Investing in Asia amid seismic policy shifts

Key information panel

- US policy shifts may have a more moderate impact on domestically driven economies (India, Indonesia, Philippines) compared to exports-reliant economies (South Korea, Japan, Vietnam)

- While the incoming US administration's policy agenda may strengthen the US dollar in the short term, it could potentially weaken the dollar in the medium term, which would bode well for Asian assets

- The global rate cut cycle benefits Asian local bonds due to potential domestic rate cuts and a weaker US dollar in the medium-term

- Asian investment grade bonds are also attractive as they offer quality fundamentals with relatively low duration and favourable technical factors

- China's stimulus efforts could also benefit the rest of Asia, especially economies and sectors more tied to Chinese final demand

- India's structural growth story and surging demand for data centres in ASEAN are two key investment themes in Asia our team focuses on

Potential implications of US policy shifts for Asia

International economic impact yet to be seen

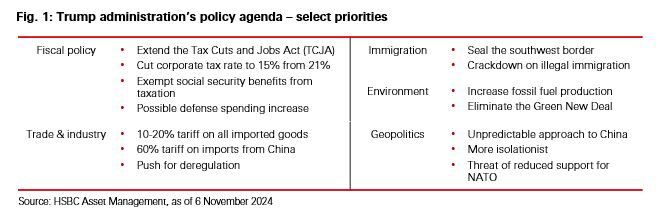

As the incoming US administration’s policy agenda starts to unfold in the coming months, it could have significant implications for Asian economies. For better context, during his campaign, Donald Trump openly advocated for imposing broad-based tariffs on imported goods, with plans for tariffs as high as 60 per cent on Chinese products and ranging from 10 per cent to 20 per cent on goods from other nations (see Figure 1).

Asian economies reliant on goods exports could be more vulnerable to these policies, notably North Asian nations such as South Korea and Japan, as well as select Southeast Asian economies including Vietnam. Despite exports constituting a relatively minor portion of China's economy, the country might still feel the effects of these tariffs, due to its lukewarm domestic demand and the outsized magnitude of the proposed tariffs on Chinese imports.

On the other hand, economies in Asia that are more domestically oriented and less reliant on goods exports, such as India, Indonesia, and the Philippines, may experience a milder impact from this potential policy shift. Depending on the extent to which the incoming US administration will be using trade tariffs as a bargaining tool to secure trade concessions from other countries, the magnitude of their impact on Asian markets and the corresponding implications might vary, from an investment perspective.

Will US dollar strength last?

Some of the policies proposed by the Trump administration, such as corporate tax cuts and tariff implementations, might, if enacted, widen the fiscal gap and drive up import prices. This could exert upward pressure on treasury rates and hence also the dollar. In addition, anticipation of higher corporate profits from potential tax cuts and deregulation may attract capital inflows, further strengthening the dollar. Market reactions leading up to and after the election have already seen increases in US treasury yields and the dollar, reflecting expectations surrounding the election outcome and the accompanying proposed policy changes. Furthermore, Asian countries affected by US tariffs may witness currency depreciation due to reduced external demand and potential monetary easing to counter economic slowdowns. Such actions could contribute even more to relative US dollar strength.

Historically, higher US treasury rates and a stronger dollar have induced capital outflows from emerging markets into the US market, due to a wider yield differential. This trend could have short-term implications for Asian financial markets. However, it should be noted that Asian central banks have policy tools (including macro-prudential measures) and, for the most part, sufficient FX reserves buffer to defend against sharp or disorderly currency movements – the type that would have serious and wide-ranging economic impact.

In the short term, the dollar is expected to maintain its strength, mainly driven by the market’s anticipation of future policy shifts, as discussed above. However, the longer-term outlook is less clear, as uncertainties persist regarding the extent of policy implementation by the new administration and global investors' reactions to a worsening fiscal picture in the US. In fact, the US Congressional Budget Office has already declared that the US fiscal trajectory is already on an unsustainable path. Consequently, while the dollar may experience initial strength, there is a possibility that it could weaken in the medium term. Moreover, the current US economic environment is still consistent with a cyclical cooling heading into 2025, further supporting the thesis that the dollar might face downward pressure in the medium term, which could bode well for Asian assets.

That said, global and emerging market investors should want to focus on local fundamentals for their asset allocation, rather than putting too much emphasis on the fluctuation of currency strength.

Source: HSBC Asset Management, as of 6 November 2024

Asian asset class positioning amidst the global rate cut cycle

Although we might witness short-term volatility in US interest rates due to the recent developments mentioned above, our base case for a soft economic landing remains. Therefore, we expect the global rate cut cycle to continue in the medium term. Notably, Asian central banks will have the bandwidth for policy easing on the back of further US rate cuts. We believe this is beneficial for Asian local bonds, while also being cognizant of recent Asian currency weaknesses in Asia that have given rise to some near-term uncertainty. Within credit, we are constructive on Asian investment grade bonds which offer quality fundamentals with relatively low duration, benefit from favourable technical factors, such as healthy local demand, and enjoy continued resilience going into the new year.

We also see many opportunities within Asian equities. For example, we observe a strategically solid demand picture for the semiconductor and other AI-related sectors, which are a key profit engine for some Asian economies. With that said, we are tactically realigning our focus away from momentum-driven sectors towards areas that could be better suited for the late stage of the business cycle. On a macro level, China’s policy support, room for monetary easing, and other idiosyncratic structural factors are positive catalysts for equity investments in the region, despite external uncertainties.

Who stands to gain from China's ongoing stimulus efforts?

