Spotlight on Commercial Mortgage-Backed Securities

Key takeaways

- Extensive due diligence to identify a winning sub-sector is needed to extract real value from the CMBS sector, which has come under pressure recently

- Historically-wide CMBS spreads present a case for realignment to the fundamentals

- Investors stand to earn a significant complexity premium, participate in potential spread tightening and lock in the high yields on offer from Investment Grade securities.

Synopsis

Commercial Mortgage-Backed Securities (CMBS) is a sector in Securitised Credit that has come under pressure recently. There are three key reasons behind this:

- The recent rise in interest rates has increased borrowing costs for new borrowers and dramatically increases the cost of refinancing existing loans at maturity

- Property valuations are inversely linked to interest rates and as property yields have risen, valuations have fallen. Lenders therefore lend less at refinance and existing loan to value ratios rise

- Changing property trends – the past decade has seen many changes in property use which were exacerbated by Covid-19. For instance, we now operate in a hybrid working environment and the rise of e-commerce has changed the demand for offices, distribution properties and retail space

In order to navigate these pitfalls and extract real value from this bifurcated asset class, extensive due diligence is required. The factors above highlight the importance of selecting:

- Securitisations on fit-for-purpose properties, that is, properties that do not require significant costs to maintain, are in a good location and are not inhibited by their age or type of use

- High quality tenants in sectors more likely to outperform in the post Covid-19 world

- Securitisations that have appropriate lease structures, the right blend of tenants and high occupancy rates

As a result of the sector coming under pressure, spreads are at historical wides. However, we believe each sub-sector is being painted with the same brush as the more problematic areas.

Thus, selecting high quality CMBS securities could result in investors potentially earning an attractive risk-adjusted return and locking in compelling yields that are on offer. What’s more, as we enter the next cycle where interest rates are anticipated to be lower, the asset class could benefit from spread tightening and capital appreciation as property values rise and the cost of finance falls.

What is a CMBS?

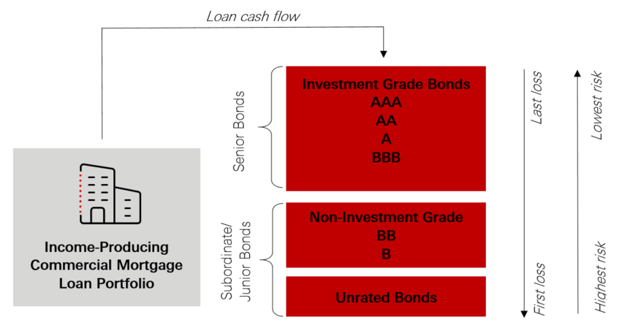

A CMBS is a fixed-income investment product that is backed by mortgages on commercial properties.

Fixed rate CMBS illustration

Source: HSBC Asset Management

The importance of due diligence

The aforementioned change in demographics has meant that there are winners as well as losers across the different sub-sectors of CMBS.

Conduit CMBS: One area that has come under scrutiny, and where a lot of the stress in CMBS lies, is conduit CMBS. These are securitisations where the underlying properties are a pool of loans which has diverse asset types such as offices, retail, hotels, apartments, self-storage etc. The asset quality is usually not prime for these asset types.

It is thus no surprise that we do not invest in this area. Instead, we take a rifle shot approach, focusing on “Single Asset, Single Borrower (SASB)” CMBS.

A SASB CMBS is where the securitisation is secured on a single property or a portfolio of similar properties with one institutional sponsor/borrower.

Sub-sectors

Office: All secondary real estate is underperforming, but secondary offices are currently in the spotlight.

The hybrid working environment we now find ourselves in has resulted in a significant reduction in the demand for secondary office space.

