Residential Mortgage-Backed Securities: A broad and diverse range of investment opportunities

This paper considers all Residential Mortgage-Backed Securities (RMBS) markets except the Agency Mortgage-Backed Securities market.

Synopsis

The dynamism of the RMBS (securitisation of residential mortgage pools) market has resulted in increased primary volumes and new issuers entering the market, broadening the choice for investors. This wide set of opportunities across jurisdictions and type of collateral can fit a large range of investment strategies and target returns, making RMBS a key component of a diversified securitised credit portfolio.

RMBS in this case excludes the large US agency guaranteed MBS – Mortgage-Backed Securities market, but instead covers all other residential mortgage securitisations that are not backed by agencies of the US Government (such as Fannie Mae and Freddie Mac).

Tighter underwriting rules for lenders, driven by increased regulatory requirements have resulted in more resilient residential mortgage pools, that have weathered recent macro-economic headwinds better than expected. Falling interest rates should support debt affordability and house prices in the near term.

The GFC stigma has progressively disappeared as it is understood that US Subprime was a specific sub-segment involved in the crisis and that other parts of the RMBS universe performed well through and after the financial crisis.

What is a RMBS?

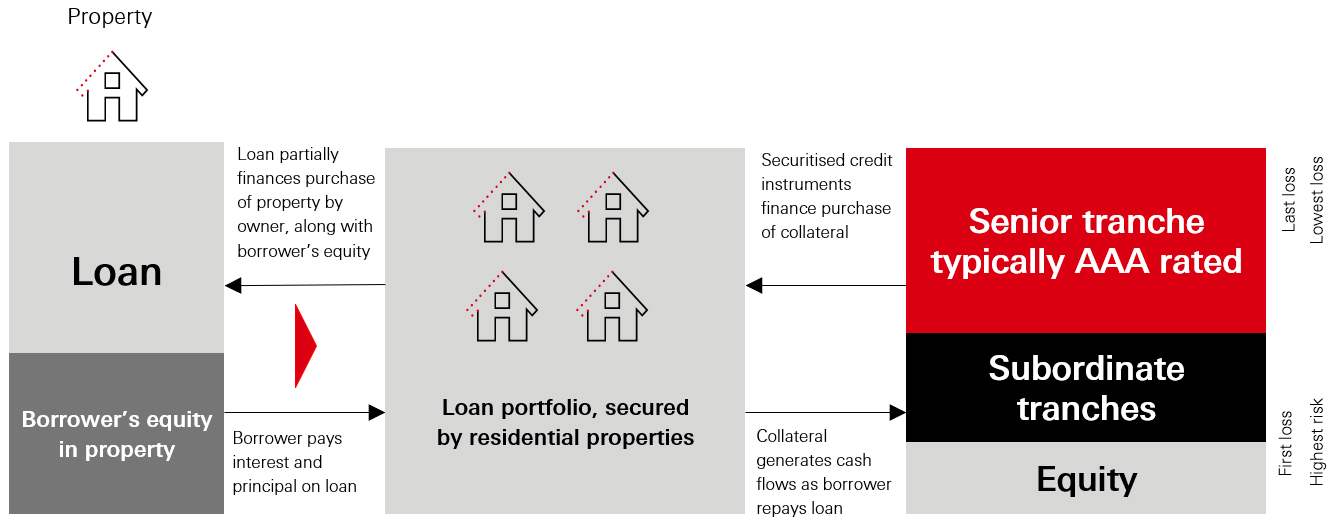

A RMBS securitisation represents a pool of thousands of residential mortgage loans to individuals on their residential properties. The RMBS market represents c. 23 per cent of the total Securitised Credit market and constitutes both fixed and floating-rate securities. As illustrated on the next page, investors are able to invest into an RMBS securitisation, according to their preferred risk-return profile.