Since late September 2024, China has shifted its policy stance to stabilise structural weaknesses and promote economic growth (for details, see China’s pro-growth policy pivot and market implications, 30 October 2024). More recently, on November 8, China approved a substantial increase of RMB 6 trillion in the local government debt limit to facilitate the swapping of hidden debts. This move, which expands the total swap scale to RMB 12 trillion, aims to alleviate the burden of hidden debts owed by local governments to creditors. The anticipated positive economic impact of this measure lies in its potential to free up local governments in the medium term, enabling them to pivot their focus towards growth-oriented endeavors, instead of fulfilling interest payment obligations.

Due to the support of the various stimulus measures, particularly a relending program, the potential benefits for Chinese equities are significant. The relending program enables listed companies to borrow from a select group of 21 financial institutions endorsed by the PBOC, facilitating share buybacks and increases in shareholding. As a result, this program provides direct support for domestic stock prices. Although we believe in the necessity for further stimulus and reform measures targeted at boosting consumption and countering deflationary pressures to sustain long-term investor confidence, we do note that the valuations of Chinese stocks are currently inexpensive and the positioning of international investors in Chinese equities remains light. This provides a substantial margin of safety, especially when accompanied with judicious stock picking practices. We especially favour Chinese quality growth companies, while also preferring dividend-paying companies against the backdrop of a potential deflationary cycle and a property market downturn.

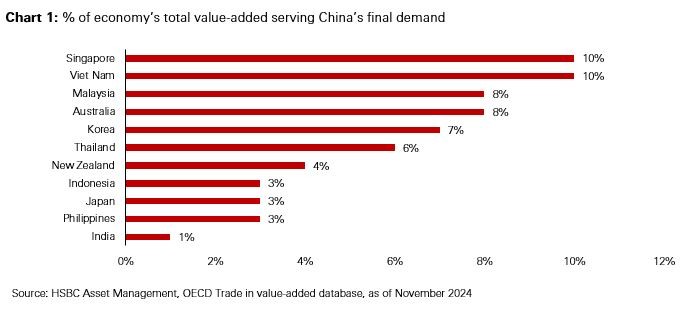

On a broader scale, a potential stabilisation of China's economy could bring positive implications for Asia as a whole, considering the impact via the trade channel. According to OECD data illustrated in Chart 1 Vietnam and Singapore are among the key economies poised to benefit from this trade dependency. Furthermore, Chart 2 identifies the sectors within the Asia region (excluding China) that stand to gain the most from a Chinese economic recovery, based on their contributions as a percentage of Asia’s (excluding China) total value-added embedded in China’s final demand. Notably, computers & electronic and mining & quarrying are the key Asian sectors poised to benefit from an upswing in Chinese economic activity.

Source: HSBC Asset Management, OECD Trade in value-added database, as of November 2024

Source: HSBC Asset Management, OECD Trade in value-added database, as of November 2024. Sector allocation are as of date indicated and should be relied thereafter. This information shouldn't be considered as a recommendation to invest in the sectors shown.

Compelling investment themes prevailing in Asia

For much of this year, we have been talking about India’s structural growth story, the premise of which we believe will continue to prevail in the medium term. India’s federal government continues to invest heavily into infrastructure. Meanwhile, young demographics and rising urbanisation continue to drive consumption. India also continues to offer a strong and stable earnings growth story, although we are cognizant of rich valuations in parts of the market. There is also healthy technical support as we see increasing demand coming from domestic investors, injecting continuous liquidity into the market. Moreover, the inclusion of local government bonds into various market indices offers further technical support on the fixed income side.

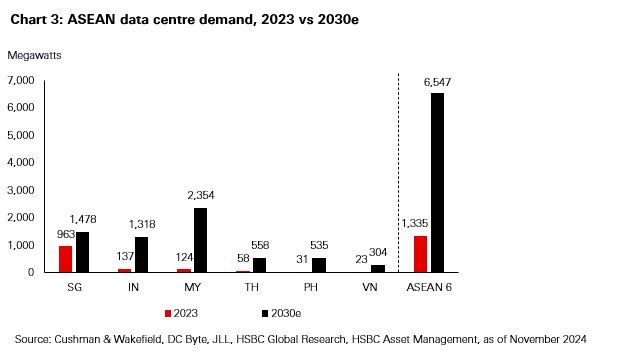

Our detailed research into the ASEAN region, which includes in-depth analyses of individual countries to identify their idiosyncratic growth drivers, has led us to believe that Malaysia is an economy in the region that has been under the radar of global asset allocators. Malaysia boasts solid growth momentum compared to some of its regional peers, helped by strong consumption and investment trends. For example, the data centre industry across ASEAN has experienced explosive growth over the past decade, driven by ever-increasing demand for cloud services and the use of web-enabled devices globally. With AI and machine learning set to transform this industry, Malaysia, being a key player in this industry alongside Singapore, is poised to reap the benefits from the escalating market demand (see Chart 3).

Japan has also captured our attention, as it displays favourable signals in its equity valuations and earnings. Also, a resurgence in foreign investor interest has added to the market’s attractiveness. We are closely monitoring the implementation of structural reforms within the economy, recognizing that their impact may need time to materialize. However, we do acknowledge that Japan’s domestic economy remains interconnected with external factors, including China’s growth trajectory and the incoming US administration’s policy agenda.

With Asia being such a vast investment universe, there are many exciting opportunities to uncover. We will continue to identify investment ideas that not only bring diversification but also offer robust growth prospects for our clients’ portfolios.

Source: Cushman and Wakefield, DC Byte, JLL, HSBC Global Research, HSBC Asset Management, as of November 2024

Source: HSBC Asset Management, as of November 2024.

Investment involves risks. Past performance does not predict future returns. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice in any specific sector or country. For illustrative purposes only.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. This document provides a high level overview of the recent economic environment. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy