Powering AI

Executive summary

Over the last few decades, the data centre industry has emerged as an integral component of the global economy. Today’s modern digital economy wouldn’t be possible without the efficient storage, management, and computation of large amounts of data. The industry growth and immense power requirements has had major implications for the electricity industry. Initially this was more focussed on specific regions that developed as data centre hubs, however, increasingly this has become more widespread.

The development of Generative AI and the training of Large Language Models (LLM), enabled by the recent rapid advancements in chips, has seen new data centre requirements on a significantly larger scale. The considerable power needs that these facilities require on a constant basis has the potential to lead to a transformation of the electric industry, the utilities, and how they serve these loads. Furthermore, this is occurring at a time when the generation mix is undergoing a transition from dispatchable and mainly fossil fuel resources, to non-dispatchable and predominantly renewable resources.

The United States has been a leader in the development and evolution of the data centre industry, as represented by half of the world’s facilities being located there today. Consequently, the US is the focus of our analysis. In this report we discuss the evolution of the data centre industry and the impact on electricity demand, and utilities more broadly. We examine the development of Generative AI, how the main proponents are pursuing this initiative and the implications for power demand. We also consider how these power requirements will be met by existing and new supply in the context of various net zero ambitions. Finally, we review the opportunity set for Global Listed Infrastructure Equity to participate in these developments.

Development and evolution of data centre industry

The data centre industry has evolved significantly since its inception in the 1940s with the development of ENIAC (Electronic Numerical Integrator and Computer). The 1990s saw widespread adoption due to the Internet and client-server computing, while 2006 marked a turning point with Amazon’s public cloud and Salesforce’s SaaS (Software as a Service) launch. These innovations spurred demand for high-performance infrastructure to support cloud computing, big data application, which led to growth for data centres. Digital transformation, cloud adoption, and multi-cloud strategies have further fuelled data centre expansion, by enabling efficient data management, remote work, and digital collaboration. The transition from traditional on-premises to off-site cloud data centres has enhanced cost-efficiency and scalability for businesses.

In more recent history, data centres have been streamlined into three main categories based on its ownership, purpose, and scale:

- Enterprise data centres are typically privately owned by a single corporation for its internal and customised operations

- Colocation data centres are third-party shared facilities, leased to multiple enterprises

- Hyperscale data centres are usually the largest in scale, supporting cloud providers with extensive compute, storage, and networking requirements

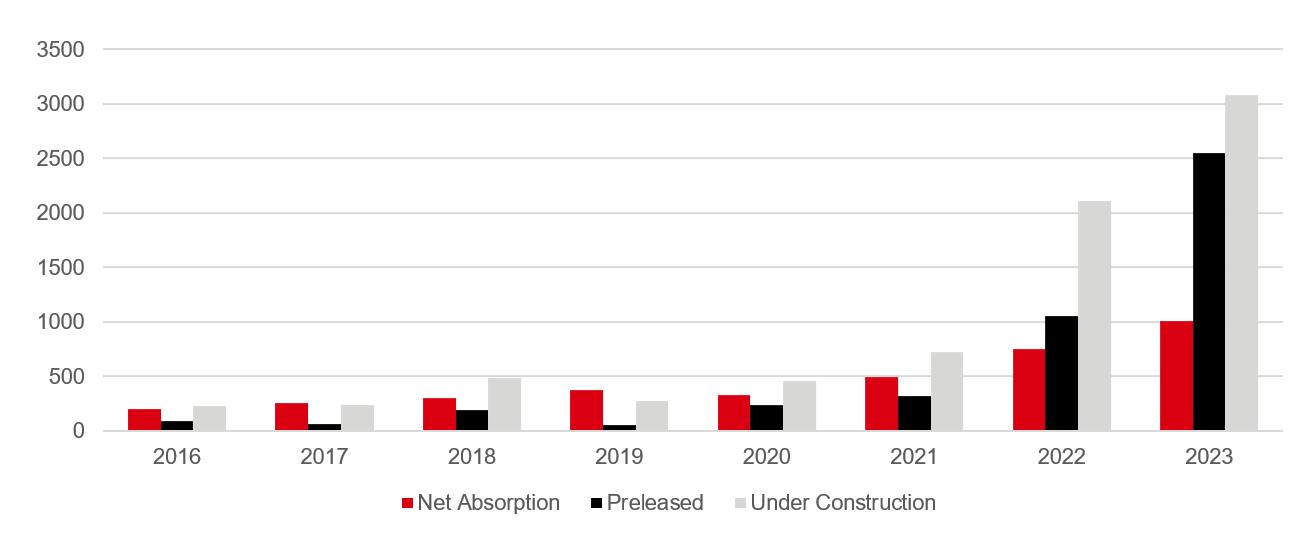

The industry has witnessed a significant capacity shift from enterprise to hyperscale data centres, including both self-built and leased capacities. The market presence of hyperscale facilities has grown from 20% in 2017 to over 40% in 2023, with projections exceeding 60% by 2029.