Investors in Conduit CMBS specifically could be inadvertently exposed to:

- Outdated office properties which are not fit for purpose and require significant investment

- Vacant office floors, due to fewer tenants

- Buildings located in areas which have become obsolete

Our SASB focus as it relates to Office allows for two things:

- Sourcing of “trophy buildings”: High quality properties can be sourced, which are well suited for the economic environment, have advanced energy standards and are in desired locations

- Transparent evaluation of borrowers: There are not pools of borrowers but essentially one borrower or sponsor. We have stuck to deals which have top tier sponsors who are experienced and well capitalised

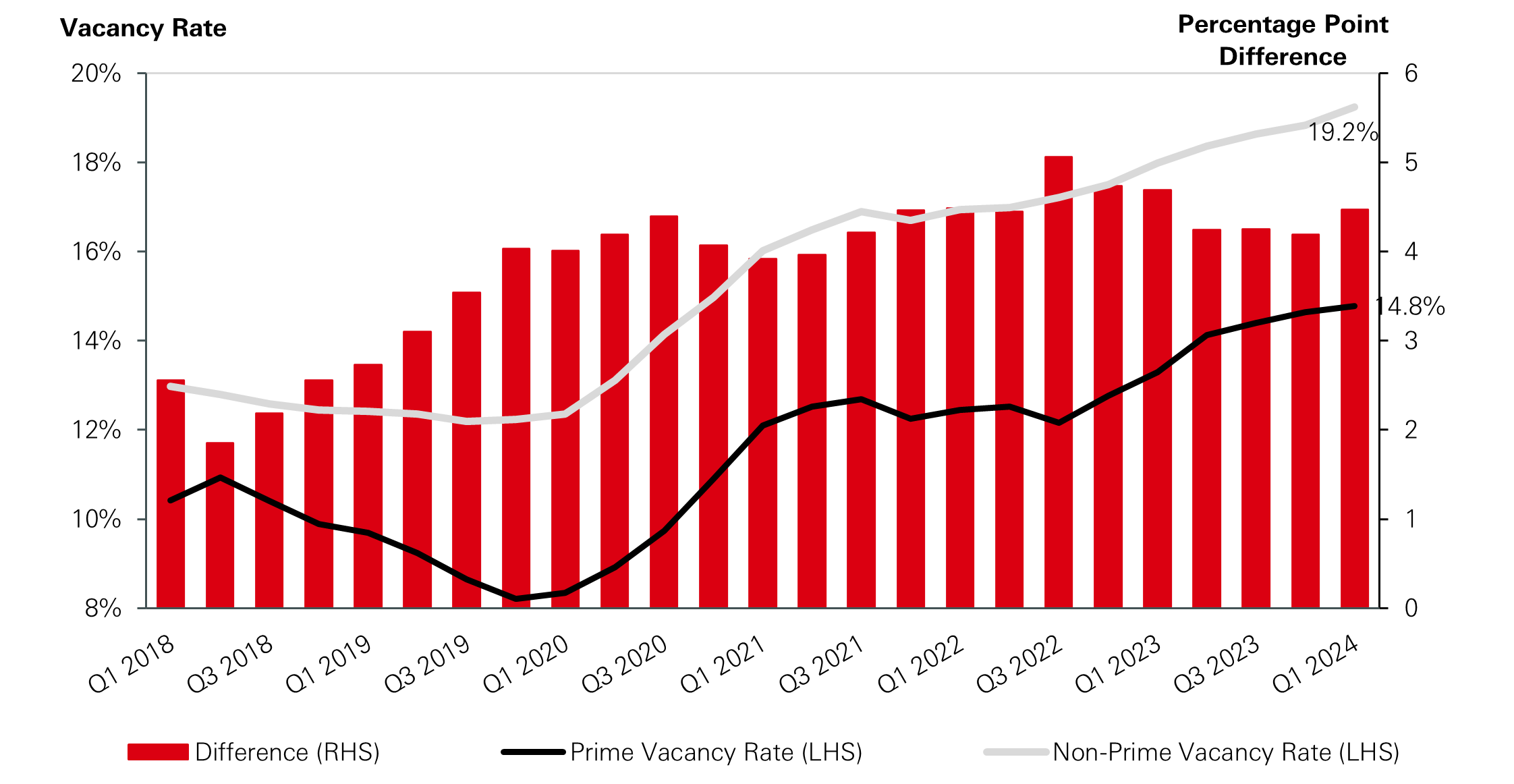

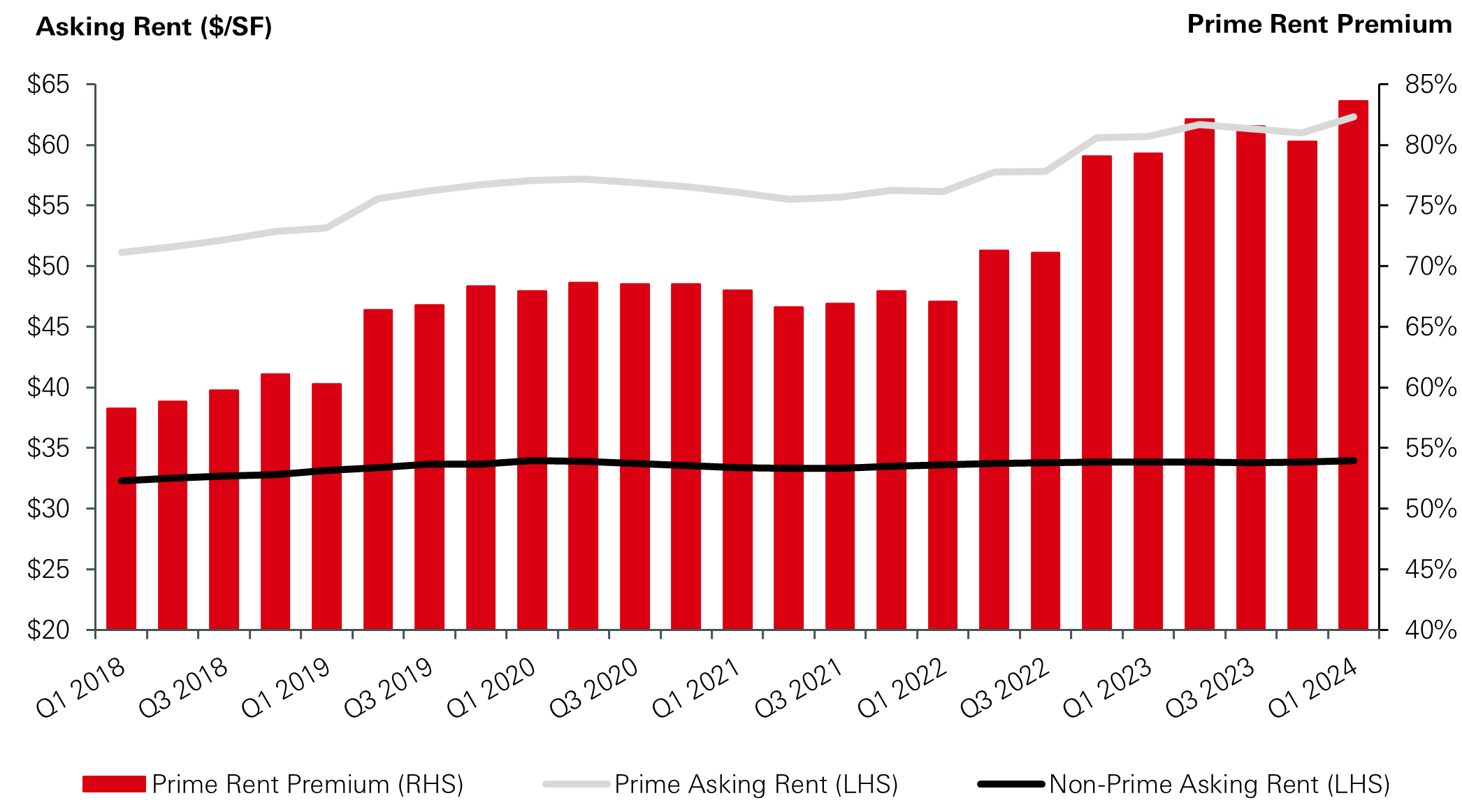

By selecting prime office buildings, not only are there lower vacancy rates but prime office buildings can charge higher rents which is illustrated by data from CBRE below.

