China’s pro-growth policy pivot and market implications

Key takeaways

- China’s recent announcement of additional stimulus is aimed at reviving domestic demand, stabilizing the property market, boosting market confidence, and mitigating risks related to local government hidden debt, property developers and banks. We are still waiting for more implementation details to further assess macro implications. More policy easing is also likely underway

- The clear pro-growth policy pivot should help improve the cyclical growth outlook and sequential price momentum into 2025. However, we think more demand-side (fiscal) stimulus with its timely and effective implementation, further property stabilisation efforts, and structural reforms to rebalance the economy and facilitate the economic transition toward quality and sustainable growth are likely needed to fundamentally reflate the economy

- The outlook for Chinese equities is cautiously optimistic. The monetary policies, which were widely anticipated though surprising in terms of upside magnitude, are certainly helpful. We believe that policymakers will still need to take up additional fiscal easing to boost consumption and address the deflation issues to sustainably turn around investor confidence

- In addition to lowering of existing mortgage rates ~50bp, other property sector measures should help improve the housing market sentiment and demand in the near term. The China USD bond market has so far benefitted from the stimulus measures, with private property developers seeing the biggest boost, followed by the industrials sector

What do the recent economic numbers say about the state of China’s economy?

Renee: China’s September activity data showed a modest pickup in domestic growth momentum toward the quarter-end. However, consumer confidence remained subdued amid ongoing future jobs and income worries, private credit demand and underlying inflation stayed sluggish, and export growth softened (albeit partly due to weather distortions).

Real GDP growth in Q3 rose 0.9 per cent quarter-on-quarter sa. – a modest rebound from Q2 (+0.5 per cent quarter-on-quarter sa.). On a year-on-year basis, real GDP growth in Q3 was largely stable at 4.6 per cent, but the 4.8 per cent growth during the first three quarters put this year’s ‘~5 per cent’ growth at risk without more policy support. Nominal growth – which is more relevant for corporate earnings, household income and debt ratios – stayed weak at 4.0 per cent year-on-year on continued GDP deflator deflation.

September domestic activity data largely beat market expectations, especially industrial production and retail sales, which likely partly reflected some effects from recent policy measures to promote consumer goods trade-in of home appliances and autos and to support corporate equipment upgrade. There are also nascent signs of policy effects on infrastructure investment and credit growth from accelerated government bond issuance since July.

Property sales improved on a month-on-month basis with the year-on-year contraction narrowing further in September, but overall housing sector indicators remained weak (new starts, investment, etc.) with ongoing home price declines.

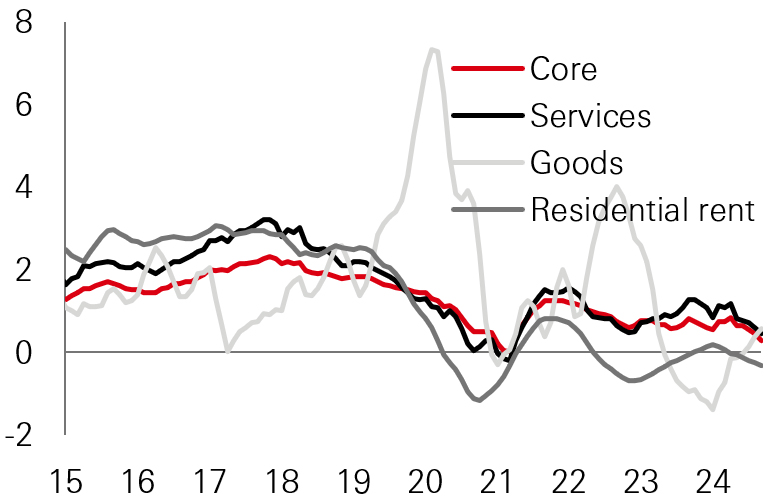

September inflation data showed persistent PPI deflation and muted headline and core CPI inflation (Fig. 1). This largely reflects the lingering domestic demand-supply imbalance (i.e. weak domestic final demand and industrial overcapacity).