RMBS: An illustration

Source: HSBC Asset Management

Key factors influencing performance of residential mortgage loans

- Borrower quality (borrowers with stronger credit profiles tend to perform better)

- Borrower equity in the home (loans with higher borrower equity perform better as borrower is incentivised to make payments on the loan). This translates into lower Loan To Value (LTV) on the mortgages

- Underwriting guidelines (loans with strict underwriting of borrower incomes and assets perform better)

- Servicer/originator quality (stronger originators and servicers result in better performance)

RMBS markets across the globe

Key geographies are:

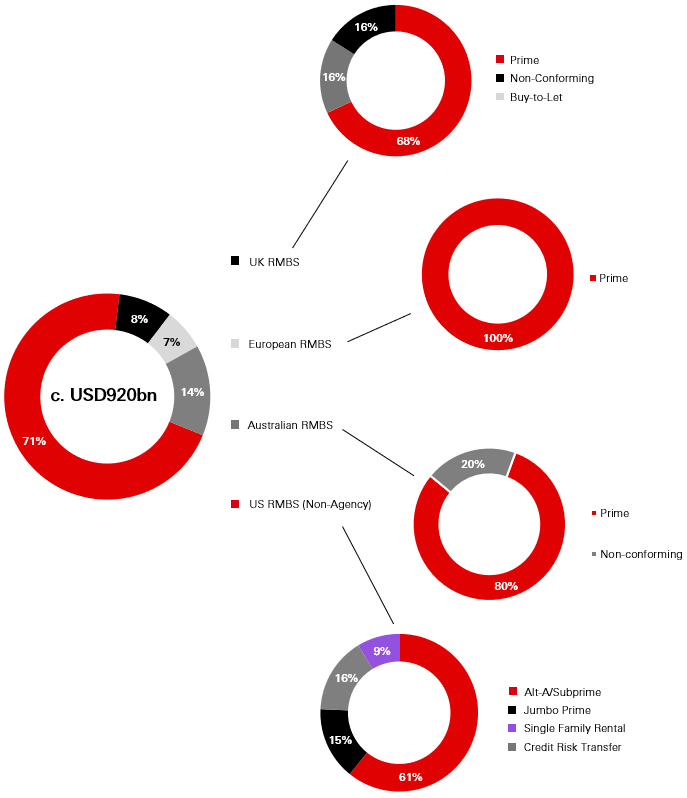

- US: The US is the largest residential mortgage securitisation market, split into agency (government guarantee) MBS – USD12tn and non-agency RMBS – USD638bn; the non-agency paper can be further subdivided into different types such as Subprime, Single-Family Rental (SFR), Credit Risk Transfer (CRT) etc.

- Continental Europe: Prime owner occupied RMBS with some Buy-to-Let RMBS

- UK: Prime owner occupied, Buy-to-Let and Non-Conforming RMBS (Non-Conforming is not the same as Subprime and often relates to self-employed borrowers)

- Australia: Prime and Non-Conforming RMBS

Addressing concerns around the GFC

The epicentre of the GFC revolved around specific sub-sectors and regions of the RMBS market. Subprime mortgages in the US were the most impacted sector. Subprime loans at the time were made to lower quality borrowers with low/no borrower equity, minimal to no documentation of income and inflated home values through fraudulent appraisals. Some categories of Subprime loans exposed borrowers to significant payment shocks once an initial low payment period ended. However, the whole RMBS market was to some extent tarnished by the performance and negative headlines of these isolated market segments. It is worth noting that we do not invest in the areas of the market that came under pressure.