Prime vs Non-Prime office vacancy rates

Source: CBRE Econometric Advisors, CBRE Research, Q1 2024

Prime vs Non-Prime office asking rent

Source: CBRE Econometric Advisors, CBRE Research, Q1 2024

As a result of this due diligence, there are two SASB office CMBS areas that have interesting features:

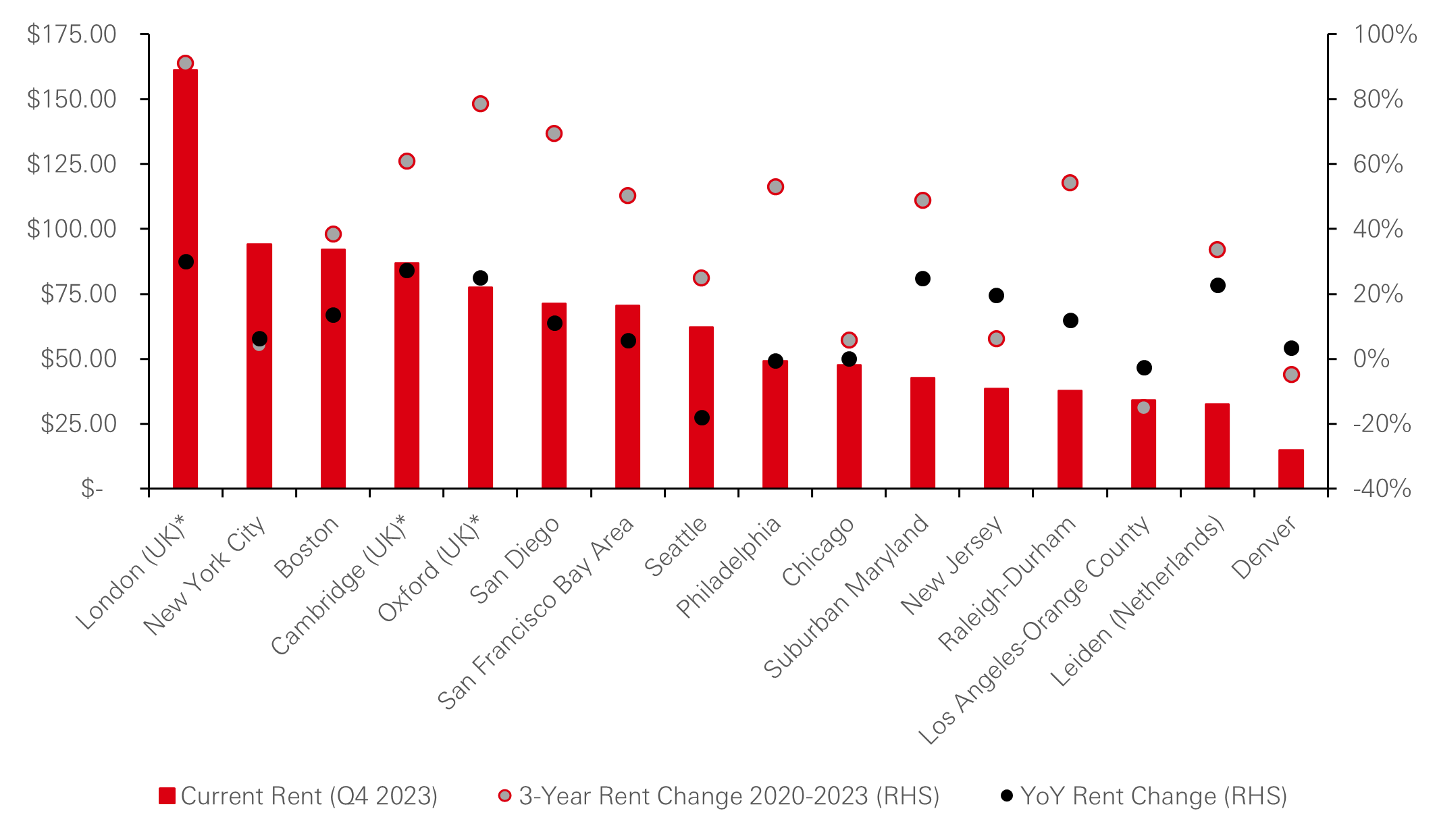

- Life Sciences: While many employees can work from home, Life Sciences requires the use of laboratory spaces and experimentation and testing for vaccines cannot be done remotely. As a result, these properties have performed very strongly, have low vacancies and rents that continue to grow significantly as can be seen below