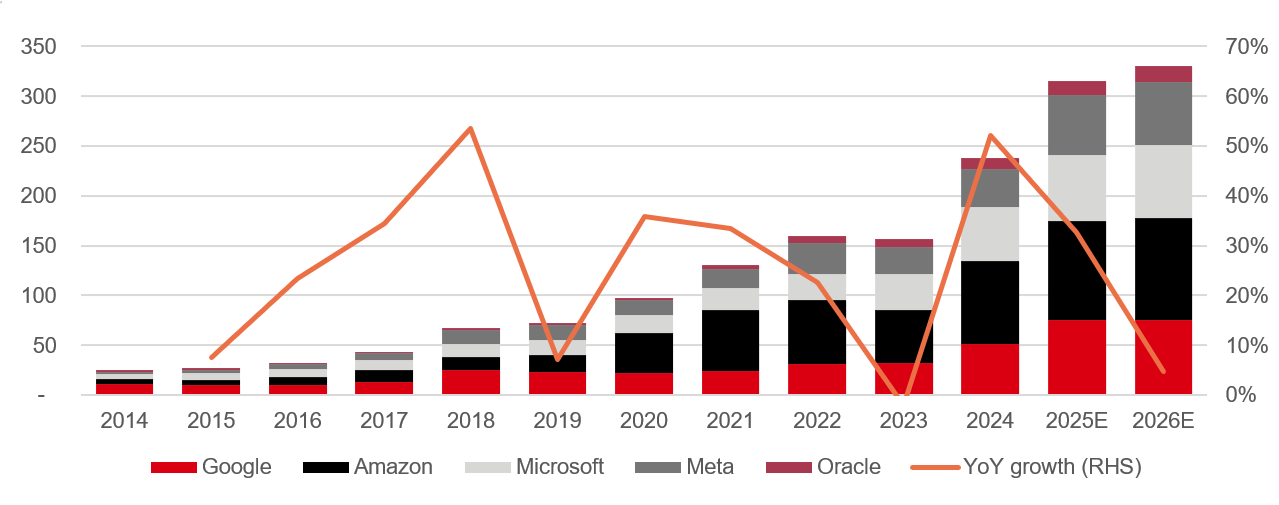

Among the US major cloud providers, including Amazon Web Services (AWS), Microsoft Azure and Google Cloud, have led the way in building their mega campuses. Capacity has doubled every four years, fuelled by capital expenditure on an increasing number of facilities and higher average capacities per campus.

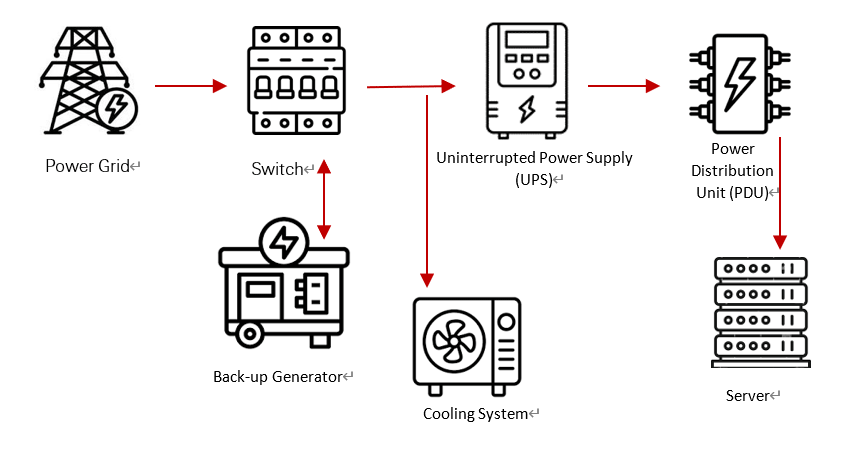

Power is the backbone of data centre success, serving as the essential input to ensure continuous operation and playing an important role in the reliability and efficiency of data centre assets.

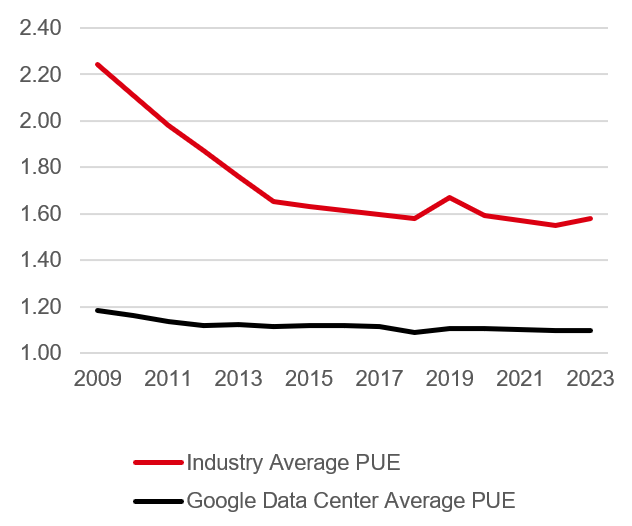

Due to public cloud adoption in between 2000 and 2005 electricity usage from data centres nearly doubled, however, growth in demand was more subdued to the mid-2010’s. During this period the expansion from enterprises transitioning from on-premises data centres to third-party colocation or hyperscale facilities was offset by a significant improvement in energy efficiency, measured in power usage effectiveness (PUE), and a growing market share of hyperscale facilities.

In recent years, gains in PUE have plateaued which has contributed to increasing power demand from the data centre industry, especially as computational workloads grew dramatically. Industry average PUE has been stuck between 1.55 to 1.59 since 2020 and further reductions become increasingly challenging across the industry. Even cloud providers, known for their industry-leading data centre designs, are approaching the theoretical limit of power efficiency of 1.00.

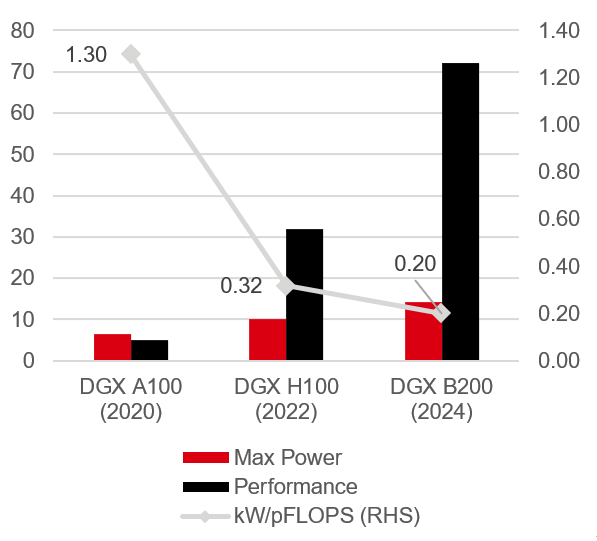

Meanwhile, the efficiency of chips continues to improve, enhancing performance per watt and potentially offsetting stagnation in overall efficiency. NVIDIA is on a cadence to release new Graphics Processing Unit (GPU) architectures or major updates every 2 years. For each generation of GPUs, computing speed per server increases at a much higher rate than peak power required, driving down overall power density required. Incorporating the latest technology in the latest GB200 NVL72 liquid-cooled system delivers a generational performance improvement that reduced costs and energy consumption by up to 25 times compared to H100 air-cooled infrastructure.

While advancements in hardware can help mitigate some plateaued PUE impacts, ongoing innovation in efficiency remains critical for managing long-term power demand. We believe that the shift towards new energy-efficient technologies, such as quantum computing or advanced cooling systems, could enable operators to better manage costs and achieve sustainability goals.