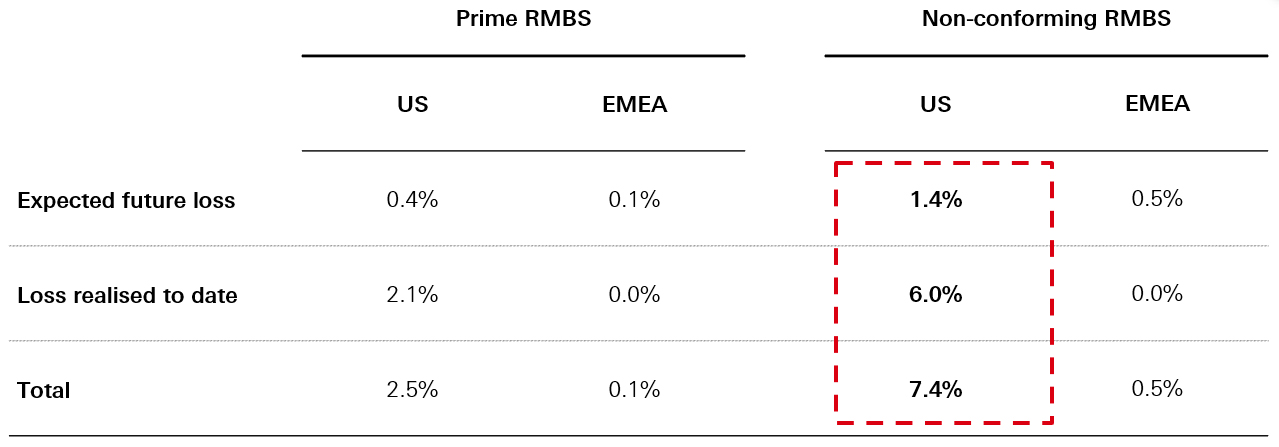

Data from Fitch highlights the rest of the market (i.e. Prime RMBS and EMEA Non-Conforming RMBS where we do invest) was much more resilient as the defaults ranged from 0.1 per cent – 2.5 per cent.

Global Securitised Finance Losses: 2000–2018 Issuance

Sources: Fitch Ratings, Global Securitised Finance Losses: 2000–2018 Issuance, Special Report US July 2019, Special Report EMEA May 2019

Since the GFC, lessons have been learnt by market participants and regulators alike and there have been significant improvements over the last 16 years to the Securitisation market in the following areas:

- Stricter underwriting of loans: Stringent stress tests are applied to individuals with affordability estimated based on increasing interest rates, while LTV ratios have decreased and lenders require proof of income and credit history

- Rating agency stresses: Rating agencies penalise pools with adverse characteristics, resulting in higher minimum levels of credit enhancement

- Risk retention: Originators now need to retain 5 per cent of a securitisation to ensure alignment of risks with investors (many originators in the lead up to the GFC were focusing on an origination to distribution model and had no skin in the game)

Where do we see value in RMBS today?

The pie chart below shows the different sub-sectors across regions that make up the RMBS universe that we invest in.

The RMBS universe

Source: SIFMA, AFME, HSBC Asset Management as at 30 September 2024

Non-US RMBS

There are three main regions where we can find value in RMBS outside of the US:

- UK:

- Securitisation has historically played a comparatively larger role in residential mortgage lenders’ funding mix with, as a result, a larger RMBS primary supply

- There is a dynamic sector of specialist lenders bringing to the market higher yielding RMBS backed not only by prime owner-occupied but also Buy-to-Let and Non-Conforming pools

- RMBS volumes issued by large banks are on an increasing trend, offering a wider access to “high street” grade prime collateral

- Continental Europe:

- While the RMBS market has historically been dominated by large banks, we see more specialist lenders joining the market, thus broadening investment options

- Relative spreads have normalised to more attractive levels, notably after the ECB stopped its ABS purchase program

- Australia:

- There is a broad range of investment opportunities, issued both by large banks and an active specialist lender sector that brings a steady flow of Prime and Non-Conforming RMBS

- Australian RMBS have historically been and remain attractive on a risk adjusted relative value basis

Non-Conforming RMBS in both the UK and Australia are pools of mortgages extended to borrowers with more complex incomes, such as the self-employed or healthcare workers; and may also include a small portion of credit-impaired borrowers typically resulting from life events such as divorce and unemployment. Credit-impaired borrowers, however, only make up a small percentage of Non-Conforming RMBS, primarily due to tighter mortgage underwriting rules and, secondly to rating agency penalties. Specialist lenders play an important role in this segment where manual assessment is key in understanding the borrower’s credit history and risk profile.

