Private Markets View Q2 2025

Strategy Snapshot

Our key perspectives for each Private Markets Strategy

Proposed Strategy Views

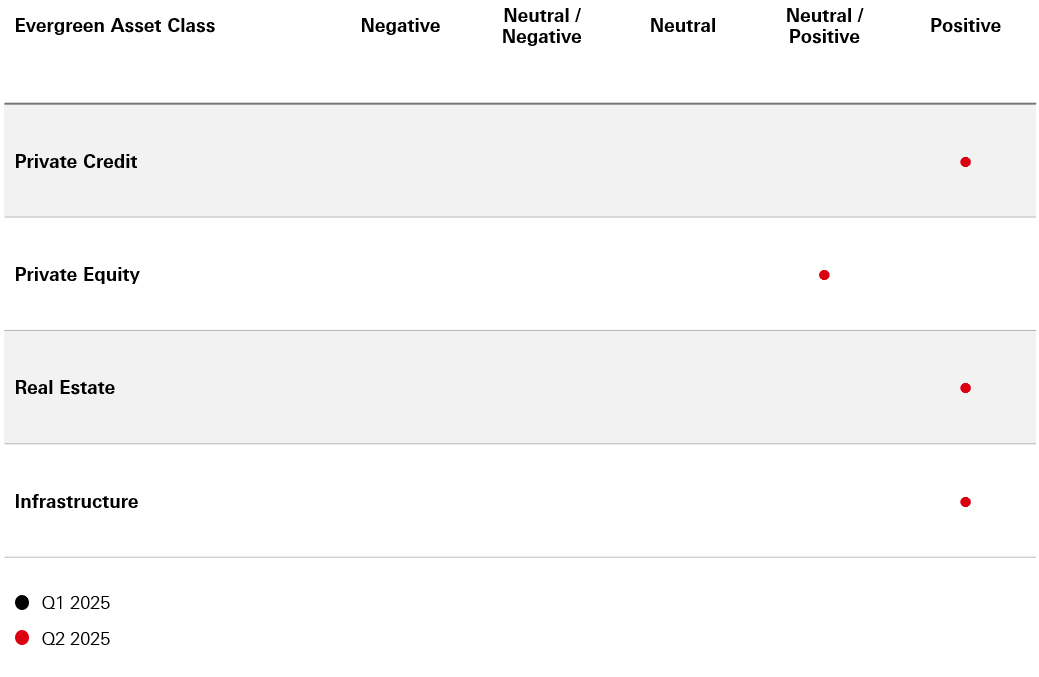

In our view, a wide opportunity set for Private markets strategies is still present in the market. Within the sub-sector of Private Credit, we continue to hold a ‘Positive’ outlook, driven by the pertinent investor demand for higher yields and stable income.

We maintain our stance on Private Equity at ‘Neutral Positive’ where the expected revival in deal volumes has commenced. With rate cuts on the horizon, this should be a tailwind for sponsors and M&A markets more broadly. Overall M&A activity should also benefit from de-regulation under new political regimes.

In Real Estate, we continue to hold a ‘Positive’ outlook for the asset class, with the expectation of an increase in capital values over 2025 being underpinned by the potential for growing incomes. From Cloud computing to Senior housing, several sectors also contribute to this favourable outlook.

Lastly, the outlook for the Infrastructure sector continues to offer a variety of opportunities for investors. US uncertainty opens investment prospects globally, but especially in Europe. As such, we remain optimistic about the asset class, holding a ‘Positive’ outlook.