Cumulative rent growth

Source: Cushman and Wakefield, HSBC Asset Management

- Data centres – the future: In the ever-increasing digital world we are in; data is a fundamental requirement. However, data needs to be stored and utilised. As a result, data centres have a very important role to play, and demand is showing no signs of slowing.

New construction has only partially met demand and thus rents for wholesale data centres are likely to continue to rise. In fact, a report by Jefferies estimates that data centre growth will grow at a compound annualised growth rate between 10–20 per cent globally to 2030.

Retail: There is no doubt that retail has changed over the past two decades. As technology continues to advance, it has become easier and easier to order and consume goods and services remotely. Consequently, secondary retail shopping malls and high street properties have arguably gone out of vogue. Covid-19 undoubtedly accelerated this trend.

However, some areas of retail still remain popular. For instance, grocery-led out of town supermarket complexes (next to retail stores) continue to see strong demand.

Industrial: Whilst the retail market is increasingly going online, goods to be delivered to the end consumer have to be stored and distributed to their homes. Unsurprisingly, warehouses which store these goods and last mile distribution/logistics is an area that has directly benefitted.

Multifamily CMBS: In this area of CMBS, size and scale matters. We tend to prefer large rented units, that is, purpose-built apartment buildings specifically designed to be let out to tenants.

Hotel: The seasonality and demand elasticity of hotels has also meant we avoid this sector.

Structural features

Once investors have picked the winning sub-sectors within the asset class backed by top tier sponsors, the structural features of the securitisation are just as important. It is crucial to consider four elements.

- Tenants and the mix of tenants:

The tenants are the income stream of the securitisation. It is therefore of paramount importance that the tenants comprising the loan are suitable. Not only do we typically invest in the higher rated tranches of securitisations, but the underlying tenants are also predominantly high-quality tenants. - Lease terms:

In some CMBS deals, there can be instances where the leases for the tenants runs out before the end of deal term. In these cases, and especially where a tenant comprises a significant portion of the property, there are risks that the tenant doesn’t renew their lease, a new tenant is not sourced or there is a period of time where the property remains untenanted whilst a new tenant is found.

Selecting securities where the lease terms are longer than the maturity of the deal or there is only a small proportion of leases that expire before the deal term is therefore necessary. - Occupancy rates:

An ongoing concern is the occupancy rate of the properties. While it is unlikely that every CMBS deal is fully occupied by its tenants at all times, should the occupancy rate fall to an unsustainable level (that is, impacting the rents received by the sponsor/borrower), this could be a cause for concern.

We evaluate deals based on their occupancy rates at the time of investing as well as applying stress tests to ensure that should occupancy fall noticeably; the tranches we invest in are adequately protected. - Properties:

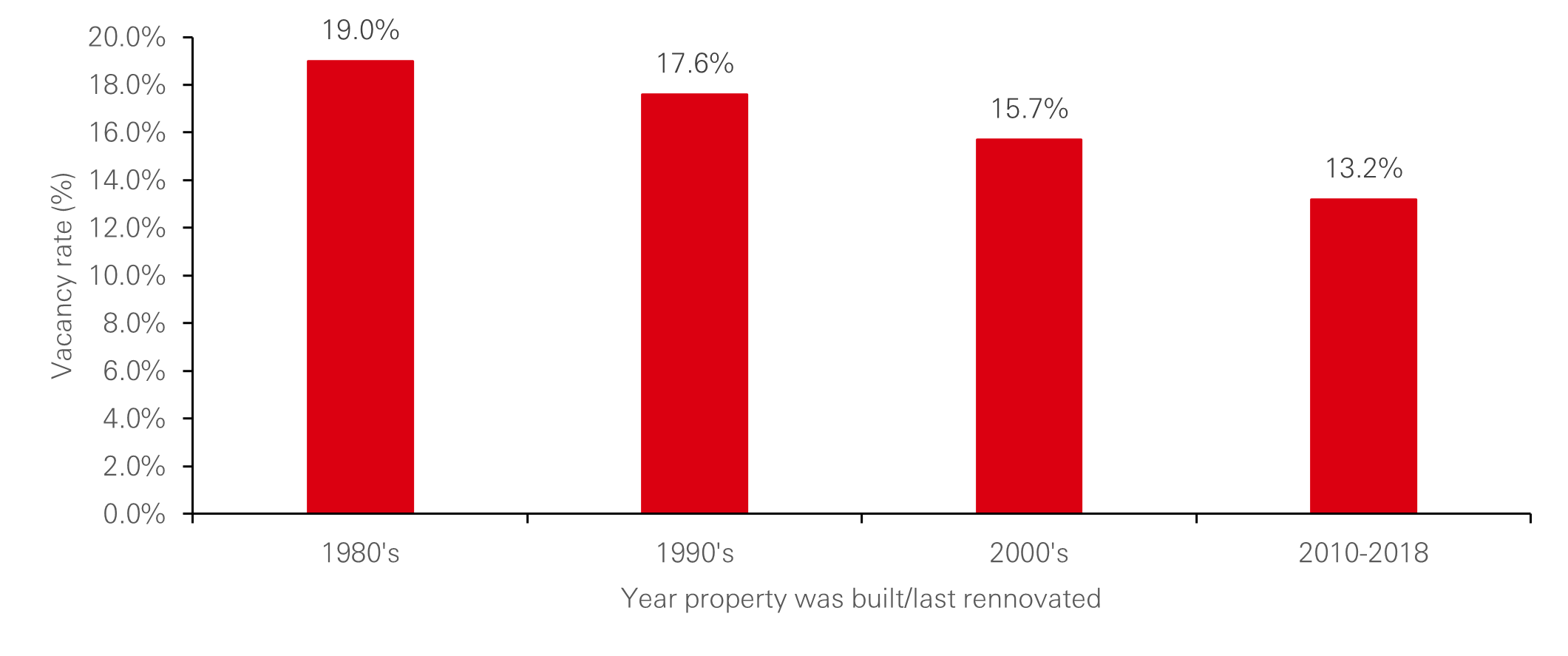

There is a direct correlation between vacancies and when a property has been built/last been renovated. Properties that have been renovated or built more recently have significantly lower vacancy rates.

This makes sense given these properties would be most likely to have been built with the demands of today’s world front and centre.

Vacancy rate by vintage (Year built/ Last renovation)

Source: Cushman and Wakefield, HSBC Asset Management

Is now the time for CMBS to realign to the fundamentals?