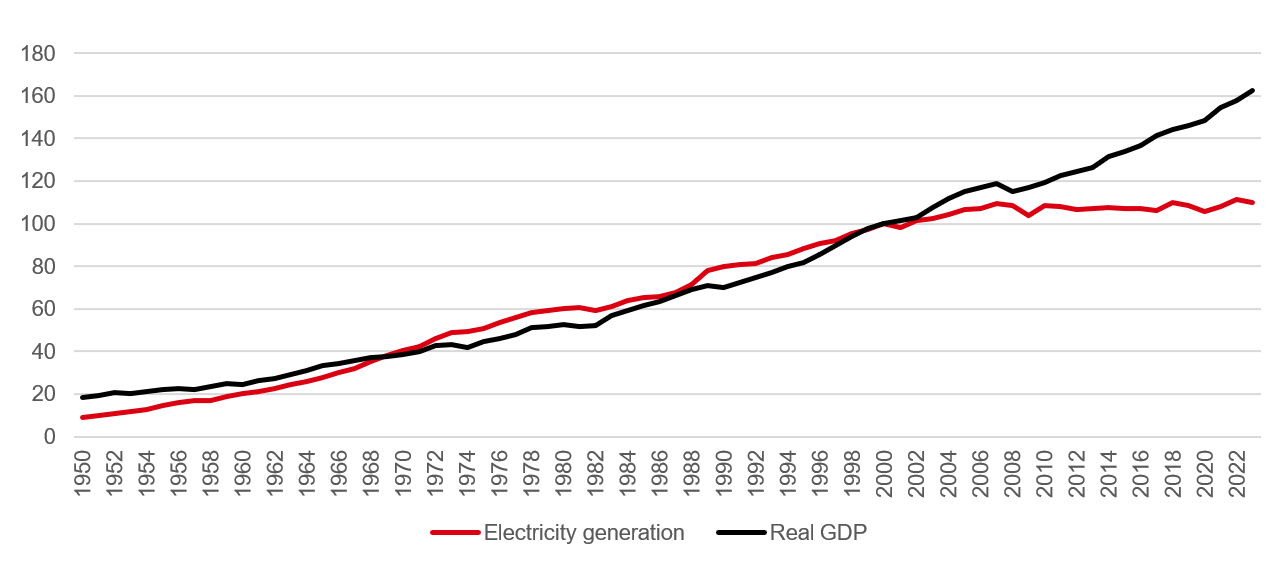

Inflecting data centre power demand potentially transformational for the electricity industry

We believe the rapid expansion of the data centre industry in the US has the potential to deliver to the electricity industry what has been elusive since the start of the millennium, power demand growth. Prior to the last 2 decades there had been a strong relationship between GDP growth and electricity demand. However, more efficient appliances, a focus on reducing consumption and the broader shift in the economy away from more energy intensive industries has seen power demand flat-line since. Electrification has long threatened to reinvigorate demand growth, and this is finally starting to materialise along with a resurgence in the manufacturing industry. However, we expect that in the short-term power demand from data centres has the potential to be more material, and more transformational.