Our Asset Class Views

Private Credit

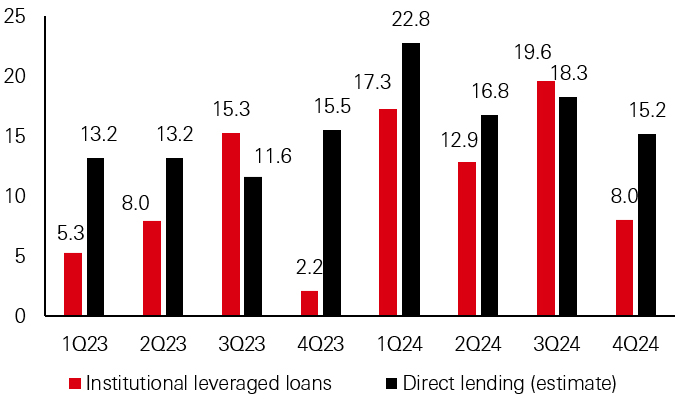

Review of Q4

Private credit deal-making gained momentum in Q4 2024, outpacing the levels seen in Q3 with much of the activity driven by refinancings and add-on financings to support portfolio company growth. M&A activity also picked up modestly in late 2024, aided by improving equity valuations and record private equity dry powder, though sponsor-backed M&A remained below historical peaks.

Direct lending maintains the upper hand

New-issue loan volume financing LBOs (USD bn)

Source: HSBC Alternatives, LCD Pitchbook

Spreads are still under pressure but appeared to stabilise during Q4, following a modest tightening earlier in the year. Higher base rates kept all-in yields (in USD) in the low double digits for many direct lending deals.

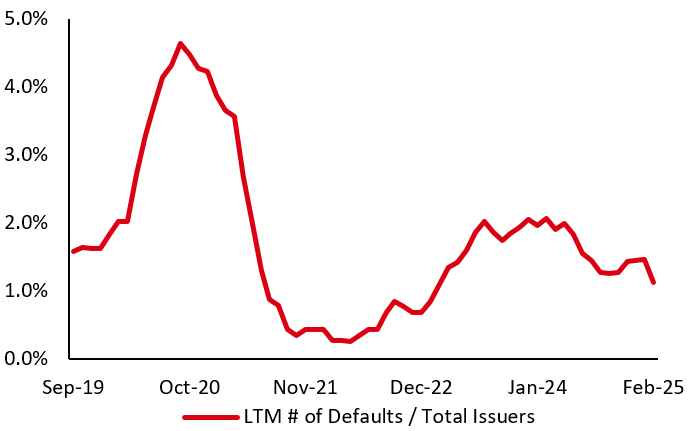

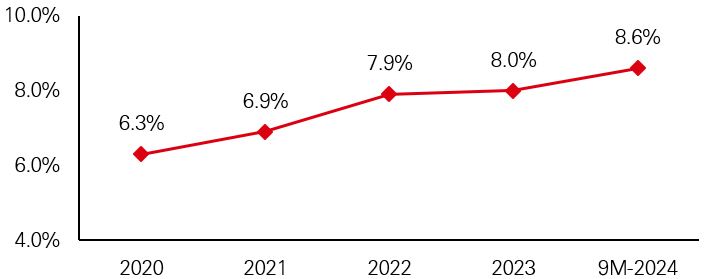

Default rates edged up slightly from Q3 but remain below historical averages. Many borrowers are managing elevated rates through sponsor support, covenants amendments, or short-term solutions like ‘Paid-in-Kind’ (PIK) toggles facilitating underlying business growth and avoiding technical defaults.

Refinancing structures often included amend-and-extend provision or PIK features to conserve borrower liquidity. The use of PIK interest continued to rise, though outright payment defaults remain limited. The trailing 12-month default rate for leveraged loans ended Q4 at 1.5 per cent, a slight uptick from 1.3 per cent in Q3. The usage of PIK can signal increased risk of default however when issued prudently as part of a broader plan, PIK can buy time for a borrower to grow into their business plan without immediate default. Furthermore, recent occurrences of longer loan tenors, amendments, and debt-to-equity swaps are often being utilised opportunistically by managers to realise upside and provide rescue financing to protect fundamentally strong business models going through headwinds.