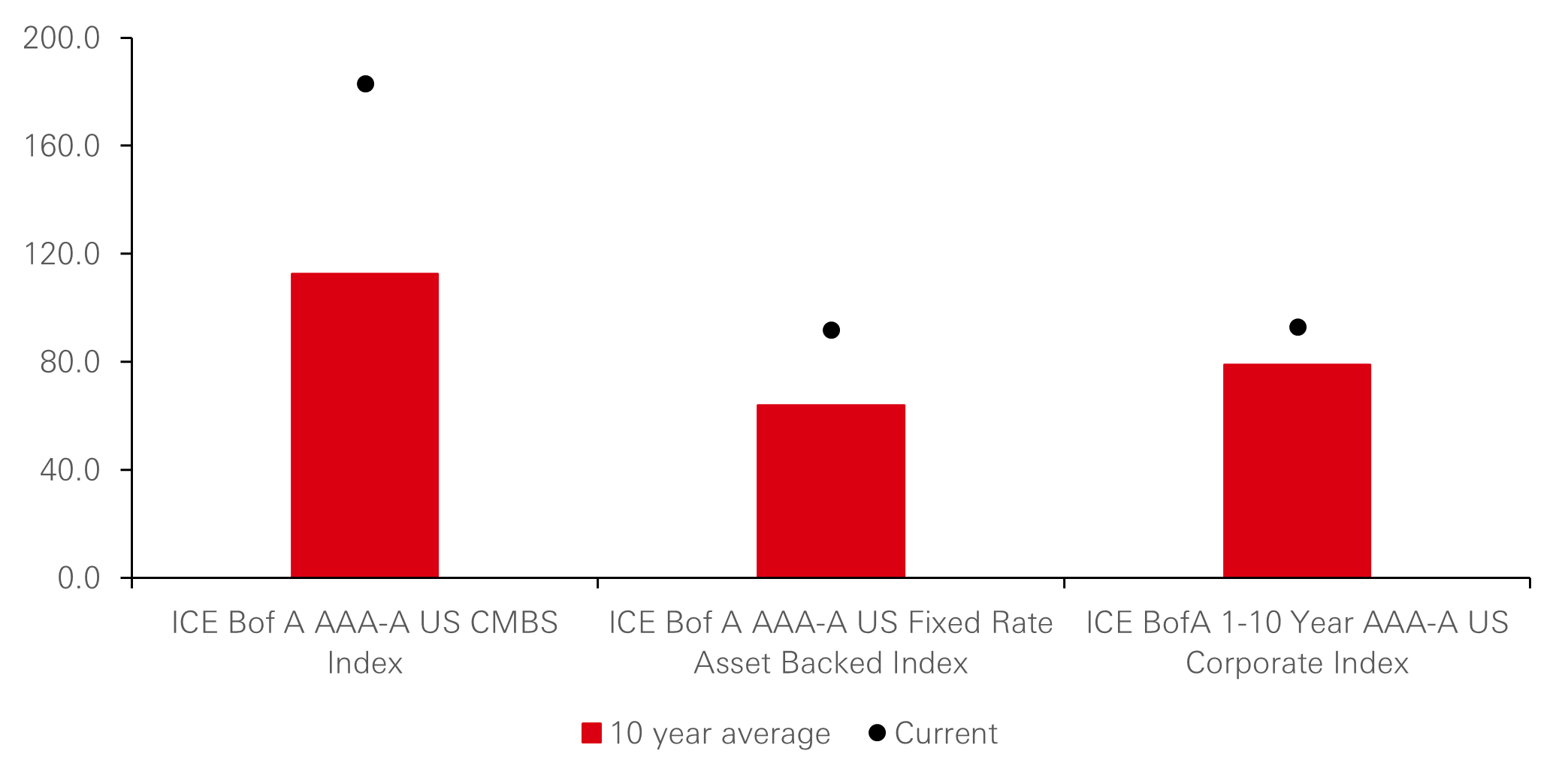

When we look at CMBS spreads, not only are they significantly wider than their historical averages, but they are the widest sub-asset class within Securitised Credit. This has been the result of the unprecedented speed and magnitude of interest rate hikes over 2022 and 2023, market shocks such as Covid-19 and the LDI crisis in 2022. The changing use of property has also had significant impact.

One can argue that the whole CMBS sector has been unfairly punished as a result of specific areas of CMBS that have come under pressure, as mentioned previously. From an asset allocation perspective, the right high quality CMBS securities with the same credit rating as high-quality corporate bonds are much more attractive at this point in the cycle.