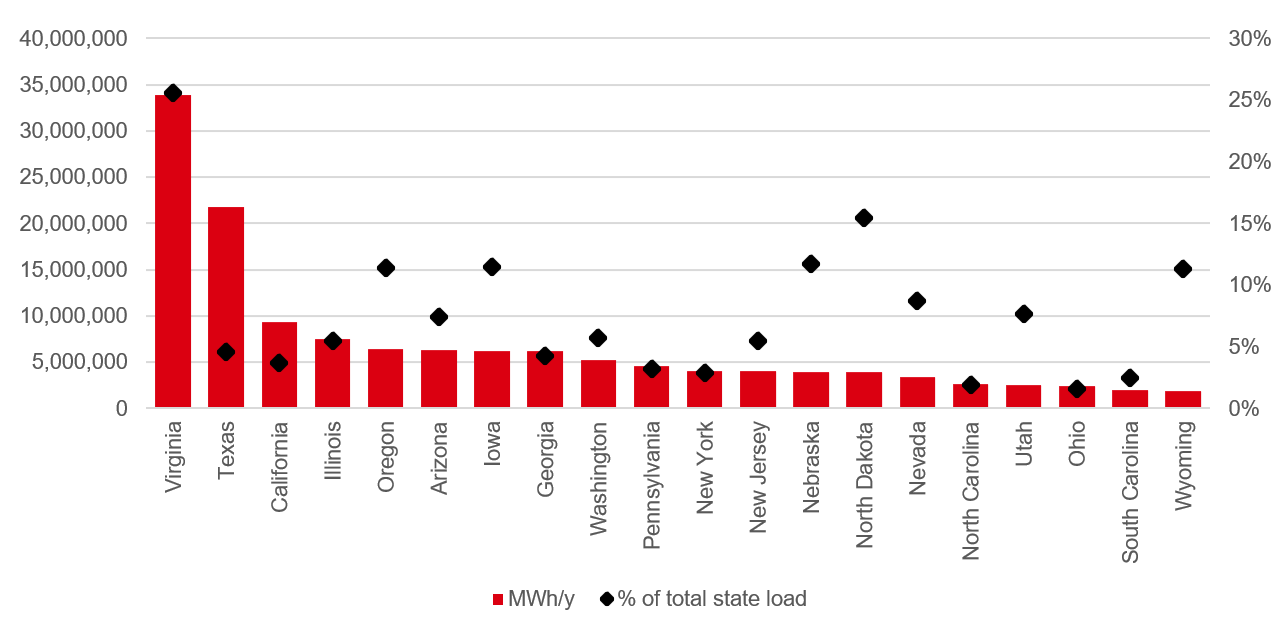

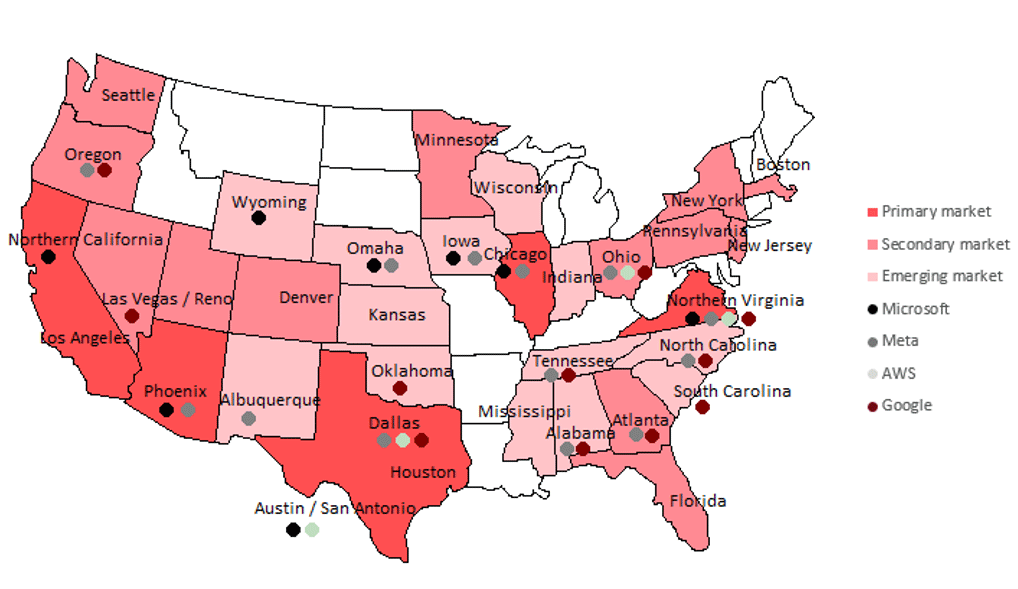

As the different segments within the data centre industry have evolved, along with their increased focus on power efficiency, recent years have seen overall demand growth steadily increase. This growth was historically more focussed on certain locations, such as Northern Virginia, Dallas, Phoenix, and Chicago. Access to fibre and low latency was key in the initial development of these hubs, but the power supply characteristics were also contributing factors. Relatively cheap rates, adequate supply, a reliable generation mix with notable clean characteristics, as well as stable weather conditions with less exposure to climate events were also contributing factors.

Over time the development of data centres has broadened to secondary and tertiary markets as the availability and price of power became more important to different data centre segments. The considerable diversity across the US electricity industry presented many new opportunities. These wide-ranging power characteristics are a function of the different regional markets and regulatory structures and the state policies that support them, in our view. Different generation resources are also more prevalent in some regions than others, whether determined by access to natural resources or state mandates. In addition, some state governments are also providing meaningful tax incentives to attract economic development to their territory.

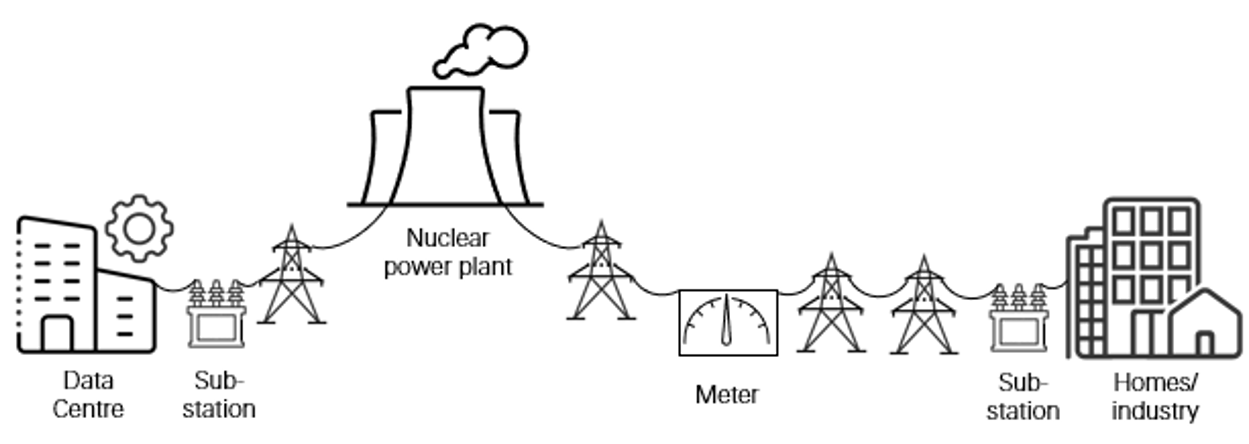

Related to these local market considerations is the capital investment required to connect the data centre to the grid. Behind the metre load (connected directly to the generation) potentially circumvents these investments, however, to date has received a lukewarm reception from regulators. As a result, most data centres are now looking to locate “front of the metre”. Notwithstanding, given the magnitude of the additional load, often upgrades of the supporting infrastructure are required in addition to the new connection. Further, as demand growth has continued, there is less available supply and a potential need for investments in new generation as well. Offsetting these additional costs to the system is the increased demand, which has been particularly advantageous for the local utility in sharing costs – both legacy and incremental – over a larger base, in our view.

These dynamics were seemingly evolving on a manageable trend until large load requirements from the Hyperscaler data centre segment began emerging over late 2023 and into 2024. Signs of a significant transformation in the electricity industry were apparent as these massive demand requests looked to locate beyond the traditional data centre hubs. Meta’s plans to invest $10b in a 2 GW data centre in Louisiana perhaps the most significant. The scale of new demand, the greater geographic flexibility in siting, generally an insufficient supply of dispatchable resources, and the need for meaningful grid investments, all whilst legacy customers face affordability challenges present challenges for the industry. In our view, the era of flat power demand growth would appear to be over.

AI-driven data centre demand inflection

Beyond traditional drivers, Artificial intelligence (AI) has rapidly emerged as a transformative force behind the recent data centre boom. AI capabilities have progressively evolved from traditional AI to Generative AI (GenAI) and more recently towards Artificial General Intelligence (AGI). The first generation of AI, based on rule-based systems, focuses on analysing data, recognising patterns, and making decisions or predictions based on predefined rules. Whereas GenAI introduces creativity by generating new content – such as text and images – through learning patterns from large datasets. Although AGI is still in its early stages, the industry is working toward developing AGI to achieve human-like intelligence with general cognitive abilities.

Regardless of the different complexity and scope required, any generation of AI capability involves two critical stages – training and inference.