Default rates remain resilient

Leveraged Loans Index Default Rates

Source: HSBC Alternatives, LCD Pitchbook

12-month outlook

Private credit demand remains strong as investors seek higher yields and stable income, even in a ‘higher for longer’ rate environment. Spreads have slightly compressed from 2023 peaks due to competition among lenders, though they continue to offer a premium over public markets. Default rates are rising gradually but remain in the low single digits, thanks for ongoing sponsor support and disciplined structures. Many sponsors are opting for amend-and-extend deals or PIK toggles to navigate tightening credit conditions and preserve liquidity.

Over the next 12 months, the market is expected to see only modest increases in defaults, with proactive refinancing tactics continuing to mitigate credit issues. Potential interest rate cuts in late 2025 could support borrower cash flows, while robust fundraising momentum ensures a steady supply of private credit capital. Overall, experienced managers with flexible strategies, prudent underwriting, and active portfolio monitoring should continue to capture attractive risk-adjusted returns.

PIK Income has continued to rise

Fitch-Rated BDCs – PIK Income/Interest & Dividend Income

Source: HSBC Alternatives, Fitch Ratings

Private Equity

Review of Q4

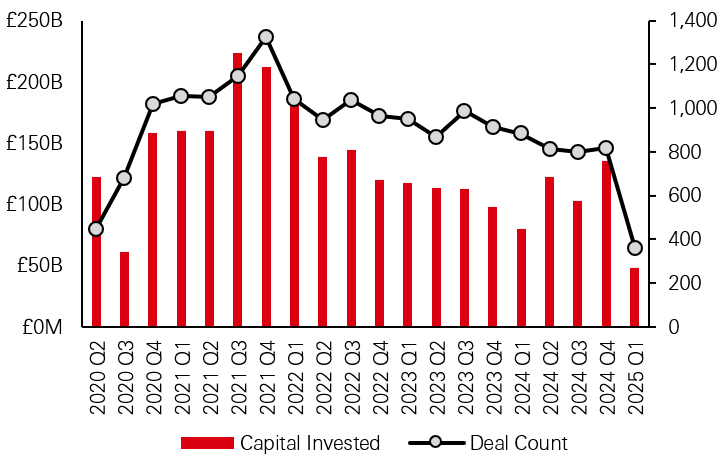

We are currently witnessing a recovery in private equity deal activity. Improving sentiment is translating more directly into deal activity, synonymous with increased exits. M&A and IPO activity are set to increase, supported by softening interest rates and inflationary pressure, driving more favourable conditions. Capital invested from Q4 2023 to Q4 2024 increased by +25 per cent in value, supported by the Fed cutting rates by 50 basis points in September 2024 and then 25 basis points in both November and December 2024.

Capital investment has increased year-on-year

Capital Invested (LHS), Deal Count (RHS)

Source: HSBC Alternatives, Pitchbook

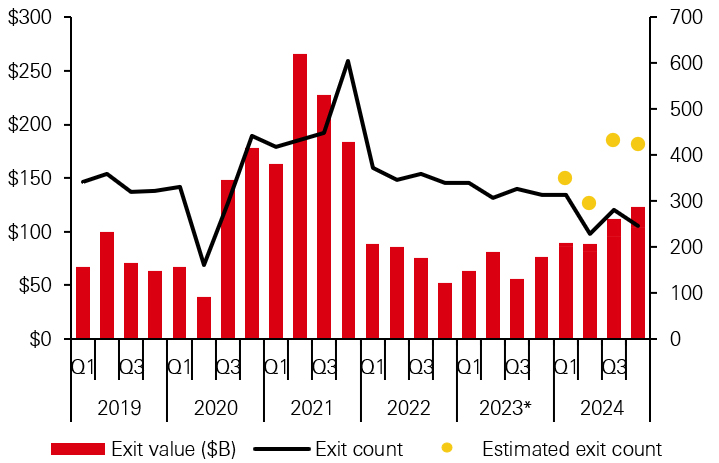

With an estimated 394 exits for an aggregate of USD 107.1bn in Q3 2024, exit activity appears to be on an upward curve into recovery. Both exit count and exit value saw QoQ growth and greater improvement on a YoY basis.

