Thematic Investment Insights

Key Highlights:

- The qualitative nature and inherent limitations of the Sustainable Development Goals (SDGs) pose challenges in accurately measuring corporate contributions. Their design for sovereigns further complicates investors' ability to evaluate corporate sustainability efforts and increases the risk of greenwashing

- Third-party SDG data solutions often lack clarity and standardisation, leading to over-generalisations that obscure true corporate contributions and result in missed investment opportunities

- We propose reimagining SDGs as investment themes rather than mere reporting tools, to allow for a more nuanced approach. By leveraging AI technology to link granular company data to these themes, investors can create diversified thematic portfolios that align more effectively with sustainability objectives and adapt to evolving market trends

The limitations of SDGs as investment metrics

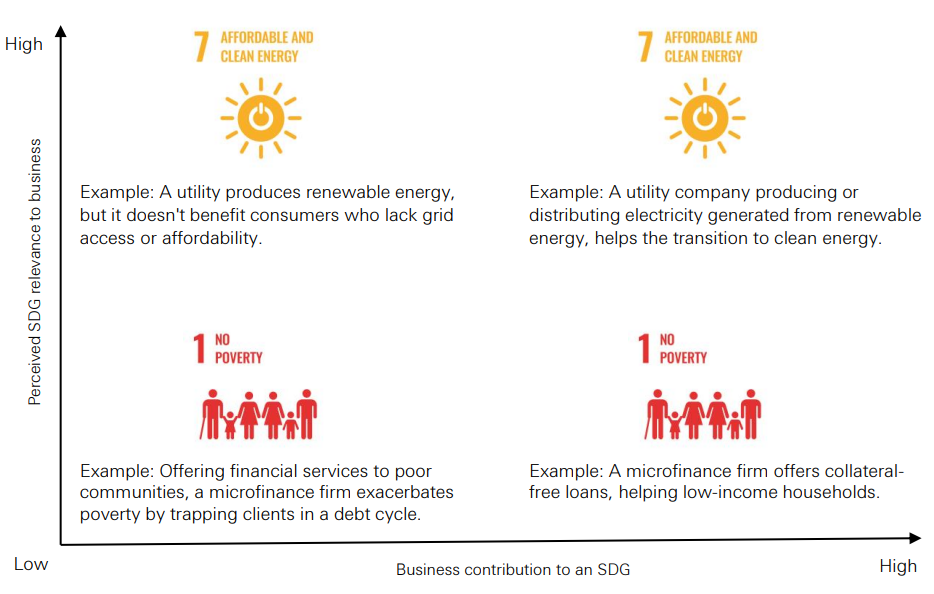

The Sustainable Development Goals (SDGs) serve as a universal framework for sustainability, created to tackle significant societal challenges such as poverty, healthcare, and education. However, their qualitative nature and design, primarily intended for sovereigns, create challenges in accurately measuring corporate contributions. The overlapping themes within the SDGs further complicate their application as precise investment metrics. Accordingly, investors may struggle to effectively integrate SDGs into their investment strategies, leading to potential misalignment with their sustainability objectives.

Linking business activities to SDGs is largely down to investor and company interpretation

Source: HSBC Asset Management, December 2024. For illustrative purpose only.

Shortcomings in third-party SDG data solutions lead to missed investment opportunities

The lack of clarity and standardisation in third-party data solutions for SDGs can hinder investors’ ability to fully understand the sustainability alignment of their portfolios. This ambiguity may result in missed opportunities from overlooking companies that align with sustainability goals due to inadequate data. Furthermore, the risk of greenwashing increases when investors rely on inconsistent metrics, potentially leading to suboptimal investment decisions.

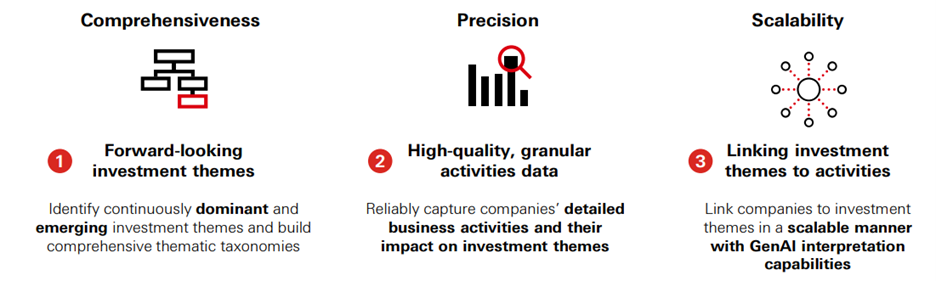

Reimagining SDGs: An investment theme, rather than a reporting tool

We propose a paradigm shift in how investors approach SDGs, viewing them as investment themes rather than mere reporting tools.

A quant solution for building thematic portfolios includes three key components

Source: HSBC Asset Management, December 2024. For illustrative purpose only.

By breaking down the SDGs into specific investment themes and granular sub-themes linked to company activities, and by leveraging granular data and AI, investors can systematically capture evolving trends and develop smart investment processes to deliver diversified thematic portfolios. This approach aims to offer practical solutions to enhance and scale up the alignment of investment portfolios with sustainability goals in an evolving world.