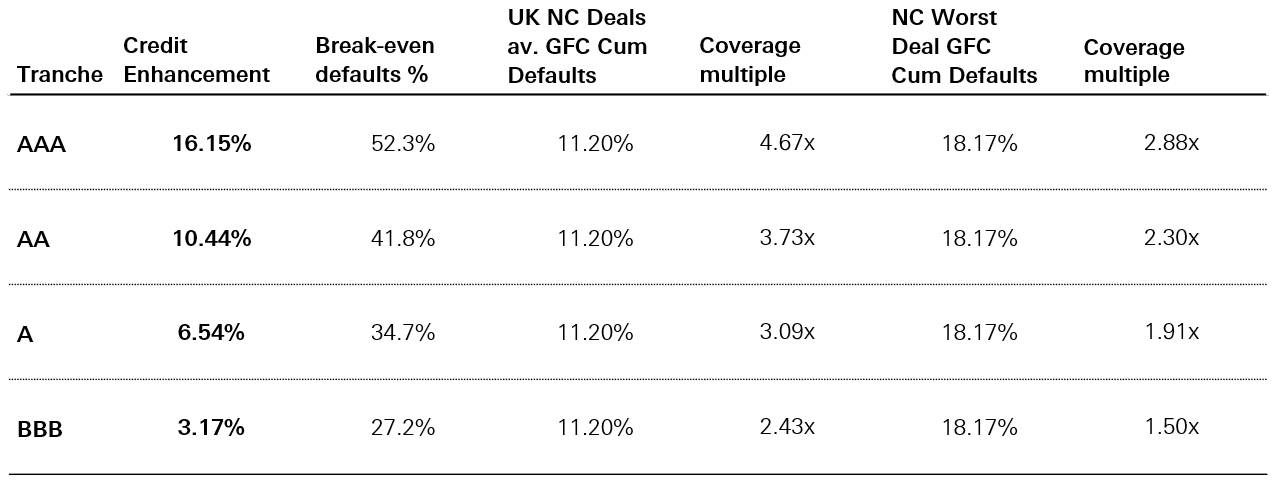

The riskiest RMBS we invest in typically have a weighted average LTV ratio around 70 per cent, leaving 30 per cent borrower equity to absorb potential losses. On top of this, there is an increasing level of credit enhancement dependent on the tranche, providing additional protection to investors. In our credit analysis we apply a severe house market correction and compare this to the worst observed performance in the respective jurisdiction.

For all three jurisdictions, recent collateral performance has been better than expected considering real income erosion, increase in interest rates and the softer macro-economic background. One likely explanation is the tightening of underwriting rules driven by regulators that has translated into stronger collateral than pre-GFC. Structures also are more credit shock resilient, with senior and top mezzanine tranches typically able to weather loss stresses that are multiple of the ones experienced during the GFC.

Table 1: Break-even for a representative UK Non-Conforming RMBS

Note: the worst Non-Conforming UK RMBS pools in GFC comprised a pool of residential mortgages that today would not be acceptable in a RMBS given the tighter regulations and underwriting standards

Source: HSBC Asset Management.

US

The US market is the largest securitisation market and represents c.70 per cent of the global RMBS securities issued (excluding agency MBS). Two areas of this market we currently see as having value but also being complex and requiring further analysis are SFRs and CRTs.