Upward trajectory for exit activity

Exit Value (LHS), Exit Count (RHS)

Source: HSBC Alternatives, Pitchbook

Distributions exceeded capital calls for the first half of 2024, putting 2024 on track to be the first full year since 2015 where Private Equity LPs saw net positive cash flows. This suggests that persistent demands from investors for liquidity were proactively addressed by GPs. This resurgence was powered by a much more benign financing environment, the cost of financing a buyout has declined.

12-Month Outlook

US rate cuts should be a strong tailwind for sponsors and the M&A markets more broadly, and in supporting confidence around macro conditions and target valuations.

There are several potential tailwinds and headwinds currently at play:

Tailwinds

- M&A de-regulation – Prospect of de-regulation under the new Trump administration (flexible approach to anti-trust remedies). De-regulation measures could result in increased M&A activity, leading to more exits

- Lower rate environment – There is a possibility that rates could be cut later this year. Rates are currently held at a target range of 4.25 per cent - 4.50 per cent (this has been maintained since January 2025)

Headwinds

- Tariffs – Canada and Mexico – President Trump introduced a 25 per cent tariff (as of 4th March) on a range of goods imported form these markets. A month-long reprieve has now been announced, suspending the tariffs. China – An additional 10 per cent tariff was applied to Chinese goods (as of 4th February). As of 4th March, this increased to 20 per cent. Tariffs are forecasted to elevate consumer prices in the U.S. Higher inflation could result in the Fed keeping rates higher for longer

- Tax cuts – President Trump has proposed reductions in income taxes on Social Security benefits, tips and overtime pay. A lower tax rate environment could prove to be inflationary, de-incentivising Fed rate cuts

Real Estate

Review of Q4

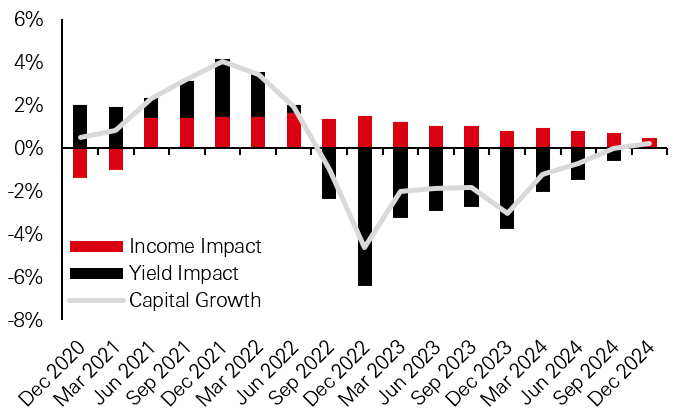

According to MSCI data, following a global cumulative decline of 16 per cent between Q2 2022 and Q3 2024, global real estate capital values edged up by 0.2 per cent in Q4 2024 as property yields were stable whilst incomes grew. Investment activity increased by 31 per cent in Q4 2024 compared with Q4 2023 as investors took advantage of stabilising interest rates and lower valuations. However, this momentum may have slowed in early 2025 as economic uncertainty relating to trade policy, inflation expectations and public spending has pushed up bond yields.

Uptick in capital growth rates

Decomposition of Capital Growth

Source: HSBC Alternatives, MSCI

Occupier fundamentals are being supported by a widespread decline in development activity, as rising costs have made new development uneconomic. The decline in new supply is most notable in the retail sector, which saw little new space being developed even in the years before the pandemic. Q4 2024 saw a continuation of stable leasing and further declines in vacancy rates, especially for neighbourhood retail with a non-discretionary grocery focus, supporting widespread rental growth.