Fig. 1: Muted core CPI reflects subdued domestic demand/confidence with falling residential rent

per cent year-on-year; 3mma

Source: CEIC, HSBC Asset Management, October 2024

Robust exports have been a key growth driver this year. However, rising risks on external demand and geopolitical uncertainties speak to the need for more domestic demand stimulus.

What are your views for what we can expect for further monetary policy easing?

Renee: On 24 September, the PBOC delivered a 20bp cut to the 7-day reverse repo rate (policy rate) and a 50bp cut to RRR for large banks. The policy rate cut translated to a 25bp reduction in the 1-year and 5-year loan prime rates (LPR) on 21 October. Major banks also lowered their demand/time deposit rates by 10bp/25bp on 18 October to cushion the impact on their net interest margins (NIM). PBOC Governor Pan guided markets that the central bank stands ready to further cut the RRR by additional 25-50bp by the year-end, while leaving the option open for more monetary easing.

We see the scope for further 20-40bp cuts to the 7-day reverse repo rate in the coming months/quarters, with greater emphasis on "price stability" in the latest PBOC communications. The US Fed easing cycle has eased external constraints on PBOC rate cuts, though domestic concerns remain – including the squeeze on bank NIMs and the risk that further deposit rate cuts would prompt outflows from deposits and inflows into wealth management products that have higher yields. We also expect more efforts to improve transmission via policy framework reforms and targeted credit support. The PBOC can also deploy quantitative tools to facilitate fiscal policy operation and aid the government quality growth agenda. For instance, the PBOC’s CNY300 relending facility will support local state-owned enterprises (SOE) to purchase unsold, completed homes for conversion into affordable housing. In the past, the PBOC’s pledged supplementary lending (PSL) had supported the monetised resettlement for shanty-town redevelopment during 2015-18. Now, policymakers also plan to renovate one million additional units of urban village and dilapidated buildings with cash compensation.

Overall, future policy actions will likely depend on incoming macro data and on market conditions. That said, monetary easing has its limits. We think effective demand-side fiscal stimulus and structural reforms are needed to rebalance and fundamentally reflate the economy.

What has been the focus of the recent fiscal policy announcement?

Renee: On 12 October, the Ministry of Finance (MOF) pledged more efforts to mitigate risks related to local government debt, property, and banks, which should be positive for medium-term macro stability and debt sustainability.