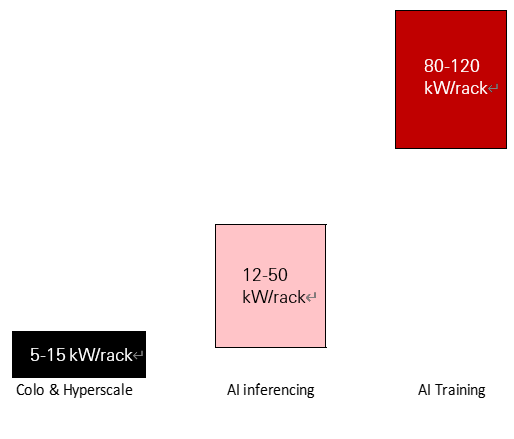

- Training focuses on feeding large sets of data to an AI model to enable pattern recognition. This process is highly energy intensive as it requires multiple iterations of model parameter adjustments to enhance prediction accuracy. With rack densities of 80-120kW, training workload demand significant power. However, training is latency-insensitive, meaning it can be performed anywhere in the world, and its workload is generally more predictable.

- In contrast, inference is the application phase, where trained models are used to make predictions or decisions based on new data. It is less computationally demanding, with typical rack densities ranging from 12 – 50 kW. However, modelling power demand for inference is more challenging due to factors such as the variability of user demand and characteristics of inference facilities. While current estimates suggest that inference power demand may be about 50% of trainings in the near to medium term, its long-term energy consumption could potentially surpass that of training. Additionally, inference is highly latency sensitive and therefore need to be located near major metropolitan areas to ensure low-latency performance.

The transition to higher power densities necessitates advanced cooling solutions, further increasing overall power requirement. While air cooling is sufficient up to 20kW per rack, liquid cooling, including direct-to-chip and immersion systems, has emerged as the standard solution for managing intense thermal demand. By targeting the heated spots precisely, liquid-cooling strategy also improves power efficiency (i.e. lower PUE), resulting in more cost-effective operations.

As AI training workloads prioritise predictable performance, reduced latency sensitivity, and limited backup power needs, these data centres are increasingly locating in emerging markets with cheaper land and power. Conversely, inference-focused data centres remain concentrated in top-tier markets to ensure proximity to end users for low-latency applications. This dual trend reflects the evolving infrastructure strategies for AI workloads based on their distinct requirements.

On the flip side, with hyperscalers rapidly building and leasing new data centre capacities, the industry might face overcapacity risk led by surging supply, demand uncertainties, and technological advancements. While hyperscalers and AI startups are not concerned about overinvesting and eager to deploy LLM training modules to gain an edge in this AI race yet, demand forecasts vary widely. If AI training workloads plateau due to rising costs and diminishing returns, and inference workloads remain underdeveloped, overcapacity risks could intensify.

Meanwhile, technological advancements are improving efficiency from existing facilities too. AWS’s 2024 upgrades can deliver 12% more compute power per site, reducing overall facility’s needs. NVIDIA’s chip innovations, driven by Huang’s Law, further enhance hardware performance, and DeepSeek’s groundbreaking algorithmic efficiencies in model construction are making AI more accessible and cost effective for enterprises.

We believe, this is an example of the commoditisation of LLMs that is catalysing a significant shift in the AI landscape. The rise of open-source LLMs has lowered the barrier to entry, intensified competition in LLM development and driven down the training cost of new models. Further fuelled by investors’ increasing scrutiny on the return profile of hyperscalers’ AI-related capital expenditure, the industry is pivoting from foundational model development to inference phase – where models are used to solve real-world problems. Unlike training workload, which are energy intensive but episodic, we believe inference will be driven by continuous interactions with users, driving further long-term power consumption .

Despite all the demand uncertainties, industry expectations for AI-driven data centre demand continue to rise. The Department of Energy, forecasts data centre capacity to reach between 74-132GW by 2028, or 6.7% - 12% of total US electricity demand.

Comparing to the 25GW of capacity in 2024, this represents about 50 to 100 gigawatts (GW) of additional data centre capacity to be installed in the US by 2028, reflecting a compound annual growth rate (CAGR) of 30-50%. With an average capital investment of $10m/MW, this expansion represents a significant investment opportunity of at least $550 billion to $1 trillion in the data centre sector. In our view, the growing need for immense computational power to support AI workloads has not only redefined the scale and capabilities of modern data centre facilities, but also significantly escalated energy consumption.