Office sector vacancy rates were largely stable in Q4 2024, having risen across all regions since 2020. Vacancy rates remain notably higher in the US (and particularly the West Coast markets) than in Europe or Asia. Despite elevated overall vacancy rates, prime office rental growth persists as tenants continue to focus on high quality buildings in global gateway markets such London, Paris, and Tokyo. In the US, the Sunbelt office markets have been more resilient.

Logistics leasing remained subdued in many markets in Q4 2024 as tenants focussed on better utilisation of existing space, while a wave of new developments pushed vacancy rates higher. This has led to rents declining in the US and Canada in 2024 and rental growth slowing elsewhere.

Residential vacancy rates tend to be low and stable. Chronic under supply of new housing is a global theme and city populations continue to grow. Meanwhile, high interest rates sustain the relative appeal of renting over buying. The US Sunbelt multifamily sector is a notable exception as new supply continues to weigh on the ability of landlords to grow rents.

Non-traditional property sectors continue to deliver the strongest rental growth. Senior housing continues to benefit from ageing demographics, particularly in the US and Canada. Data centre leasing had a notably strong end to 2024, with demand from hyperscalers (such as Alphabet, Amazon, and Microsoft) growing in Asia and Europe, as those markets catch up with the US.

12-Month Outlook

The recent US trade policy announcements have stoked inflation concerns and fears of a possible economic slowdown. Despite the uncertainty, our base case is for capital values to grow in 2025, underpinned by growing incomes, rather than yield compression. Although the outlook for leasing is mixed, the widespread lack of development activity should support property fundamentals across sectors.

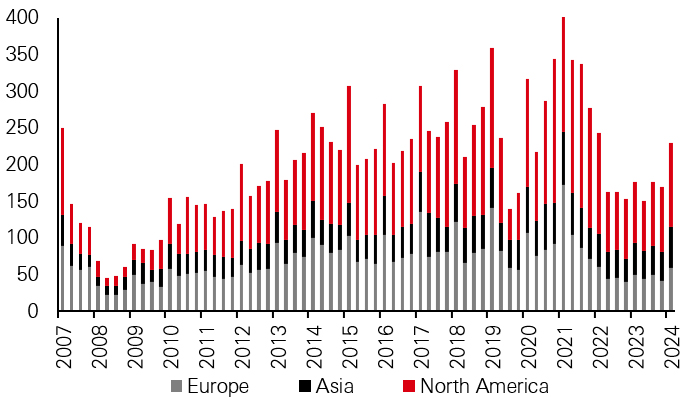

Global Investment Activity

Investment Volume USD bn)

Source: HSBC Alternatives, Real Capital Analytics

Investors are expected to continue targeting property types that are underpinned by long-term demand tailwinds such as urbanisation (urban logistics), demographic shifts (senior housing), and the rise of artificial intelligence (data centres).

Confidence in data centres was shaken in January 2025 when China’s DeepSeek cast doubt on the need for the vast capital expenditures made by US tech companies.

However, cheaper AI is likely to expand use cases, ultimately boosting demand. Meanwhile, strong demand from cloud computing and the ongoing digitization of work (video conferencing), entertainment (streaming), and retail (e-commerce) remains steady. Persistent challenges in securing power connections also limit new supply, keeping upward pressure on rents.

Senior housing is expected to continue to be one of the strongest sectors for real estate investors, particularly in North America where the sector is most established. The growth of an over 80 age cohort with substantial housing equity, combined with a drop in new supply, has created the conditions for the sector to continue to perform well.

Though logistics sector fundamentals have notably softened, an inflection point is anticipated in 2025 as new supply dries up whilst leasing demand recovers, underpinned by e-commerce and supply chain adjustments. Moreover, significant rental reversion will continue to support income growth in the US, Europe, and parts of Asia (such as Australia) as in place rents are marked to market levels.

Infrastructure

Review of Q4

Q4 saw continued steady performance by evergreen infrastructure funds, with annualised returns across the industry in the range of 8-12 per cent.