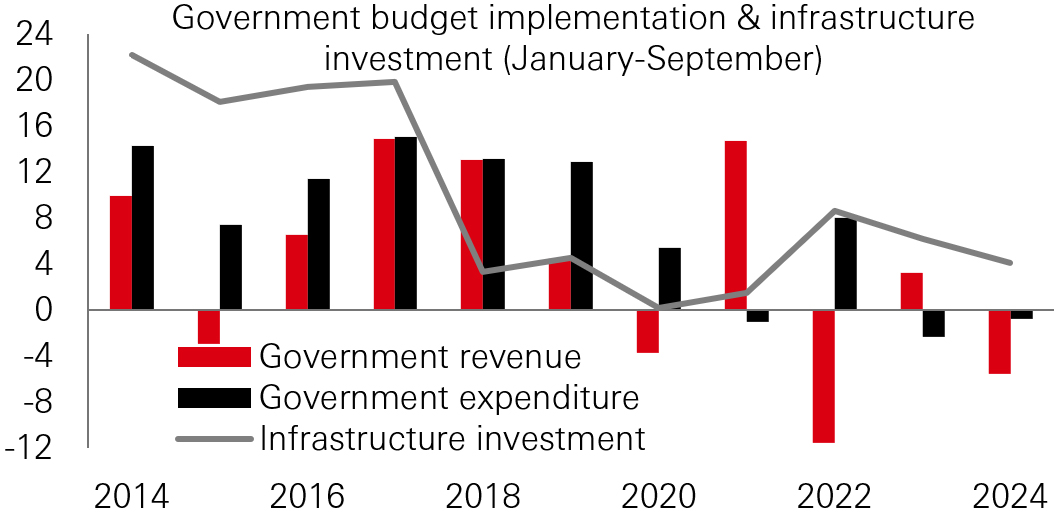

The MOF laid out key areas for incremental fiscal support in the near term. These include additional efforts for local government (hidden) debt resolution (including raising the government debt limit and a larger bond issuance quota for debt swap); special central government bond (CGB) issuance to replenish SOE banks’ capital; and a combination of local government special bonds, designated funding and tax policies to support the property market – special bonds can be used to buy back unsold homes and undeveloped land from developers. For Q4, the MOF called for better utilisation of the remaining fiscal room within the debt ceiling to address local government revenue shortfalls and reverse the fiscal austerity so far this year (Fig 2.).

Fig. 2: (Local) gov’t revenue shortfall led to fiscal austerity this year

Year-on-year (per cent)

Source: CEIC, HSBC Asset Management, October 2024

The MOF sent a clear pro-growth forward guidance. It indicated further support is underway and that there is a large scope for the central government to increase fiscal deficit and raise debt. We think this likely indicates a meaningfully expansionary budget for 2025 (e.g. deficit target exceeding the normal 3 per cent of GDP limit), as well as a larger scale of local government debt swap programme and the potential for an increase in quotas for ultra-long-term special CGBs in the coming years. We await further fiscal policy clarity. The upcoming National People’s Congress (NPC) standing committee meeting (4-8 November) and Central Economic Work Conference in December are key events to watch on fiscal measures.

What are the overall macro implications of the recent easing measures?

Renee: We are still waiting for implementation details of recent policy measures to assess the potential implications. The composition of policy measures matters as we believe fiscal support to households (with higher propensity to consume) and to corporate investment (with the potential to create high-quality, high-paying jobs and boost long-term productivity gains) will likely have a higher policy multiplier compared to the credit multiplier of infrastructure or property investment.

Overall, we see the recent and upcoming policy easing moves as a comprehensive and coordinated attempt to rein in the downward spiral of lower asset prices and weaker sentiment seen in recent years. There appears to be a strong commitment from the top leadership to reflate domestic demand, stabilise the property market and reviving market confidence, with clear forward guidance of further policy support in the pipeline. We think the positive medium-term impact of local government debt resolution may be underappreciated by markets.

A pro-growth policy pivot helps improve the cyclical growth outlook and sequential price momentum into 2025. We expect GDP growth to recover sequentially in Q4 2024 and into Q1/H1 2025, though countercyclical policy easing is unlikely to materially alter the structural prospects. We also expect higher but still moderate inflation in 2025. That said, China’s deflationary / disinflationary pressures come from both cyclical headwinds and structural imbalances. We think timely and effective implementations of demand-side stimulus, further property stabilisation efforts, and structural reforms to rebalance the economy and facilitate the economic transition toward quality growth are likely needed to fundamentally reflate the economy with a return to benign inflation on a sustainable basis.

Policy easing may help stabilise credit growth with the potential for a modestly higher credit impulse in the coming months as policy effects gradually feed through. However, to restore households’ borrowing risk appetite, we would need to see better prospects of housing market stabilisation and macro improvements. There are some concrete measures to support consumption, such as consumer durable goods trade-ins. Additionally, the ~50bp cut to existing mortgage rates potentially benefits ~50 million households and 150 million individuals, which could help household disposable income and consumption at the margin. That said, more consumption support is likely needed, such as fiscal measures and a more favourable regulatory environment that can support jobs creations and tackle the youth unemployment issue as well as further social welfare spending to reduce precautionary savings.

The step-up in property policy easing should help improve the housing market sentiment and demand in the near term, especially in tier 1-2 cities, with the potential for the physical market to gradually stabilise on a sequential basis over 2025. However, the sustainability of any sentiment improvement or sales recovery depends on effective policy execution and the overall macro trajectory. Home prices may still be under pressure in the near term as the inventory overhang will likely take an extended period to clear before it returns to a more reasonable or normal level nation-wide, even with the government’s pledge to control new housing construction.