Limited supply options to meet the demand challenge

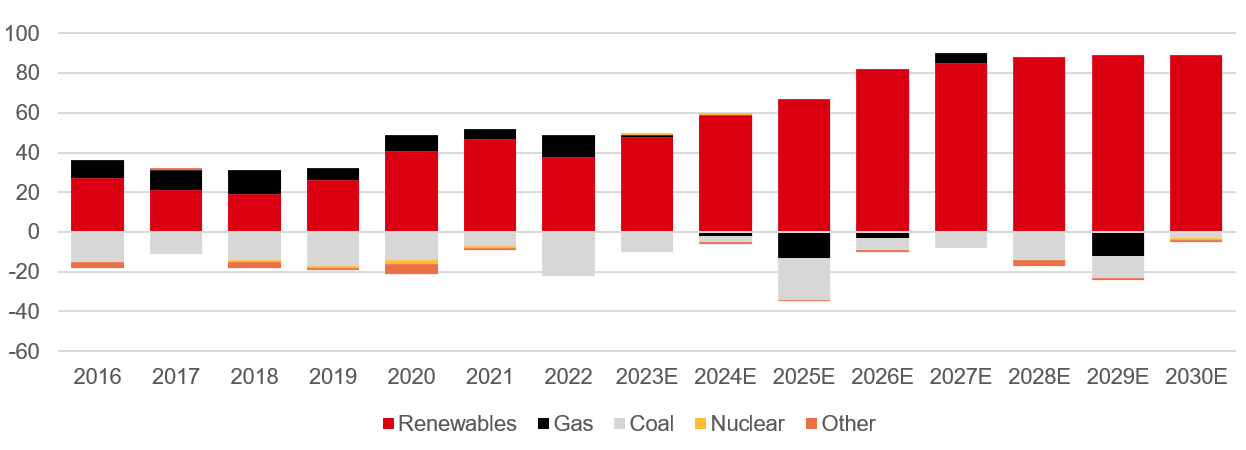

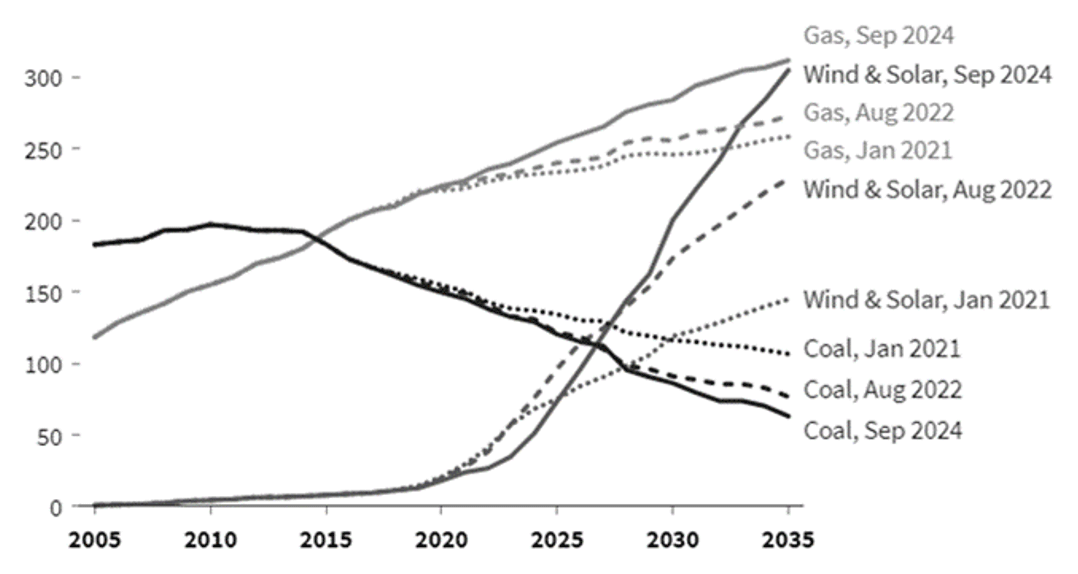

The magnitude of the potential power demand growth from data centres presents significant challenges for the supply response. Hyperscaler demand for less latency-sensitive AI-training has been scouring the country for available supply with few remaining opportunities. Utilities from region to region reflect this interest in their backlogs and there is undoubtedly double counting of the underlying demand, but even so the numbers are significant. The forecasted addition of 100 GW of data centre demand in 4 years is equivalent to the nuclear fleet in the US, or 8% of total generation capacity. Considering most of the country is at a stage in the evolution of the generation mix where non-dispatchable generation (i.e. renewables) are replacing dispatchable resources (mainly coal) the addition of large inflexible load presents a difficult challenge for utilities and system operators.

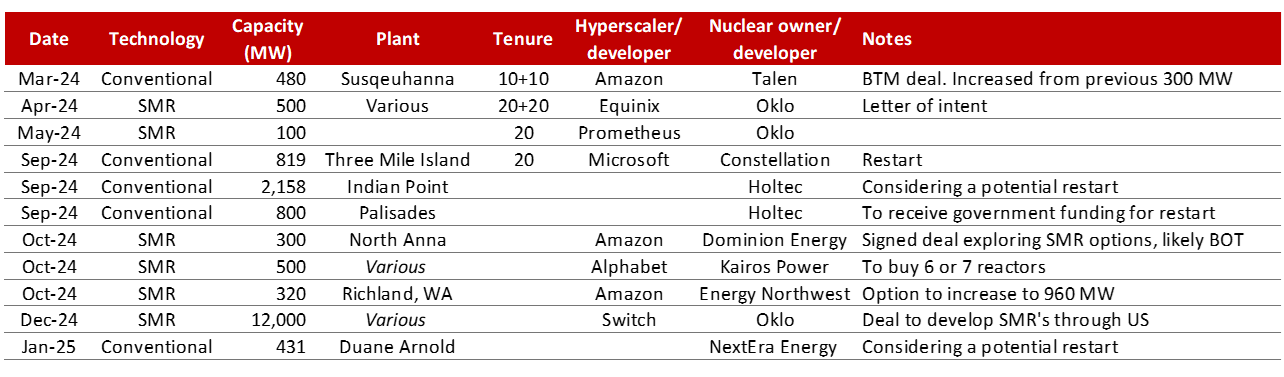

Aspirations by the hyperscalers to increase their proportion of clean energy consumed towards net zero targets only complicates the situation. Forecasts for the generation mix see renewables as the most likely resource to be added, however, due to their intermittency are poorly suited to the 24/7 demand requirements of data centres. We believe the only potential solution to this dilemma is additional nuclear power, as it is both clean and dispatchable. The value of these characteristics has been very quickly reflected in nuclear power purchase agreements (PPA’s) with recent prices more than double the market rate. However, further nuclear capacity from conventional technologies is likely limited to up-rates of existing units as there are few remaining retired units that can be returned to service and currently no plans for any new-builds. New technologies, such as Small Modular Reactor (SMR), represent a potential solution and have received commitments from some of the hyperscalers but remain unproven and in our view are unlikely to be operational before the mid 2030’s.

As a result, and with hyperscalers intently focussed on speed to market, we believe gas is likely the only dispatchable resource that can be built in the near-term. This is becoming evident in regulated markets where utilities are increasingly adding gas to their integrated resource plans. Meanwhile in deregulated markets, despite underwhelming capacity auctions or forward prices in recent years there are reports of delays to fossil plant retirements and bringing back of previously retired gas. These are only small data points at this stage with market participants closely following reforms proposed to capacity auctions in the large PJM region (representing the mid-Atlantic region of states) and developments with regards to Texas’ proposed energy fund to subsidise 10 GW of new gas. In the meantime, previously planned coal retirements are likely to get deferred even further into the future.

Whilst these represent positive developments the lead times on new dispatchable generation remain lengthy and not helped by a backlog of demand for new gas turbines. Whether through regulated utility planning processes or a lack of confidence in price signals from deregulated markets, we believe there is unlikely to be new gas built within the next 5-7 years. Given this and the hyperscalers’ focus on speed to market they have increasingly been exploring the potential to develop and even own gas generation plant themselves. Deals are expected between the hyperscalers and gas pipeline companies, a direct benefit for the broader Energy industry that has also seen the indirect positive of more demand for the commodity across their systems.