- SFRs: These deals are backed by single family properties which are:

- Situated within good school catchment areas, near local amenities and are well connected by highways

- Renovated/built to a high-standard increasing the attractiveness of these properties

- Let out to middle-class families who are in the best position to pay rent and are less likely to move frequently

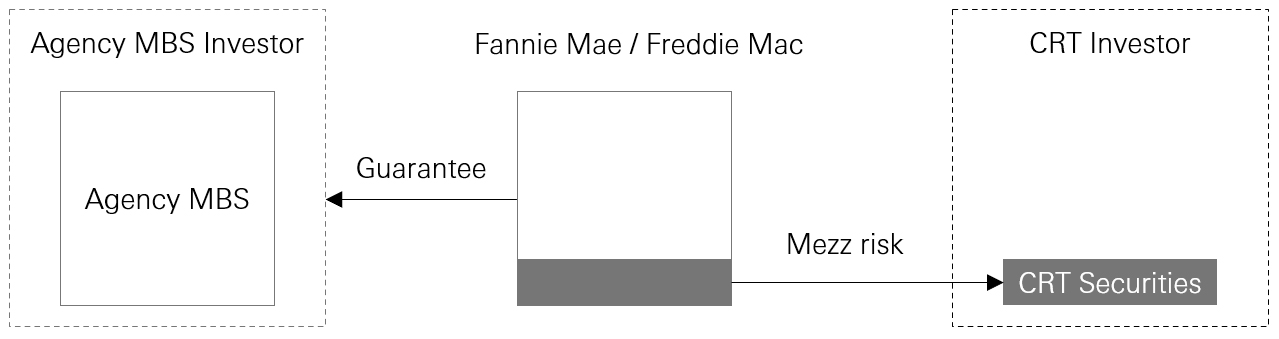

- CRTs: Investors get paid a floating-rate coupon in exchange for selling credit protection on agency mortgage loans (these loans meet origination guidelines of US Government agencies Fannie Mae and Freddie Mac).

Fannie Mae/Freddie Mac retain the top and bottom tranches of the securitisation. The tranches that we invest in are typically rated A/BBB and also benefit from credit enhancement (1.5 per cent – 3.5 per cent). Loans in these deals are made to prime borrowers with no previous delinquency histories and losses on these pools are projected to be less than 0.20 per cent, far below the credit enhancement. Losses are expected to be small because:

- The underwriting guidelines and documentation of borrower income are significantly stricter than pre-GFC

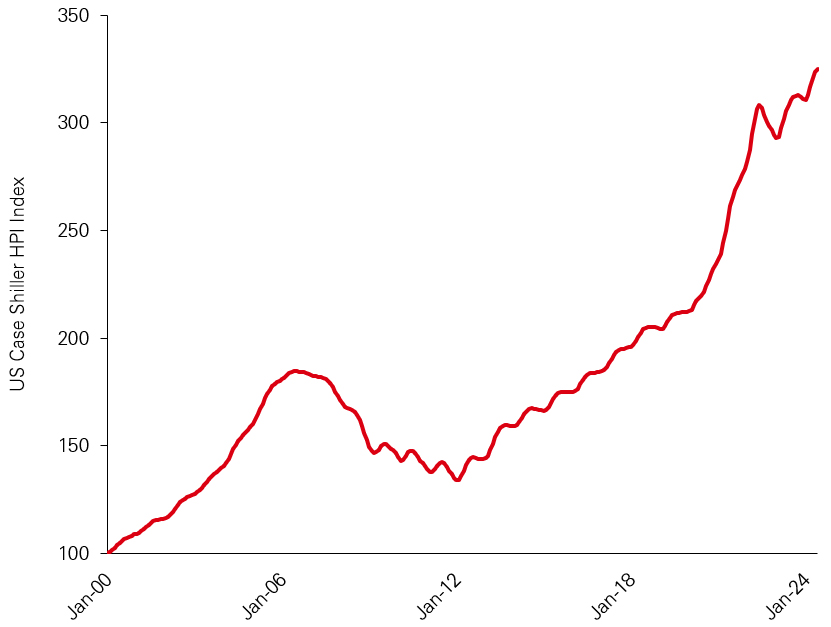

- US has seen a significant undersupply of homes relative to demand since the GFC, supporting home prices and increasing borrower equity

Note: given the rating of CRT bonds, these are often most relevant for higher yielding lower rated investment strategies.

The following graph demonstrates the growth of US house prices over the past two decades.