Managers remain focused on digitalisation and electrification, two of the dominant investment themes of our time. Digitalisation is driving enormous demand for investment in data centres and networks. We continue to see a variety of opportunities to invest in data centre platforms which are seeking to generate explosive growth in capacity. We consider that these investment opportunities need to be reviewed carefully. There are a number of risks in large scale data centre development, including: securing permitting for ever larger sites; securing power availability in a manner that isn’t seen to weaken the availability of power for the grid; risks to construction arising from contractor and labour capacity constraints and the potential impact of US tariffs on the price of steel and other building materials; contracting risk for any sites which are developed without having secured long term capacity usage agreements; and valuation risk on exit, particularly given the possibility that, in time, supply of data centre capacity may exceed demand.

Over the past twelve months, we have extended our investing focus into value-add infrastructure, while continuing to invest in the more traditional core and core plus markets. Much of our investment focus is on Europe and North America, although we also invest selectively in other markets, particularly in Asia. Our approach is very much on trend. A survey of Limited Partners by Infrastructure Investor found that 29 per cent of LPs are intending to increase their investment allocation to value-add infrastructure in 2025, double that of any other infrastructure market sector.

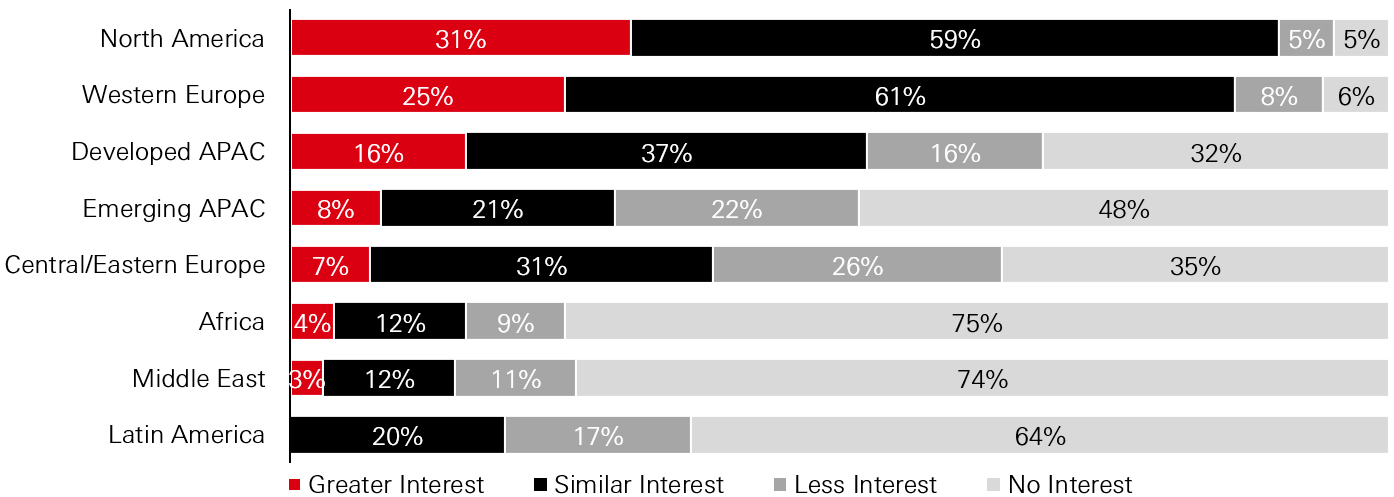

LP Regional Preference for 2025

Source: HSBC Alternatives, Infrastructure Investor

The same survey provides a good perspective on the regional preferences of infrastructure LPs. North America and Western Europe are, unsurprisingly the most popular, with interest in developed APAC also showing some strength. All other regions have seen a decline in interest as investors seek safe jurisdictions for their infrastructure investments.

12-Month Outlook

The outlook for infrastructure remains dominated by the new US federal government. We see signs that this may lead to greater investor interest in European infrastructure, which can be seen as having a more stable policy environment.