A transformation of supply and demand fundamentals such as this is very likely to require additional investments in the transmission and distribution networks. Recovering the costs of these investments, along with what might be required for new generation (whether regulated or market-driven), will have implications for the impact on customer bills. In some states this is not a new concept and utilities have put in place specific tariffs for data centres or the utility can contract directly with the customer. We believe that in others, and likely those seeing significant data centre demand for the first time, the appropriate response still needs to be developed with regulators. However, managing the impact such that existing customers aren’t negatively impacted by the new demand will be an important consideration.

ESG perspectives

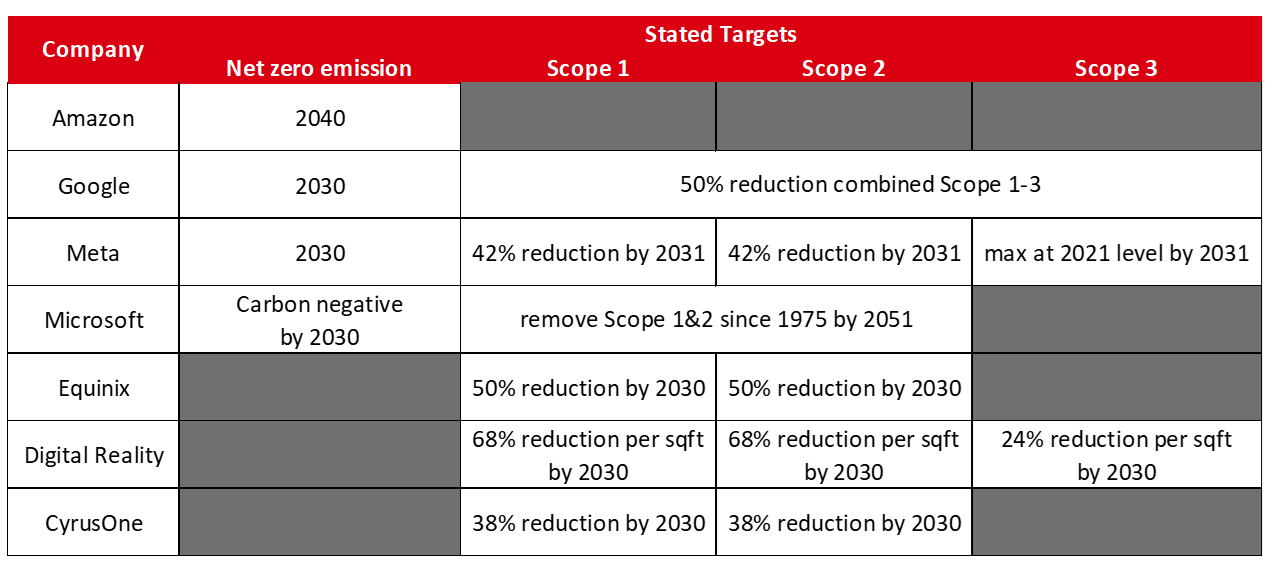

Fast power demand from data centres, in addition to other sources of demand growth, has the potential for rising emissions. Forecasts for emissions from the data centre industry suggests this could double by 2030. As a result, the sustainability record of the colocation segment has become a significant consideration for hyperscalers when selecting development partners. This has increased the pressure on colocation data centres to meet their own sustainability goals.

Renewable energy still has an important role to play in this effort and indeed hyperscalers have been a dominant player in the corporate power purchase agreement (PPA) market for many years. Just in Dec-24, Google announced its partnership with TPG Rise Climate on a $20 billion initiative to develop “industrial parks” across the US to collocate AI-training purposed data centres with renewables sites. However, without battery storage providing more than a short-term solution dispatchable resources are needed at some point. Hyperscalers are therefore focussed on utilising carbon offsets to achieve their climate-related targets. In this regard Apple, Google and Meta achieved carbon neutrality by 2020, whilst AWS is aiming to achieve 100% renewable energy for its operation as early as 2025.

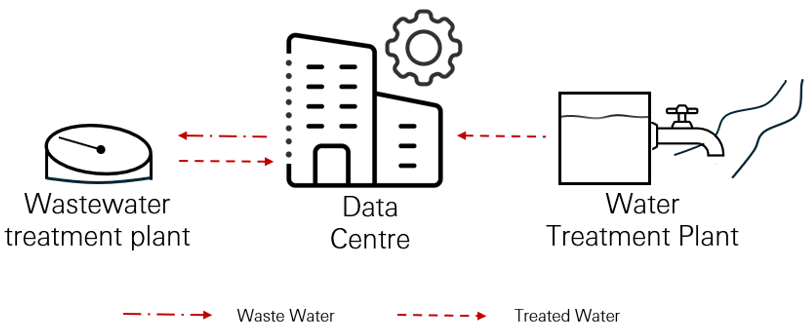

Apart from power, water is another important input to the data centre industry. Cooling systems are the primary driver of water usage in data centres, making water sustainability an increasing focus for the sector. Leading global data centre operators are implementing innovative initiatives to reduce water consumption and improve overall sustainability .

Historically, potable water was predominantly used for cooling purposes, however, there is now a growing shift toward utilising reclaimed or non-potable water as an alternative. For instance, many operators are integrating stormwater retention ponds into their data centre campuses to collect and reuse rainwater for cooling.

Another effective strategy to improve water efficiency is reusing water multiple times within cooling systems. Google, for example, reports that by circulating water several times through its cooling system it can achieve up to 50% water savings compared to conventional approach.

These initiatives demonstrate the industry’s commitment to sustainable practices and highlight the potential for innovation solutions to address the challenges of water-intensive cooling processes in data centres.

In addition to the increasing environmental impact of the growing data centre industry there are also important social considerations emerging. Chief among them is the consequence of their development and expanding footprint, in some regions encroaching on neighbourhoods and suburbs not accustomed to the scale of construction and imposition on the local community. Increasingly data centres are having to manage this “Not in my backyard”, or “NIMBY” opposition as they search for new land for their growing requirements. In addition, and as mentioned previously, the impact on local power bills needs to be carefully managed. This may be a delicate situation to manage given the data centre may also be the beneficiary of material state tax incentives. Ensuring the local ratepayer and community have not been disadvantaged by any new development are important considerations for the data centre.

