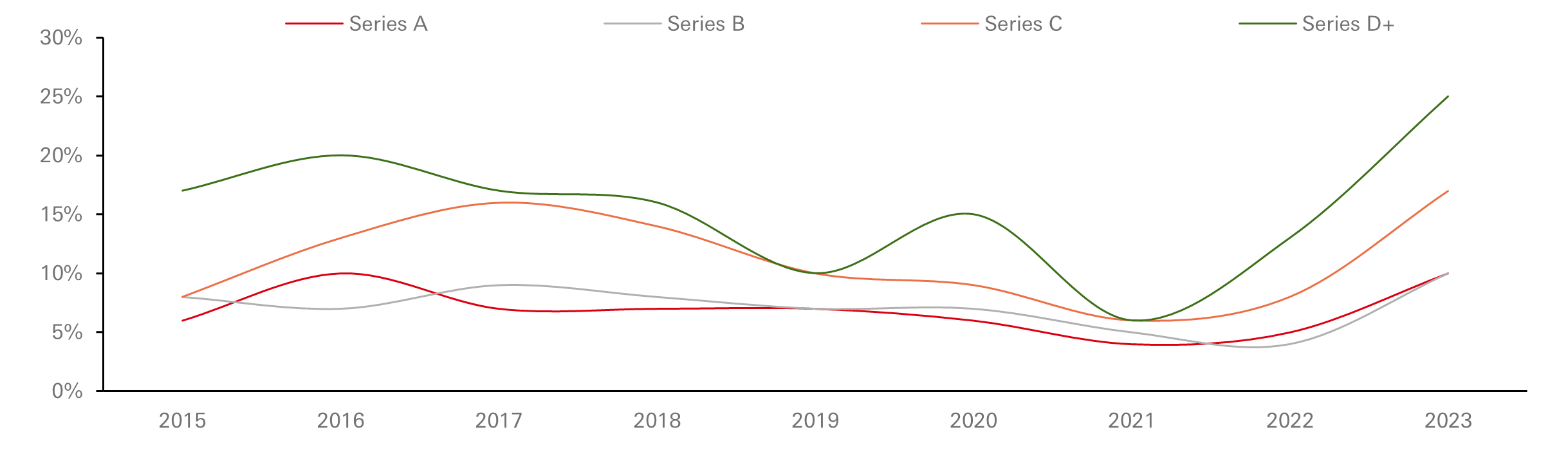

When assessing US VC deals further, it is clear that valuations have fallen. The proportion of firms raising capital at lower valuations than they have in the past is currently the highest it has been for many years. In 2023, down rounds became a reality, with nearly a quarter of later-stage (series D and later) deals raising rounds at valuations below their previous round. Firms will aim to avoid down rounds (new fundraising rounds at lower valuations than the prior round) when they can, as they can negatively impact sentiment, both among existing investors and employees, who might have their own stake in the firm through equity options. That being said, while down rounds are generally unavoidable in many instances, there are two benefits:

- Companies have become more efficient with the use of funding, focusing on profitability rather than growth at all costs, resulting in a longer time between fundraising rounds

- The lower rounds offer a chance for some VC fund managers to buy into solid businesses at far more attractive valuations than may have been available in the past. Those funds with dry powder to deploy, particularly more recently closed funds, may be able to take advantage of the current market and gain exposure to high-quality companies at favourable prices

Down round by series for US start-ups

Source: KPMG Venture Pulse, data as of Q1 2024, HSBC Global Private Banking, November 2024. Past performance does not predict future returns.

For illustrative purposes only. There is no guarantee that the trend illustrated by the chart above will continue.

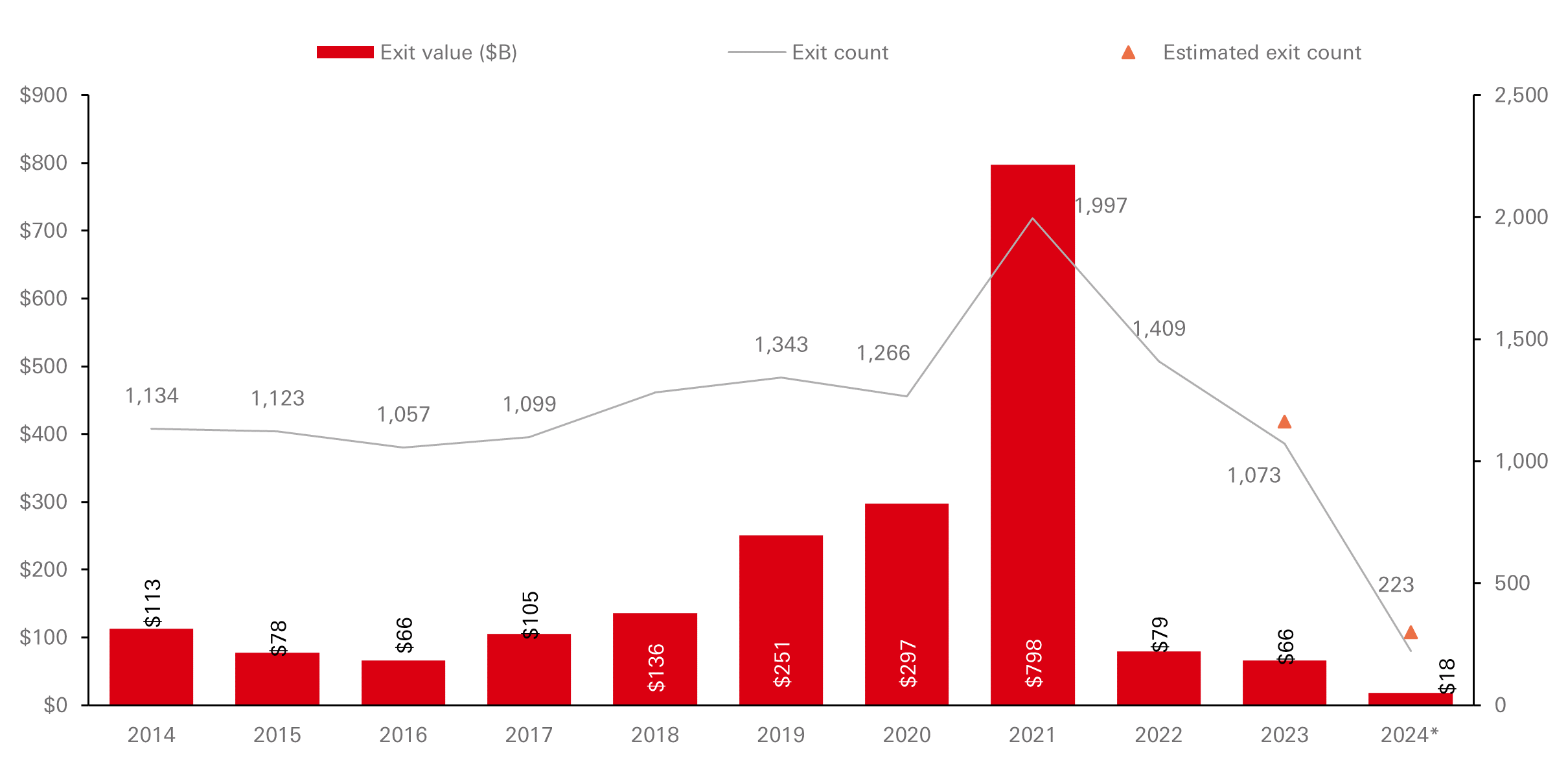

Lower distributions in recent years

While deal activity peaked in 2021, a similar story was evident when it came to exit activity. The peak in 2021 of almost USD800bn in exits was followed by a sharp pullback in both 2022 and 2023, driven by the weaker IPO markets, a typical exit route for VC-backed companies. A record backlog of exit-ready unicorns has formed. It is estimated that the aggregate valuation of unicorns with high pressure to exit, based on company age, isUSD1.2tn. Data for Q1 in 2024 suggests the exit market remains weak, but when the data is assessed more closely, there may well be some room for optimism. While the USD18.4bn in aggregate in exit values remains low so far in 2024, this figure was delivered with a relatively small number of exits, including the high-profile IPOs of Astera Labs and Reddit. These successful IPOs point towards the potential re-opening of the IPO market.

In addition, VC fund managers are increasingly seeking creative ways to provide liquidity to their LPs, including through secondaries or continuation funds. The VC secondaries market has only recently started to open up and we expect these types of deals to generate strong returns, similar to the early secondaries in PE.

US venture capital exit activity

Source: Pitchbook, data to end Q1 2024 as of May 2024, HSBC Global Private Banking, November 2024. Past performance does not predict future returns.

For illustrative purposes only. There is no guarantee that the trend illustrated by the chart above will continue.