What does the latest round of stimulus mean for Chinese equities?

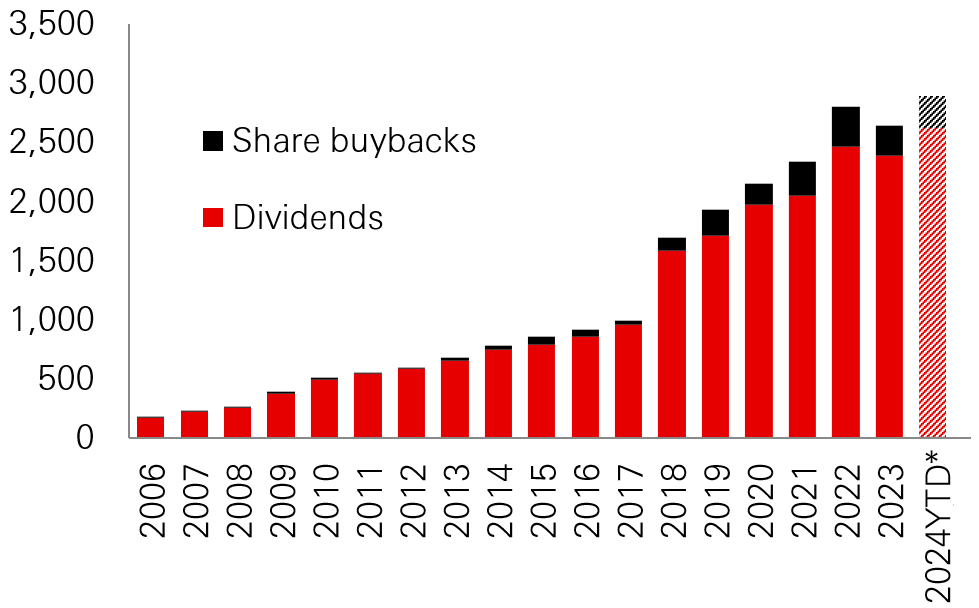

Caroline: Following the easing announcements on 24 September, the PBOC on 18 October officially launched unprecedented measures including a swap facility and a relending program that are especially beneficial for equity markets. These steps indicate a more aggressive fiscal approach from the central government, providing hope for a stabilizing effect on the economy and markets. Under the swap facility, the PBOC launched the first batch with an approved size of RMB 200 bn, whereby eligible institutions can pledge their assets, such as stocks and bonds, in exchange for liquid assets, with an aim of improving market liquidity. Under the relending program, listed companies are allowed to borrow from 21 financial institutions selected by the PBOC to fund share buybacks or shareholding increases, which should bolster shareholder returns.

The stimulus package was delivered after successive months of soft macro data that put China’s full-year official growth target of around 5 per cent at risk. The style of communication was firm, direct and even had forward guidance, suggesting a high level of consensus and authority. It shows that the central government is increasingly concerned about weakness in the economy and markets. However, implementation remains key while the long-term sustainability of market sentiment improvement and rebound rally are more dependent on macro recovery as well as corporate earnings growth bottoming out. Near term relaxation in the property sector may support a short-term rally but structural oversupply remains. Policy visibility is also low with local government fiscal revenue worsening.

Going forward, measures such as easing monetary policy, increasing local government bond issuance, and utilizing unused budget funds are designed to support key sectors, including property, financials, and technology.

What’s the outlook for Chinese equities?