We continue to monitor the policies of the Trump government and their impact on three aspects of infrastructure investing:

(i) Potential redrawing of the scope and value of tax benefits available under the Inflation Reduction Act and other Biden era policies. This could be driven by the President’s own stated climate scepticism, by his fondness for the oil & gas industry, and by the desire of some Republicans to fund the continuation of the previous Trump government’s tax cuts by reducing subsidies. We don’t anticipate any tax benefits being removed from existing and in construction renewable energy projects. If tax breaks are removed for new renewable energy projects that may have some adverse impact on projected investment returns, but investment in this sector will continue to grow because onshore wind and solar are price competitive without tax breaks.

What we have observed so far is that US offshore wind will see development activity significantly constrained by the refusal of the administration to grant permits for new projects. The sector will, however, remain strong in Europe and is set to grow in North Asia in particular. We also anticipate that US grants for new EVs will be removed. This will have some impact on the growth prospects for the EV charging infrastructure sector.

(ii) Tariffs: to the extent that tariffs on imports lead to greater onshoring of production in the USA this is generally expected to be positive for the energy sector as it can be another contributor to greater demand for power. Large and sudden tariff increases can lead to short to medium term disruption to supply chains and delays and cost increases for construction projects. In the 2022-24 inflation cycle, additional costs to build renewable power projects have ultimately been rebalanced by an increase in the prices available from purchasers of power. The effect of tariffs on redirecting trade flows could be adverse in some cases for fixed transport assets such as ports and toll roads, though on the whole both asset types will be positively correlated to US GDP growth;

(iii) Inflation: a general increase in tariffs could result in an increase in US inflation. That and the prospect of a growing US fiscal deficit may lead to the Federal Reserve keeping interest rates higher for longer. The recent inflationary and interest rate cycle has demonstrated that infrastructure assets tend to be positively correlated with inflation (because their income streams are often index linked) and robust to the interest rate cycle (because they often have long term, fixed rate financing).

Forecasts, forward-looking statements, views and opinions are subject to change without notice, are by their nature, subject to significant risks and uncertainties, and are not a reliable indicator of future performance. Past performance does not predict future returns.Diversification does not ensure a profit or protect against a loss. There is no guarantee that the trend illustrated by the charts above will continue.

Source: HSBC AM Alternatives, Bloomberg, Real Capital Analytics MSCI, Real Capital Analytics, Pitchbook, LCD, Fitch Ratings, LSTA, S&P Global Ratings as of March 2025.

Important information

Risks of investing in Private Markets

The value of investments and income from them can go down as well as up, meaning you may not get back the amount invested, and you may lose some or all of your investment. Past performance information presented is not indicative of future performance. The return and costs may increase or decrease as a result of currency fluctuations.

- Alternative Risk - There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realisable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements

- Liquidity Risk - Investors may be unable to dispose of an investment quickly or at all and at a price that’s closely related to recent similar transactions, if any. There is no guarantee of distributions and secondary market is expected to be established

- Event Risk - A significant event may cause a substantial decline in the market value of all securities

- Long-term Horizon - Investors should expect to be locked-in for the full term of the investment, which is subject to extensions

- No Capital Protection - Investors may lose the entirety of invested capital

- Unpredictable Cashflows - Capital may be called and distributed at short notice

- Economic Conditions - Ability to realize/divest from existing investments depends on market conditions and the regulatory environment

- Risk of Forfeiture - Failure to make call payments could result in forfeiture of commitment, including invested capital, without compensation

- Default Risk - In the event of default investors risk losing their entire remaining interest in the vehicle and may be subject to legal proceedings to recover unfunded commitments

- Reliance on Third-party Management Teams - Underlying investments will be managed by various third-party management teams that will in aggregate determine the eventual returns for the investor, if any

Disclaimer

Important information

For Professional Clients and intermediaries within countries and territories set out below, and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

- The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

- The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

- All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

- HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D042338_v1.0; Expiry Date: 28.02.2026