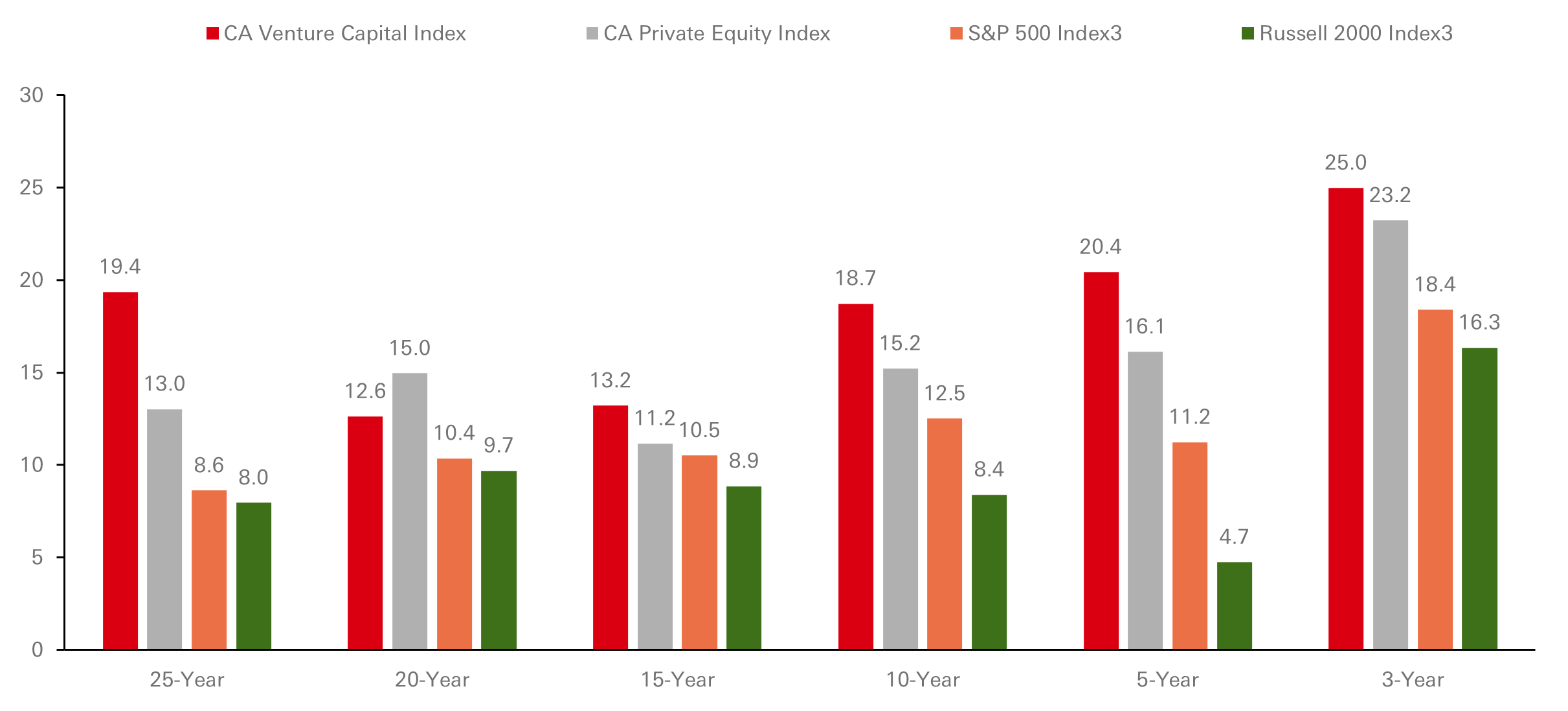

Wide performance dispersion in VC highlights the importance of manager selection

There is an increasing body of evidence to highlight the benefits of adding VC assets to a multi-asset class portfolio. Research suggests that adding VC investments to the portfolio mix not only helps with diversification, but also enables investors to demand higher returns from their portfolios. What’s more, this is also true when performance benchmarks are unsmoothed, to reflect a more realistic movement in values over time. These benefits are increasingly accepted by investors and have been an additional driving force behind the VC industry’s growth in recent years.

The inefficiencies that exist in private markets, particularly in the venture part of the market, expand the opportunity spectrum and, we believe, make the asset class a viable long-term, high-return solution for those able to tolerate its inherent illiquidity. These traits also highlight the need to select the ‘right’ managers, as the dispersion of returns between winning funds and those less successful has been widening in recent vintages. Clearly, manager selection is incredibly important in maximising the benefits of an allocation towards VC.

Global VC Periodic Rates of Return (per cent)

Source: Cambridge Associates LLC, Frank Russell Company, MSCI, Thomson Reuters Datastream, and Pitchbook, as of 31 December 2023, HSBC Global Private Banking, November 2024. Past performance does not predict future returns. Performance provided is of an index and not a fund. You cannot invest in the index directly.

We believe that now is an attractive time to invest in VC

VC is a growing asset class and provides access to cutting-edge technology and market disruptors while they are in the nascent stage. These businesses are often exited via IPO and so, historically, there is little overlap between VC-backed businesses and those backed by PE firms. As such, it is an important portfolio diversifier as part of a multi-asset portfolio and can generate risk-adjusted returns superior to what is achievable from Private Equity Buyouts alone. With the valuation correction and pullback of LPs due to the denominator effect, now is an excellent time to invest in venture capital and access top performing VC fund managers.

Important information

For Professional Clients and intermediaries within countries and territories set out below, and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain and Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D037518_v1.0; Expiry Date: 30.11.2025