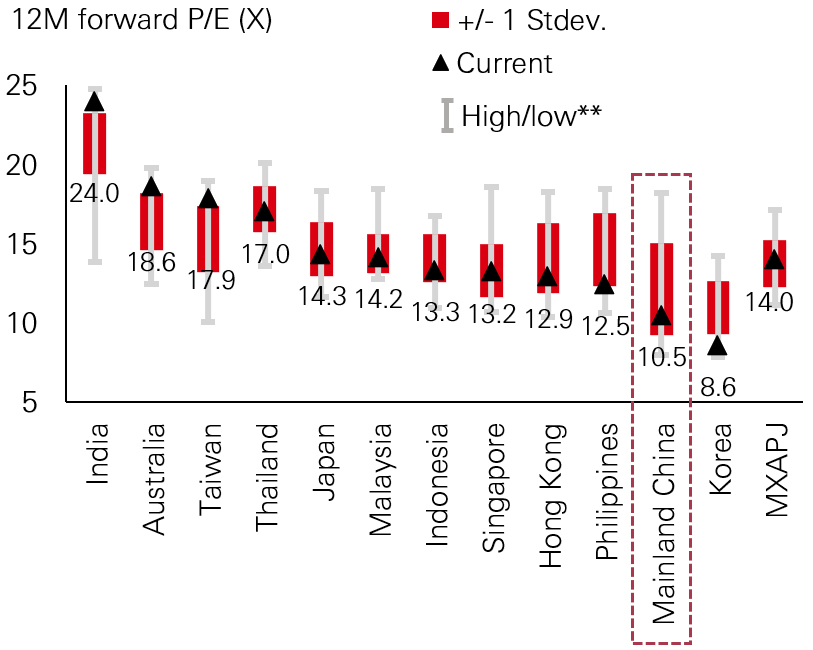

Caroline: The outlook for Chinese equities is cautiously optimistic. The widely-anticipated (though surprising in terms of upside in magnitude) monetary policies are certainly helpful. We believe that policymakers will still need to take up additional fiscal easing to boost consumption and address the deflation issues, especially against a backdrop where loan demand is weak and real interest rates have been restrictive given the persistent deflationary pressures, to sustainably turn around investor confidence.

On a positive note, valuations of Chinese stocks are currently inexpensive and positioning of international investors in Chinese equities remains light. With China's ongoing efforts to stabilize its economy and implement supportive policies, there is a strong potential for growth and recovery, making now an opportune time for investors to carefully consider adding Chinese equities to their portfolios. In our HSBC Chinese equities strategy, we continue to favor quality growth companies, while dividend-paying companies remain attractive to us on the backdrop of a deflationary cycle amid a property market downturn. However, we remain vigilant to potential risks, including geopolitical tensions and global economic conditions.

Fig. 3: Policy/valuation driven share buyback may mitigate downside pressures

Share buybacks/dividends for all China listed universe (Rmb bn)

*2024 dividends were estimated based on companies with available consensus estimates for dividends; otherwise 2023 actual numbers were used; share buybacks in 2024YTD includes year-to-date actual buybacks as estimates data were generally not available.

Source: Goldman Sachs, HSBC Asset Management, data as of September 2023.

Fig. 4: Chinese equities: attractive valuations

** over last 10 years

MXAPJ refers to MSCI Asia Pacific ex Japan Index.

Source: MSCI, Goldman Sachs, data as of October 2024

What are the implications for China fixed income in light of supportive policies?

Ming: We are very encouraged by the latest stimulus measures announced by the Chinese authorities, but we must remain vigilant and keep a close eye on further announcements and the impact of the measures. Any positive outcome is likely to benefit the credit market most. Meanwhile Chinese rates remain low, but Chinese domestic government bonds maintain their strong diversification benefits.

CNY / CNH bonds

5-year CGB (China government bonds) yields are now at 1.85 per cent as of 24th October (Fig. 5). With the strong rally in the onshore equity market from mid September through early October, the allocation of flows from bonds to equity was a key driver of the move up in yields. CGB yields are likely to trade within a range, though we will continue to closely monitor the yield level should the policy stimulus fail to reignite growth momentum. In the HSBC RMB fixed income strategy, we hold a small overweight duration position with varying underlying contribution, whereby we are overweight duration in the offshore CNH space but underweight duration in the onshore CNY portion. In terms of allocation, we are overweight CNH bonds and underweight CNY bonds due to the attractive carry in the former.

Fig. 5: China government bond yields

5-year CGB yields (per cent)

Source: Bloomberg, 24 October 2024.