In addition, and more broadly, we believe there are also important societal implications from the development of AI and integration into our daily life, particularly on the workforce. These considerations and any potential regulatory response could be significant and have the potential to impact the speed of development .

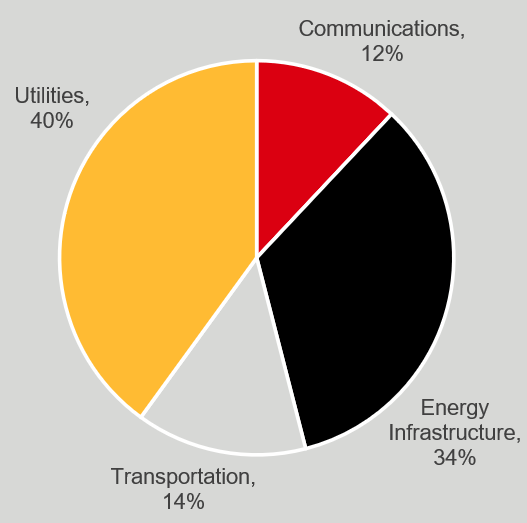

Implications for the Global Listed Infrastructure Equity asset class

Communications sector – so much growth but focussed exposure

The data centre industry has experienced significant growth, yet its representation within the Communications sector remains somewhat limited. This has been due to privatisation and fewer new public listings as private equity continues to fund sector growth, attracted by the high growth potential and stable cash flow profile.

The listed sector is dominated by two global players and several regional ones, all benefiting from robust demand and strong operational performance. These players cater to different subsectors: hyperscale wholesale and colocation retail. Colocation facilities exhibit more infrastructure-like characteristics, with higher barriers to entry and potentially more attractive returns despite shorter contract durations. While current capacity expansion is largely driven by AI training requirements, the next phase – AI inference workloads – will favour the colocation players due to their proximity to end users and lower overcapacity risks in primary markets.

To capture and accelerate hyperscale capacity expansion opportunities near existing colocation sites the listed companies focused on colocation markets are increasingly leveraging off-balance sheet capacity by partnering with private equity. This strategy creates an ecosystem enabling hyperscalers to deploy core workloads closer to access points, offering benefits such as low latency, seamless integration, and cost efficiency.

Looking ahead, apart from AI advancement, we see that geopolitical factors such as data sovereignty laws will also influence industry development. Data localisation will create more opportunities for regional operators while potentially adding complexity for global operators.

Energy infrastructure - connecting gas supply to growing markets

The investment opportunity in the sector is a combination of large multi-basin and multi-commodity players, to more basin-specific and single commodity companies. Those owning gas assets are particularly well-placed and already benefiting from growth across their platform, both from data centres and liquified natural gas (LNG) export demand. In addition, the data centre dynamic is on the cusp of transforming from indirect demand via their utility customers to serving the data centre directly via pipeline laterals. This is a particularly interesting dynamic, which has the potential to drive additional investment opportunities. Companies are also looking to do bolt-on acquisition, or even larger mergers, to better position themselves for these growth opportunities, ensure speed to market, and potentially offer integrated power generation / gas supply solutions.

The incremental demand and discrete projects may be small in comparison to the larger energy sector, but the growth opportunity has important implications for capital allocation decisions when the sector was only recently been more focussed on share buybacks, in our view.

Utilities - volume growth and investment opportunities across the sector

Across the broader utilities sector, we focus on those companies owning regulated assets, which in the US are the integrated utilities in regulated markets and transmission and distribution utilities in deregulated markets. A large proportion of these companies in the US are listed and as such it represents the largest country exposure within the largest sector of the Listed Infrastructure Equity universe. This results in a broad range of companies across all regions and markets exposed to different aspects of the data centre growth dynamic. It is not an understatement that the impact for some companies is potentially transformational, in our opinion the extent to which is very likely to be determined at a local level with many contributing factors.

Similarly to the trends seen by data centres in the Communications sector, private capital has also been present in the sector. More recently this has involved larger multi-state utilities selling smaller exposures and minority stakes in larger assets to fund growth. Given many utilities are facing balance sheet constraints and see growth opportunities beyond what they can fund organically, we expect the trend of private capital involvement to continue. In addition, given the magnitude of the growth, to ensure security of supply whilst attracting new data centre demand we expect the re-prioritisation of investments towards generation and away from more recurring grids programs to continue.

Conclusion

The data centre industry is undergoing a significant expansion in capacity driven by demand from hyperscalers’ and their pursuit of AI initiatives. As the industry moves from the training build-out to the inference application phase, we expect the wide-ranging forecasts of these requirements to narrow. Technological developments, both hardware and software, will also be influential.

For the electricity industry that has seen no growth for two decades the risks are to the upside and potentially transformational. However, in our view the extent to which will very much be driven by where and when supply can be made available to meet demand as it comes online. The energy infrastructure industry has a role to play too, beyond just supporting their growing utility customers. Whether they can locate generation adjacent to their pipelines is likely to be advantageous as data centres strive for speed to market. We expect timeliness will drive supply opportunities in the short to medium term, whilst net zero targets guide longer term considerations and the potential for nuclear opportunities. Meanwhile, we believe that renewables will continue their build-out. The opportunities are many and varied across the Global Listed Infrastructure sector and they remain in focus as we look to position the Fund for the best interests of our clients.

Meet the Authors

|

Joseph Tittmus

Managing Principal, Listed Infrastructure Equity joseph.titmus@hsbc.com.au |

|

Claire Zhangs

Principal, Listed Infrastructure Equity claire2.zhang@hsbc.com.au |

For more information contact:

|

Giuseppe Corona

Head of Listed Real Assets | HSBC Giuseppe.Corona@hsbc.com |

Jessica Nguy

Investment Specialist | HSBC Jessica.Nguy@hsbc.com |

Please visit:

HSBC Asset Management

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. For informational purposes only and should not be construed as investment advice. This information shouldn't be considered as a recommendation to invest in the specific country mentioned.