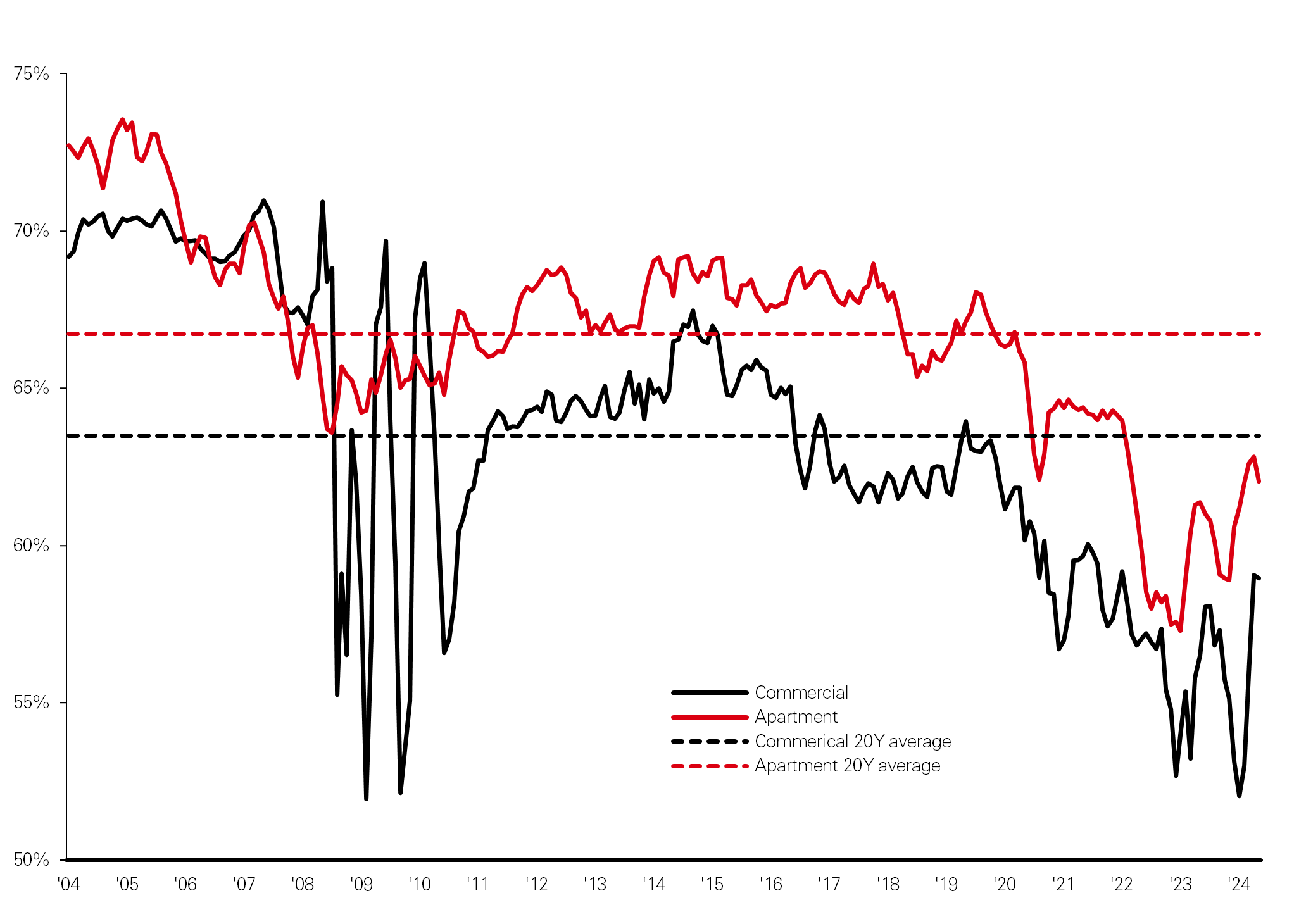

Interestingly, since the GFC, commercial real estate debt as a whole has had better credit metrics such as lower loan to values (LTV), suggesting the sector is better able to survive stress in the market.

LTV and historical averages

Source: Real Capital Analytics, Morgan Stanley, HSBC Asset Management

What’s more, should consensus for slow and gradual interest rate cuts by central banks materialise, this would ease pressure on the sector as a whole. When compared to equivalent rated corporate bonds, CMBS provides a significantly higher spread.

In fact, as can be seen below, the potential for spread compression to historical averages is highest in CMBS when compared against Securitised Credit as well as US investment grade corporates.

CMBS spreads are compelling versus historical averages

Source: Bloomberg, HSBC Asset Management, as at 31 July 2024

Conclusion

It would be fair to say that investing in CMBS requires significant research. However, if done correctly, investors stand to earn a significant complexity premium, participate in potential spread tightening and lock in the high yields on offer from Investment Grade securities. As we shift towards a lower interest rate environment, the tide appears to be turning for an arguably undervalued sector.