On the currency front, the RMB has seen a brief appreciation since the stimulus press conference on 24 September. We may see some continued pressure from the ongoing easing of interest rates, but the strong stimulus measures being implemented and increased capital inflows could bolster the currency. In the longer term, the RMB’s fundamentals remain supported by China’s export competitiveness, solid external balances, and positive fund flow dynamics.

China USD bonds

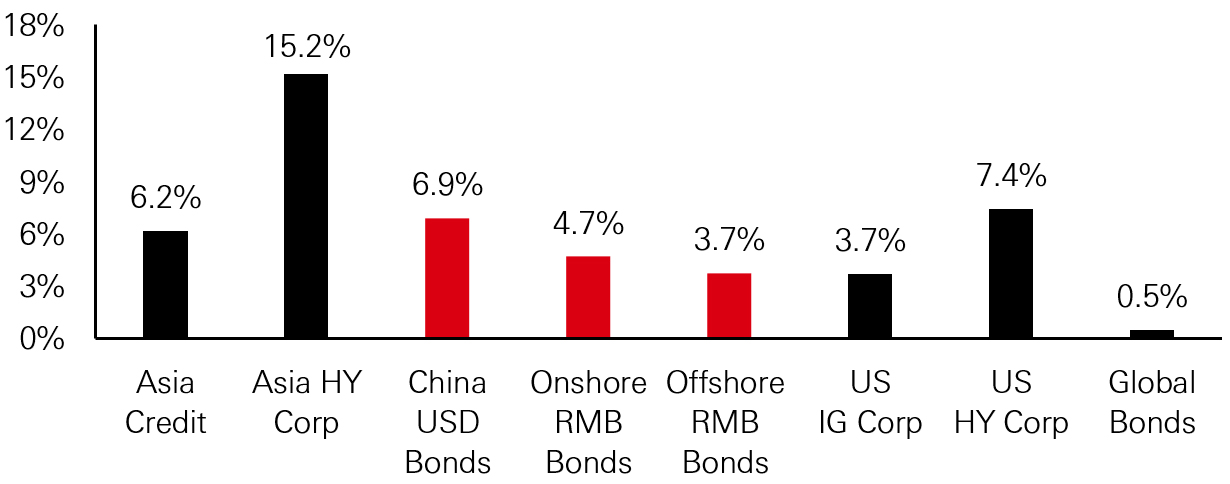

The China USD bond market has so far benefitted from the stimulus measures, particularly within the high yield sectors. China private property developers have seen the biggest boost, followed by the industrials sector, thanks to improved sentiment. On a year-to-date basis, yields have come down by 100bp to 6.4 per cent and produced a return of 6.9 per cent as of 24th October,1 but are still relatively attractive compared to other global credit markets.

While we believe there is still momentum in the property sector in the near term and have increased our overweight position in the sector across our Asia bond strategies, we continue to remain highly selective. The robust rebound in physical property sales is a consequence of recent policy easing and hinges on economic stability.

Outside of the property market, we see investment opportunities in TMT companies, which have strong balance sheets and cashflows, as well as the consumer and industrial sectors in a selective manner.

It should be noted that year-to-date, China USD bonds, along with Asia USD bonds, have been outperforming other bond markets in other parts of the world this year (Fig.6).

Fig. 6: China USD bonds strong year-to-date performance

Performance, unhedged USD for non-USD indices (per cent)

Source: Bloomberg, JPMorgan, BofA, 24 October 2024.

Source: HSBC Asset Management, China Ministry of Finance, Bloomberg, CEIC, MSCI, October 2024.

This publication is intended for Professional Clients and intermediaries’ internal use only and should not be distributed to or relied upon by Retail Clients. The information contained in this publication is not intended as investment advice or recommendation. Non contractual document. This commentary provides a high level overview of the recent economic environment, and is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. Past performance does not predict future returns. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Investment involves risks. Past performance does not predict future returns. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way.

The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. This document provides a high level overview of the recent economic environment. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.