US house price growth has been strong

Source: Bloomberg, HSBC Asset Management

Lower interest rates bode well for borrowers

We have entered a new market cycle of interest rate cuts as evidenced by the Federal Reserve cutting interest rates in September and November 2024. As the RMBS securities we invest in are predominantly floating rate, this means lower coupons.

Interest rate cuts have a positive impact for the RMBS sector as follows:

- Lower interest rates improve mortgage affordability for borrowers through a lower cost of refinancing and lower mortgage payments for floating rate mortgages

- Lower interest rates improve the demand side of the housing market. If this results in house prices rising, the LTVs of residential mortgages would be lower

- Interest rates are unlikely to return to as a low as 0 per cent and we believe rates are likely to stabilise at more neutral levels. At these levels, there is still attractive levels of income available to investors

The three points above highlight the potential for future returns in the sector to be a combination of high levels of income and spread tightening owing to improved credit fundamentals.

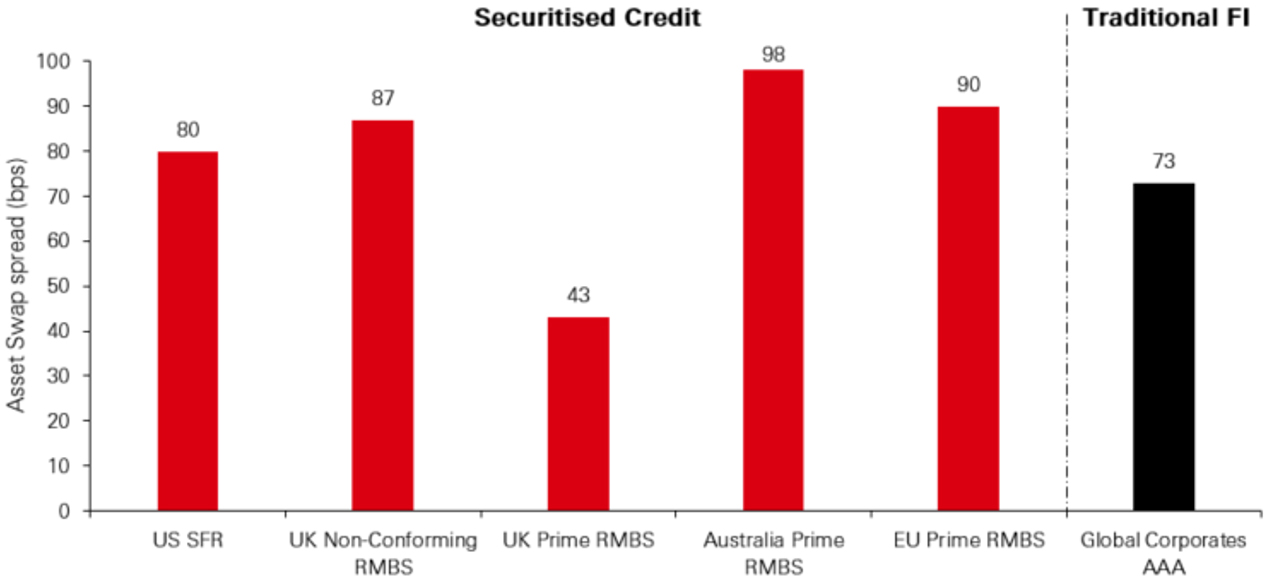

High quality investment grade RMBS securities can offer a higher spread than traditional fixed rate corporate bonds as can be seen in the below chart.

AAA RMBS vs AAA Traditional Fixed Income

Source: Bloomberg, HSBC Asset Management as of 30 September 2024

Conclusion

Each region has interesting features and investment opportunities such as specialist lenders in the UK Non-Conforming RMBS market, Prime and Non-Conforming securities in Australia and SFRs in the US market. The sector has undergone significant reform post GFC and high quality RMBS securities have proven their strength during periods of stress. As we enter a more favourable environment for borrowers and house prices continue to remain strong, the outlook is supportive for this essential asset class.